Automotive Market Guide for February 2021

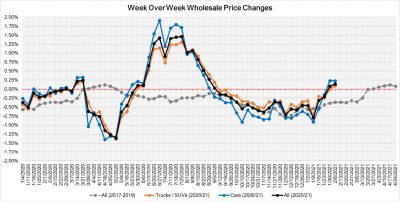

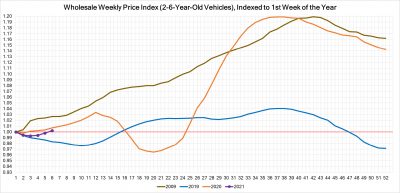

The wholesale price index continues to get stronger in what is beginning to look like an early start to the Spring market.

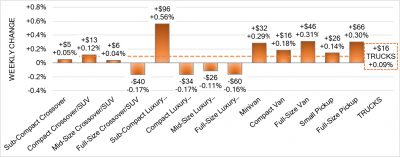

The largest increases were in the Auto segments, but the bulk of the Truck segments also saw week–over–week increases.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.23% | +0.23% | –0.32% |

| Truck & SUV segments | +0.09% | +0.00% | –0.40% |

| Market | +0.14% | +0.08% | -0.37% |

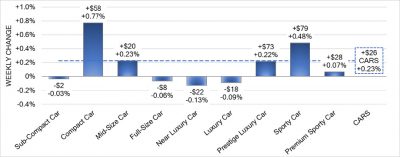

Market Highlights:

- Small Car prices rose for a third week in a row with this past week being the greatest of those increases at 0.77%, opposed to 0.23% the week prior.

- Sports Cars continued to show signs of growth with another week of gains increasing the rate of appreciation to 0.48%, compared to 0.35% last week.

- Premium Sports Cars saw a slowing in the rate of increase to only 0.07% this past week.

- Prestige Luxury Cars changed direction last week and saw a gain of 0.22% after twenty-two weeks of drops.

- Van and Pickup segments, both Full-Size and Compact/Small, increased this past week.

- Full-Size Vans are showing significant strength as the volume in the segment remains low.

- Full-Size Pickups continue to gain strength each week, with the rate of growth increasing to 0.30% this past week, compared to 0.09% the prior week.

- Sub-Compact and Compact Crossovers are showing consistent week-over-week gains as this price point fits well into the traditional Spring market demand.

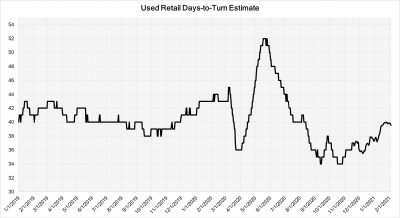

Used Retail Prices

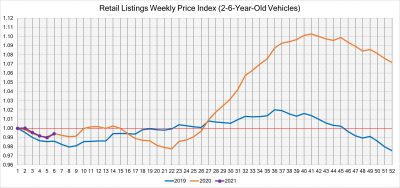

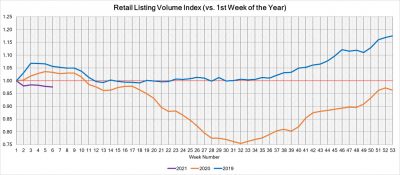

With the increase of ‘no-haggle pricing’ for used-vehicle sales, asking prices accurately measure trends in the retail space.

Retail demand slowed down leading up to the December holidays, and thus resulted in declining retail asking prices over the last several weeks of 2020.

As demand bounced back in January, retail prices seemed to stagger wholesale prices – retail asking prices continued to decrease throughout January.

This analysis is based on nearly two million vehicles listed for sale in the US.