Auto Loan Payments By Credit Score – 2016

Auto Loans Factors

There will be 3 factors that determine how much your monthly auto payments will be; how much you borrow, the interest rate you are offered, and the term of your loan. The amount you borrow is up to you and the car choice you make. The interest rate is also within your control as long as you are prepared. Most auto lenders will look at your FICO®Score to determine the rate they will offer you.

1- how much you borrow

2- the interest rate

3- the term of your loan.

The amount you borrow is up to you and the car choice you make. The interest rate is also within your control as long as you are prepared. Most auto lenders will look at your FICO®Score to determine the rate they will offer you.

What is a good credit score to buy a car?

According to bankrate.com the average auto loan rate on a new car for a 5-year loan was 4.15%. On a four-year loan for a used car, the average was 4.77%. It is possible to find interest rates as low as 0% to 1.99%. However, these loans are often reserved for particular new models of cars and require credit scores above 700. With a credit score of 650 and auto loan interest rate below 5% would be great. Chances are, though, according to USA Today you will be shopping in the range of 6%-9%.

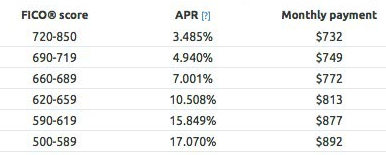

Here is an example of 36-month auto loan for the amount of $25,000:

| FICO Score | ARP | Monthly Payment |

| 720 – 850 | 3.49% | $732 |

| 690 – 719 | 4.94% | $749 |

| 660 – 689 | 7.00% | $772 |

| 620 – 659 | 10.51% | $813 |

| 590 – 619 | 15.85% | $887 |

| 500 – 589 | 17.07% | $892 |