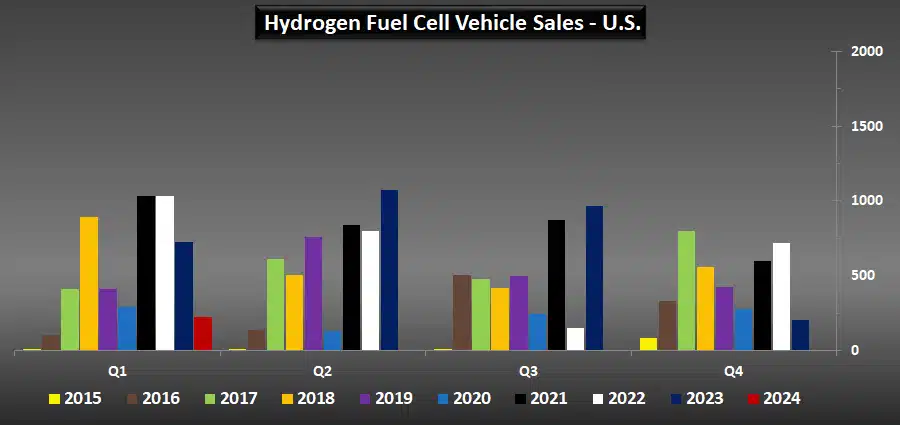

Once heralded as the dawn of a new era in transportation, hydrogen fuel cell vehicles (FCEVs) seemed poised to take the roads by storm. However, the brisk wind of enthusiasm has seemingly cooled, as recent data paints a starkly different picture.

The beginning of 2024 wasn’t just chilly in terms of weather; it also brought a frosty reception to hydrogen car sales in the U.S. With a 70% plummet in the first quarter, the hydrogen car market experienced its most significant setback since 2016. This unexpected detour on the road to a hydrogen future invites us to explore what’s behind the sudden brake in sales.

America’s Hydrogen Car Sales Suffer 70% Drop in Early 2024 (PDF)

The Hydrogen Highway Becomes a Byway

Stark Numbers Tell the Tale

The hydrogen car market isn’t just sputtering; it’s facing a substantial roadblock. According to the Hydrogen Fuel Cell Partnership, a mere 223 new FCEVs found owners in Q1 of 2024. It’s not just a dip; it’s a free-fall—a 70% nosedive from the previous year and the slowest start since the winter of 2016. We’re witnessing a pattern here, with the second consecutive quarter painting a grim picture for FCEVs.

FCEV Sales Data

- Q1 Sales Overview:

- 2024: 223 vehicles

- 2023: 744 vehicles

- Year-over-Year Change: Down by 70%

The Loneliness of the Long-Distance Runner

With only two models on the market, the choices for potential buyers are slim. The Toyota Mirai, once the poster child of hydrogen mobility, saw its sales wither to 172 in the first quarter, a sharp 74% fall from the year before. The Hyundai Nexo, a less common sight, also suffered a dip, selling 51 units, down by 22%.

Model-Specific Sales Breakdown

| Model | Q1 2024 Sales | Year-over-Year Change |

|---|---|---|

| Toyota Mirai | 172 | -74% |

| Hyundai Nexo | 51 | -22% |

A Glimmer of Hope on the Horizon

The Japanese automaker Honda, once a competitor with its Clarity Fuel Cell, bowed out of the running. However, they’re teasing the market with the upcoming 2025 Honda CR-V e:FCEV. But with promises of limited supply, it’s unlikely to cause a splash in the troubled waters of the FCEV segment.

Refueling or Refuting? The Infrastructure Dilemma

A Desolate Landscape

If the sales figures weren’t dire enough, the state of the refueling infrastructure delivers another blow. Shell’s abrupt closure of all seven of its hydrogen stations in California this past February further fuels the fire of concerns. The infrastructure was already a bottleneck, and now the noose tightens.

Hydrogen Station Stats at a Glance

- Retail Stations: 55 (unchanged since January)

- Total Infrastructure: 90 stations (down from 97)

- Under Development: 25 stations (down from previous reports)

Navigating a Range of Issues

High hydrogen prices and a sparse refueling network aren’t the only speed bumps. When you factor in the overall efficiency, cost of vehicles, and the lack of infrastructure compared to the rapidly advancing EV market, it’s a steep hill for hydrogen cars to climb.

The Road Ahead: A Mirage or a Milestone?

While the past years have seen some ups, with a 10% increase in 2023 compared to 2022, the start of 2024 is more reminiscent of a stall than acceleration. The cumulative sales of over 18,000 FCVs in the U.S. might seem encouraging, but the growth is slow, setting the 25,000th sale target farther into the future—perhaps as late as 2025.

The Quiet Before the Storm or the Calm After?

There’s speculation that a new shipment of FCVs from Japan or South Korea might rev up the sales. Yet, the question remains—has the zero-emission race already been won by electric vehicles?

The era of EVs flaunting long-range capabilities and swift charging times has overshadowed the once-promising hydrogen cars. And with none of the fundamental issues being effectively addressed, it begs the question: is the age of the hydrogen car over before it even began?

With all these elements on the table, we look toward the horizon, pondering the future of hydrogen mobility. Will the hydrogen fuel cell vehicle find its path in the U.S., or will it be relegated to the pages of ‘what could have been’? What do you think will be the turning point for hydrogen cars?