The U.S. wholesale vehicle market continues to soften through mid-June, reflecting broad-based declines across nearly all vehicle segments. Although some isolated categories showed minor signs of resilience, the overall trend points to ongoing depreciation and reduced market momentum.

Market Overview: Declines Deepen

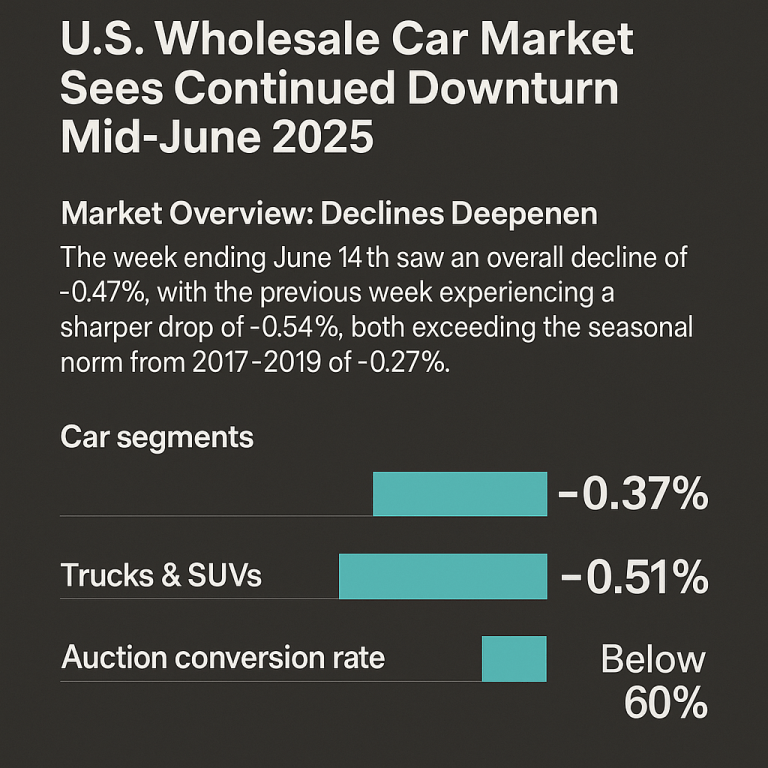

In the week ending June 14th, wholesale vehicle values dipped by an average of 0.47%, following the previous week’s steeper drop of 0.54%. Notably, this recent rate of decline outpaced the historical seasonal norm from 2017–2019, which averaged only 0.27% during the same period.

- Passenger cars declined by 0.37%

- Trucks and SUVs experienced a sharper fall of 0.51%

- Auction conversion rates slid below the 60% mark, signaling softer demand from buyers.

Car Segment Trends

Most car segments recorded price drops, with eight out of nine categories showing negative movement.

- Sub-compact cars faced the steepest drop at -0.98%, marking the second consecutive week of heavy losses.

- Premium sporty cars bucked the trend, rising modestly by +0.11%, following three weeks of slow decline.

- Full-size cars (0–2 years old) continued to perform well, appreciating +0.94%, having increased in value in 14 of the last 15 weeks.

Older vehicles (8–16 years old) across most categories also saw broader depreciation, aligning with the general downturn.

Truck & SUV Segment Breakdown

Trucks and SUVs faced more severe headwinds than cars:

- Compact and sub-compact crossovers/SUVs posted the largest losses at -0.76% and -0.70%, respectively.

- Newer full-size trucks (0–2 years old) declined more steeply week-over-week, falling -0.54%, more than doubling the prior week’s -0.24% loss.

- A total of 12 out of 13 truck categories declined in value.

Broader Market Indicators

Wholesale & Retail Price Indices

Data visualizations from the Wholesale Price Index (Page 3) and Used Retail Price Index (Page 4) show a diverging narrative:

- The wholesale price index for 2–6-year-old vehicles continues to trend downward.

- Meanwhile, used retail prices are holding stronger, aided by transparent pricing models like no-haggle retailing, which have made consumer price tracking more consistent.

Inventory and Turnover

- The Used Retail Active Listing Volume Index (Page 5) reveals a stable inventory pattern across dealerships.

- The average days-to-turn for used vehicles is around 37 days, reflecting a reasonably fluid retail environment.

- Auction conversion rates fell to 58%, down 2% from the week prior, even as auction inventory held steady for the second week in a row.

While the market overall remains in a declining phase, certain categories—such as premium sporty vehicles and younger full-size cars—hint at selective demand pockets. However, the broad trajectory continues to suggest caution for sellers and opportunities for strategic buyers.