After nearly three months of steady price increases, the U.S. wholesale used vehicle market is signaling a shift. The week ending May 24, 2025, marked the first broad- based downturn in wholesale values in recent memory, suggesting the market may be reverting to more typical seasonal patterns.

| Segment | This Week | Last Week | 2017-2019 Avg (Same Week) |

|---|---|---|---|

| Car segments | -0.09% | +0.07% | -0.33% |

| Truck & SUV segments | -0.07% | -0.07% | -0.09% |

| Overall market | -0.07% | -0.03% | -0.19% |

Signs of Normalcy Returning to the Market

After nearly three months of steady price increases, the U.S. wholesale used vehicle market is signaling a shift. The week ending May 24, 2025, marked the first broad-based downturn in wholesale values in recent memory, suggesting the market may be reverting to more typical seasonal patterns.

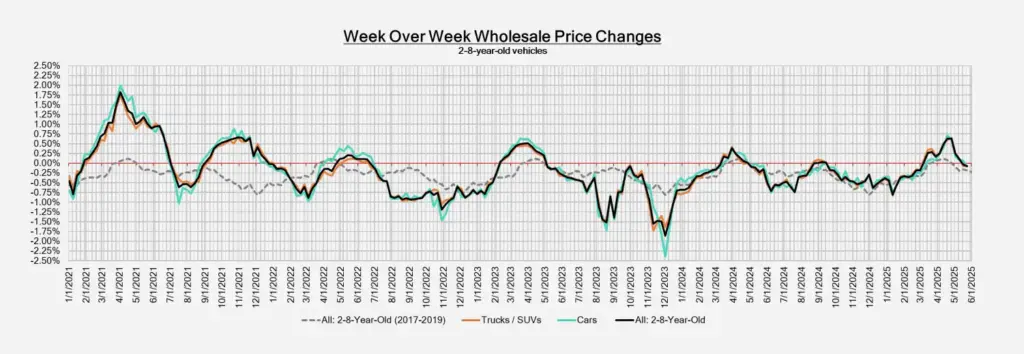

Recent data reveals a -0.07% overall dip in wholesale prices—seemingly modest, but significant when viewed against the backdrop of 11 consecutive weeks of appreciation. This decline aligns more closely with the historical average decline of -0.19% for this time of year, indicating that after a prolonged stretch of upward movement, the used car market is finding its way back to a pre-pandemic rhythm.

Vehicles aged 0–2 years, previously leading gains, were not immune to this cooling trend, registering their first weekly drop at -0.07%. Similarly, models aged 2–8 years echoed this trend, while older units (8–16 years) saw steeper average losses of -0.20%.

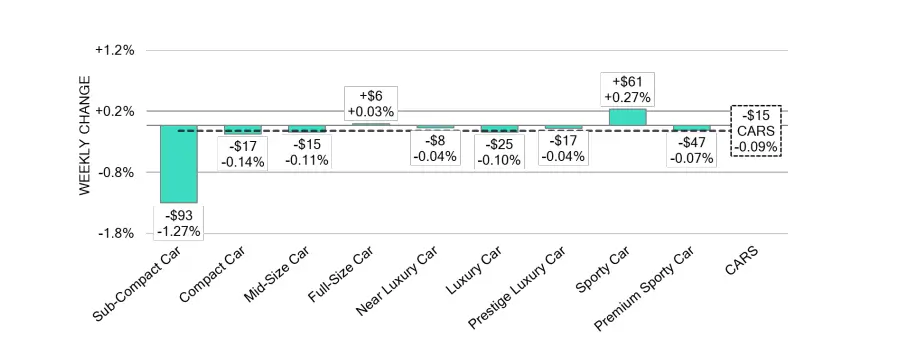

Passenger Cars See a Mixed Bag

The car segment as a whole posted a -0.09% drop, reversing the +0.07% gain from the previous week. Notable movement within sub-segments included:

- Sub-Compact Cars: The biggest losers, falling by -1.27%, with an ongoing three-week average decline of -0.87%.

- Sporty Cars: Still defying gravity, these models gained +0.27%—their tenth week of consistent appreciation.

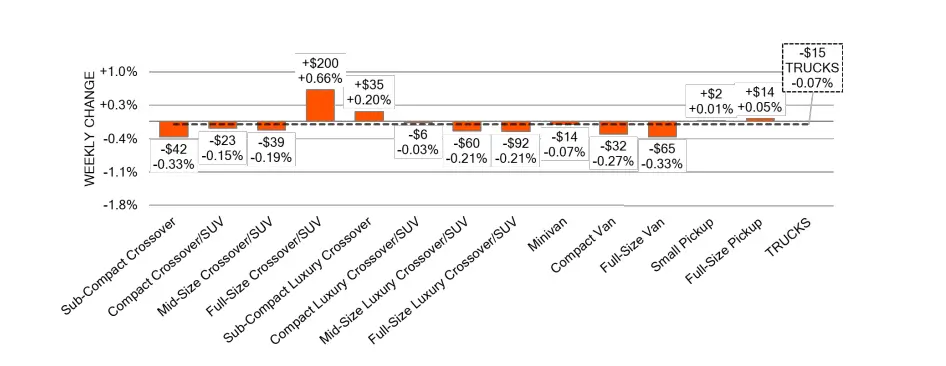

Trucks and SUVs Follow the Downtrend

Pickup trucks and SUVs also slipped -0.07% overall, mirroring last week’s figures. However, the performance varied significantly by age and segment:

- Full-Size Crossovers and SUVs: The standout performers, climbing +0.66%—marking growth in 13 of the past 14 weeks.

- Full-Size Pickups: Growth slowed, rising only +0.05% versus the +0.24% average of the past quarter.

- Older Models (8–16 years): Declined at a sharper -0.21%, reflecting cooling demand in high-mileage units.

Auction Activity & Inventory Insights

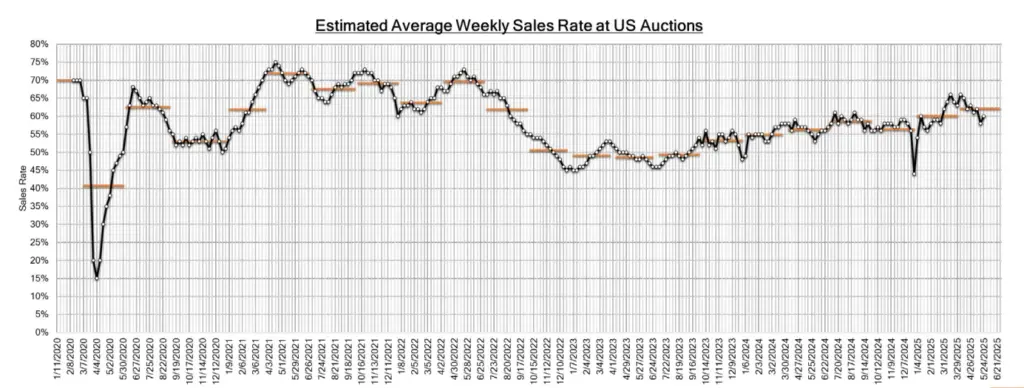

Despite declining values, auction floors remain active. Conversion rates rose 2% week-over-week, reaching 60%. This uptick indicates continued buyer interest, even as wholesale values adjust. On the inventory side, an increase in available units is also contributing to the softening of prices.

What This Means Moving Forward

The early signs of depreciation are not cause for alarm but rather a sign of stabilization. As supply levels recover and demand normalizes, the market is likely entering a more predictable phase after years of volatility. For buyers, sellers, and analysts, the coming weeks will offer clearer signals about whether this is a short-term pause or the start of a broader pricing correction.