If you’re searching for a Kelley Blue Book diminished value calculator, you’re not alone—and you’re in the right place.

After a car accident, your vehicle instantly loses market value, even after repairs. This is called diminished value, and recovering that loss can make a significant difference in your insurance settlement.

Here’s the catch: Kelley Blue Book (KBB) doesn’t actually offer a diminished value calculator. But that doesn’t mean you’re stuck guessing.

In this article, we’ll show you a smart, step-by-step DIY method using KBB’s own tools—including their vehicle condition quiz and car value estimator—to help you get a close estimate of how much value your car may have lost after an accident.

By the end of this guide, you’ll know:

- How to evaluate your car’s condition the way KBB does

- Where to enter those results to get a market-based value

- How to calculate the difference (your estimated diminished value)

Let’s get started.

Does Kelley Blue Book Offer a Diminished Value Calculator?

The short answer is: no, Kelley Blue Book does not provide a dedicated diminished value calculator.

While many drivers search for one—especially after a collision—KBB doesn’t calculate how much your car has depreciated due to accident history.

What they do offer are two powerful tools:

- A Vehicle Condition Quiz, which helps you objectively determine the overall condition of your car (Excellent, Very Good, Good, or Fair).

- A Car Value Estimator, where you can enter your vehicle’s details—along with its condition—to receive a market-based value range.

While neither tool was designed specifically to calculate diminished value, you can combine them to estimate it yourself. By comparing your car’s value in pre-accident condition vs. its current post-accident condition, you can get a rough idea of how much value was lost.

This DIY approach won’t be as precise as a professional appraisal, but it’s a useful starting point—and can help you decide whether it’s worth pursuing a claim.

How to Use Kelley Blue Book to Estimate Your Diminished Value (Step-by-Step Guide)

Even though Kelley Blue Book doesn’t offer a built-in diminished value calculator, you can still use their tools to estimate how much value your car has lost after an accident. Just follow these three simple steps:

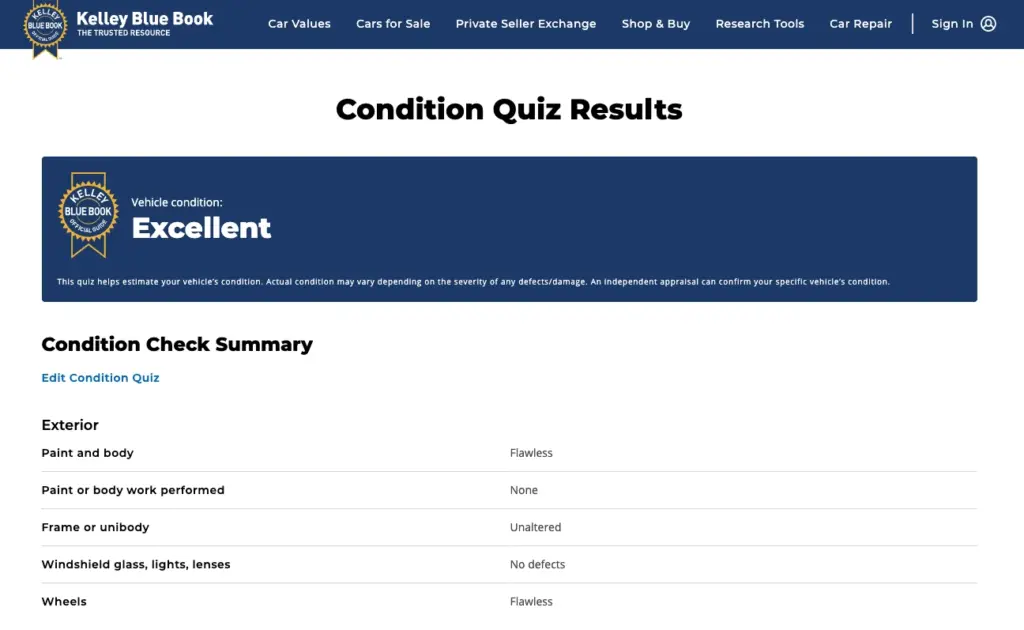

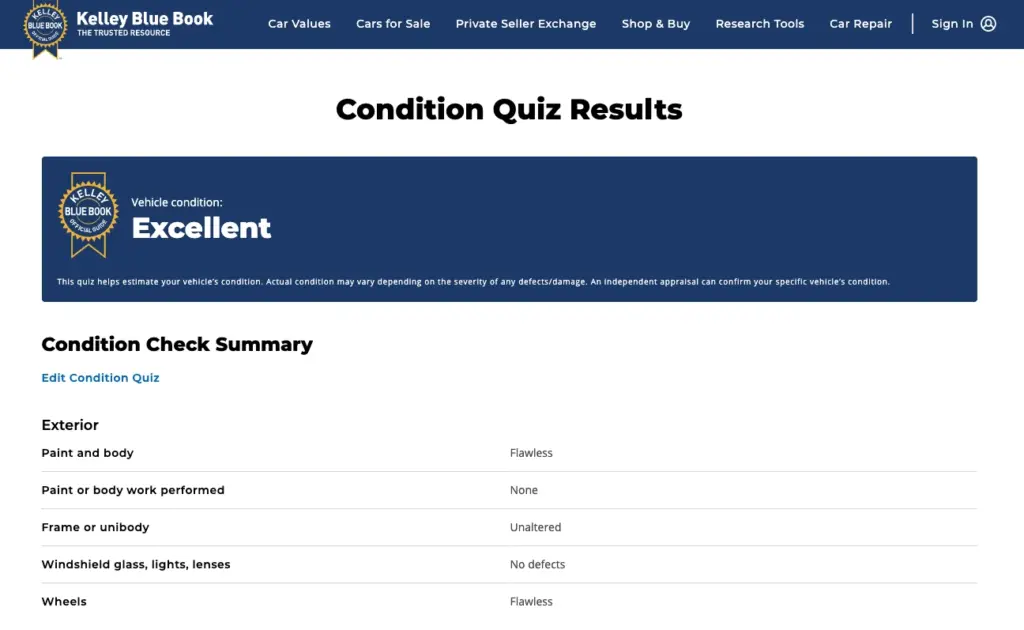

Step 1: Determine Your Vehicle’s True Condition Using KBB’s Quiz

Kelley Blue Book relies on condition ratings to determine your car’s value. A vehicle with no prior damage, minimal wear, and excellent maintenance may qualify as Excellent or Very Good.

But once that same vehicle has been in an accident—even if repaired—its rating will typically drop to Good or Fair, depending on the type and extent of the damage.

To help owners determine where their vehicle stands, KBB provides a Vehicle Condition Quiz, which walks you through key aspects like:

- Paint and bodywork

- Frame or unibody integrity

- Glass, lights, and lenses

- Interior and exterior condition

- Mechanical functionality

- Wheels and tires

These questions are crucial because specific answers automatically lower your condition rating. For example:

- If you select “significant amount of paint and/or body work”, the car is unlikely to remain in the “Very Good” or “Excellent” category.

- Choosing “repaired, altered, replaced” under the Frame or Unibody section will likely result in a Fair condition rating, as structural repairs significantly impact resale value.

This is why even after high-quality repairs, your vehicle may still fall into a lower condition bracket—because KBB’s condition model focuses on perceived market impact, not just physical appearance.

Once you’ve completed the quiz, KBB will assign your vehicle one of four condition ratings:

- Excellent

- Very Good

- Good

- Fair

To estimate diminished value, you’ll actually go through this process twice:

- First, select the condition your vehicle would’ve had before the accident (usually “Excellent” or “Very Good”).

- Then, retake the quiz and answer honestly based on your car’s post-accident condition.

Step 2: Use the KBB Car Value Estimator

Now that you know the condition ratings, head over to KBB’s What’s My Car Worth? tool. Enter your car’s:

- Year, make, and model

- Mileage

- ZIP code

- Trim level

- Options

- Condition (as determined by the quiz)

Run the tool twice:

- With the pre-accident condition (e.g., Excellent)

- With the post-accident condition (e.g., Fair)

Step 3: Calculate the Difference (Your Estimated Diminished Value)

Now that you have two market values from Kelley Blue Book—one based on the vehicle’s pre-accident condition and one based on its post-accident condition—you can easily estimate your diminished value.

Here’s the simple formula:

Diminished Value = Pre-Accident KBB Value − Post-Accident KBB Value

This difference reflects how much your car’s market worth has dropped due to the accident, even after repairs.

Example:

| Condition | KBB Value |

|---|---|

| Excellent (before) | $21,500 |

| Fair (after) | $17,300 |

| Diminished Value | $4,200 |

⚠️ Important: This DIY method is just a rough estimate. It doesn’t factor in things like accident history, localized market demand, severity of repairs, or if the vehicle is flagged as having structural damage—factors that can heavily affect resale value.

Next, we’ll explain why this method falls short when it comes to real claims—and what you can do to get an accurate, professional valuation for free.

Why the DIY Method Isn’t Always Accurate

While using Kelley Blue Book’s tools can give you a general sense of your car’s diminished value, it’s far from a complete picture—especially if you’re trying to negotiate with an insurance company or prove loss in a legal context.

Here’s why:

It Doesn’t Factor in Accident History Reporting

Even if your car looks and drives like new, once the accident is logged on Carfax or AutoCheck, its resale value drops sharply. KBB doesn’t consider this in its calculations—but buyers (and insurers) do.

Severity of Damage Is Not Measured

Two cars rated “Fair” could have very different stories. One might have a few cosmetic dings; the other could have sustained major frame damage. KBB’s condition grading can’t assess severity—only surface condition based on your inputs.

No Local Market Adjustments

The DIY estimate doesn’t reflect what buyers in your area actually pay for vehicles with an accident history. A diminished value in rural Georgia won’t match one in downtown Atlanta, even for the same make and model.

Insurance Companies Don’t Accept “Rough Estimates”

If you’re filing a diminished value claim, you’ll need a professional appraisal that:

- Documents the damage

- Analyzes comparable sales

- References vehicle history reports

- Provides a signed valuation report usable in negotiations or court

Using the KBB method is a great first step, but when it comes to getting fair compensation, the number that truly matters is the one supported by market data, expert analysis, and official documentation.

The Best Way to Know Your Diminished Value (It’s Free)

Using Kelley Blue Book’s tools is a smart way to understand how your vehicle’s condition affects its value—but it’s only a starting point. When it comes to real-world diminished value, especially after an accident, there are more factors at play than condition alone.

That’s why many drivers choose to get a professional opinion—just to be sure they’re not leaving money on the table.

At Diminished Value of Georgia, we offer nationwide free claim reviews to help you understand what your vehicle may truly be worth in today’s market. Our team takes into account:

- Your specific repair details

- Vehicle history

- Local market conditions

- Real sales data for comparable vehicles

You’ll get an honest, no-pressure assessment—at no cost. If we believe you have a strong claim, we’ll explain your options and next steps. If not, you’ll at least know where you stand, with clarity and confidence.

🔗 Get Your Free Diminished Value Review Now

Don’t leave money on the table. If your car lost value after an accident, you deserve to recover it. Let us help you take the next step with confidence.

What Happens Next?

- You tell us a bit about your car and the accident

- We review it for free, no strings attached

- You decide if a formal appraisal makes sense for your situation

Final Thoughts

Searching for a Kelley Blue Book diminished value calculator often leads to confusion—and now you know why. While KBB doesn’t provide a dedicated tool for calculating value loss after an accident, their condition quiz and pricing estimator can still give you a helpful ballpark figure.

By comparing your car’s value before and after the accident using their tools, you can estimate how much value may have been lost. It’s not exact, but it’s a good first step toward understanding your position.

If you want more clarity—or if you’re considering filing a diminished value claim—getting a professional review can make a big difference. It’s simple, free, and gives you real data to support your decisions.

At the end of the day, knowing your car’s true value means you’re better equipped to protect it.