Auto Market Update – May 9, 2025

As we navigate through May, the automotive market continues to reflect the complexities of global shifts and evolving consumer behaviors.

This week’s insights delve into price trends across vehicle segments, the dynamics of the used retail market, auction conversion rates, and pivotal industry developments—from BYD’s ascension in the EV sector to the UK’s strategic investment in battery manufacturing, and the growing momentum of Mobility-as-a-Service (MaaS).

Quick Stats

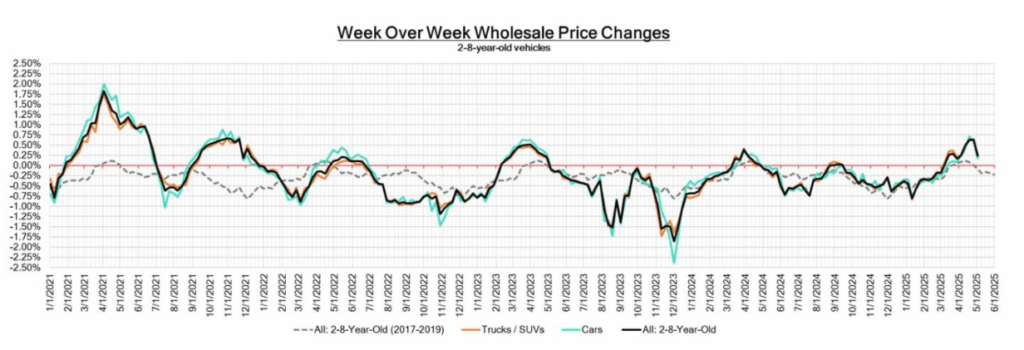

- Car Segments: +0.08% (This Week), +0.24% (Last Week)

- Truck & SUV Segments: +0.20% (This Week), +0.36% (Last Week)

- Overall Market: +0.17%

| This Week | Last Week | 2017~2019 Same Week Average | |

| Cars | +0.17% | +0.59% | -0.14% |

| Trucks and SUVs | +0.26% | +0.65% | -0.06% |

| Market | +0.24% | +0.63% | -0.09% |

Car Segments

The car segment experienced a modest increase of +0.08% this week, a slight deceleration from the previous week’s +0.24% rise.

Full-Size Cars led with a +0.36% gain, while Prestige Luxury and Sub-Compact Cars saw declines of -0.60% and -0.13%, respectively.

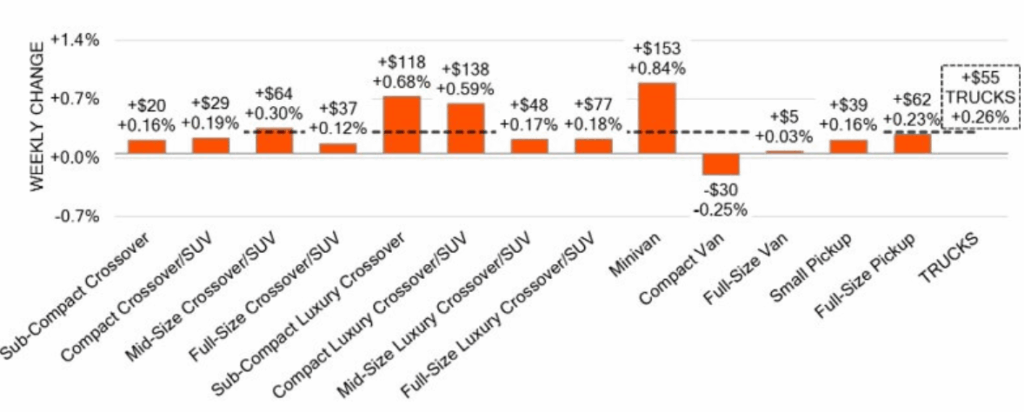

Truck & SUV Segments

- Trucks and SUVs continued their upward trajectory with a +0.20% increase.

- Mid-Size Crossovers/SUVs topped the segment at +0.52%, followed by Full-Size SUVs at +0.36%. Conversely, Full-Size Vans and Luxury Crossovers experienced declines of -0.30% and -0.61%, respectively.

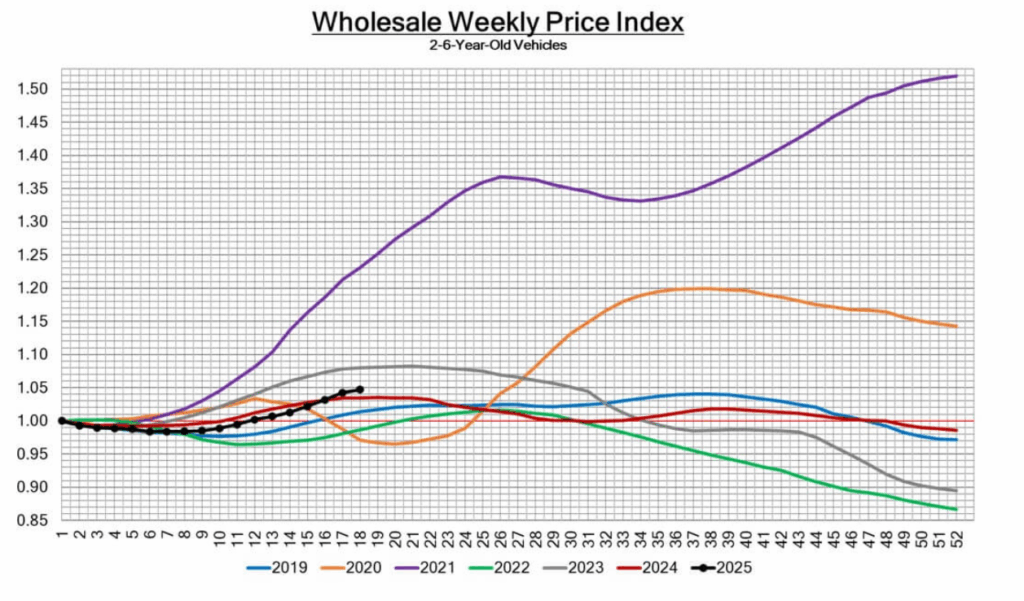

Weekly Wholesale Price Index

Wholesale prices for 2-to-6-year-old vehicles maintain a steady climb, albeit at a moderated pace. The index reflects sustained demand, particularly in domestic trucks and SUVs, influenced by recent tariff implementations.

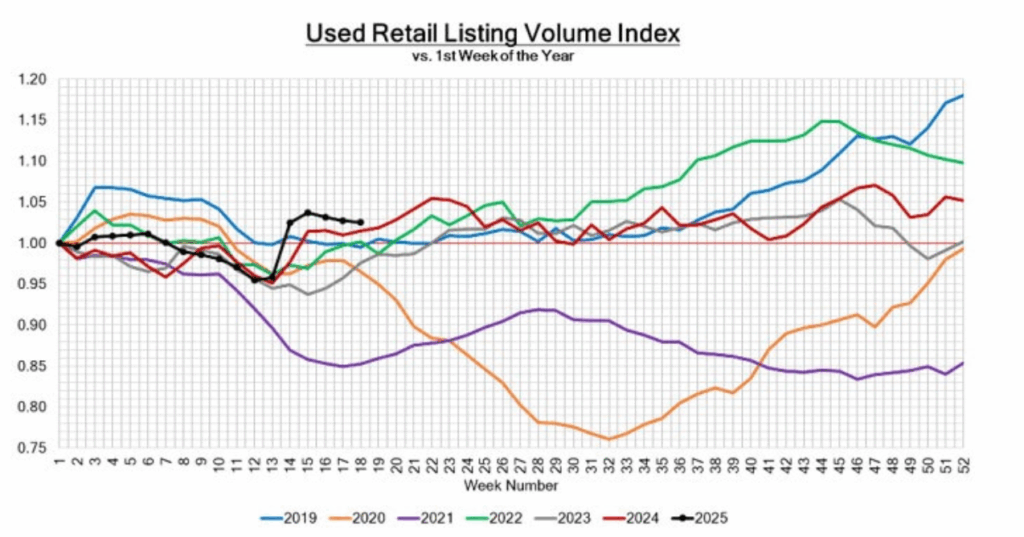

Inventory

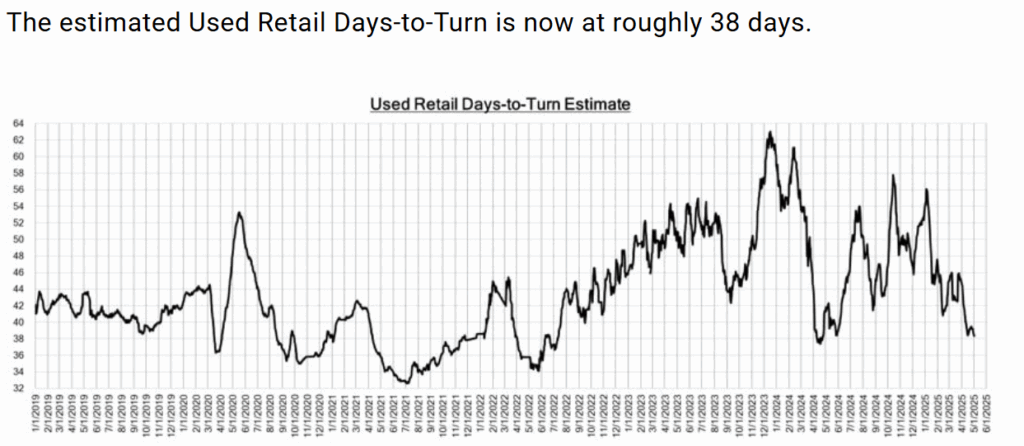

Used Retail

The Used Retail Active Listing Volume Index indicates a tightening supply, with dealers reporting increased demand for domestic models. The estimated Days-to-Turn has decreased to approximately 41 days, highlighting accelerated retail activity.

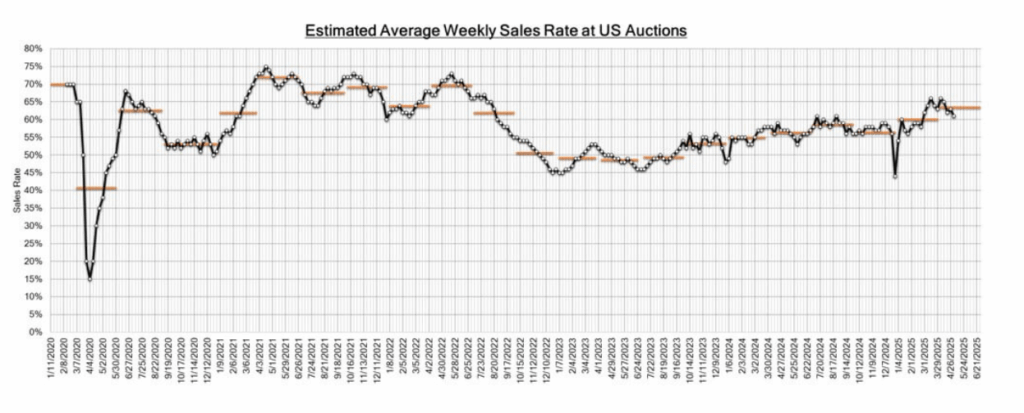

Wholesale

Auction conversion rates remain robust at 61%, with heightened activity in domestic trucks and SUVs. Dealers are actively sourcing inventory to meet consumer demand amidst supply constraints.

News Highlights

1. BYD Surpasses Tesla in Global EV Sales

In a significant industry shift, Chinese automaker BYD has overtaken Tesla as the world’s leading electric vehicle manufacturer, selling over 1 million EVs in Q1 2025 compared to Tesla’s 336,681. BYD’s growth is attributed to its diverse EV lineup, affordability, and rapid international expansion. Meanwhile, Tesla faces challenges with declining sales and increased competition.

2. UK Invests £1 Billion in New EV Battery Gigafactory

The UK government has announced a £1 billion investment in a new electric vehicle battery “gigafactory” in Sunderland. The facility, led by AESC, aims to produce batteries for up to 100,000 EVs annually, significantly boosting the UK’s EV production capacity and creating 1,000 jobs. This move underscores the UK’s commitment to strengthening its EV infrastructure and reducing reliance on foreign battery imports.

3. Mobility-as-a-Service Gains Momentum

The automotive industry is witnessing a significant shift from traditional vehicle ownership to Mobility-as-a-Service models. Consumers are increasingly favoring ride-sharing, car-sharing, and subscription services, prompting automakers to explore alternative revenue streams and adapt to changing consumer preferences.

Final Thoughts

The automotive landscape in May 2025 is marked by transformative shifts. BYD’s rise signals a new era in EV dominance, challenging established players like Tesla. The UK’s substantial investment in battery production highlights the strategic importance of localizing EV supply chains. Meanwhile, the growing preference for Mobility-as-a-Service reflects changing consumer values and the need for adaptability in the industry.

For consumers and industry stakeholders alike, staying informed and agile is paramount in navigating this evolving market.