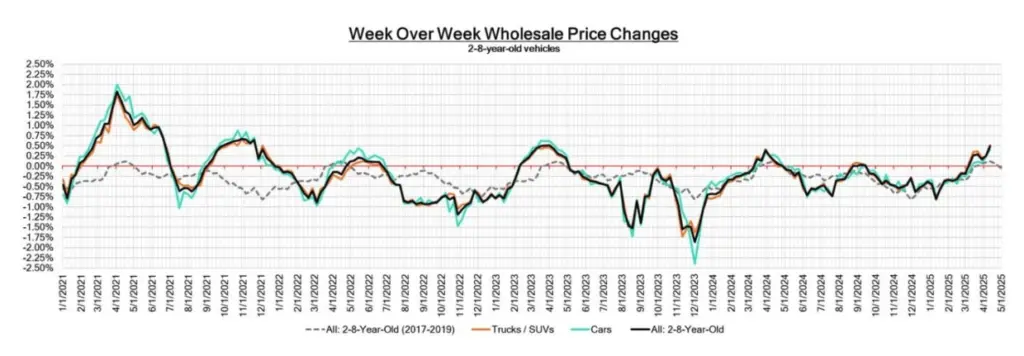

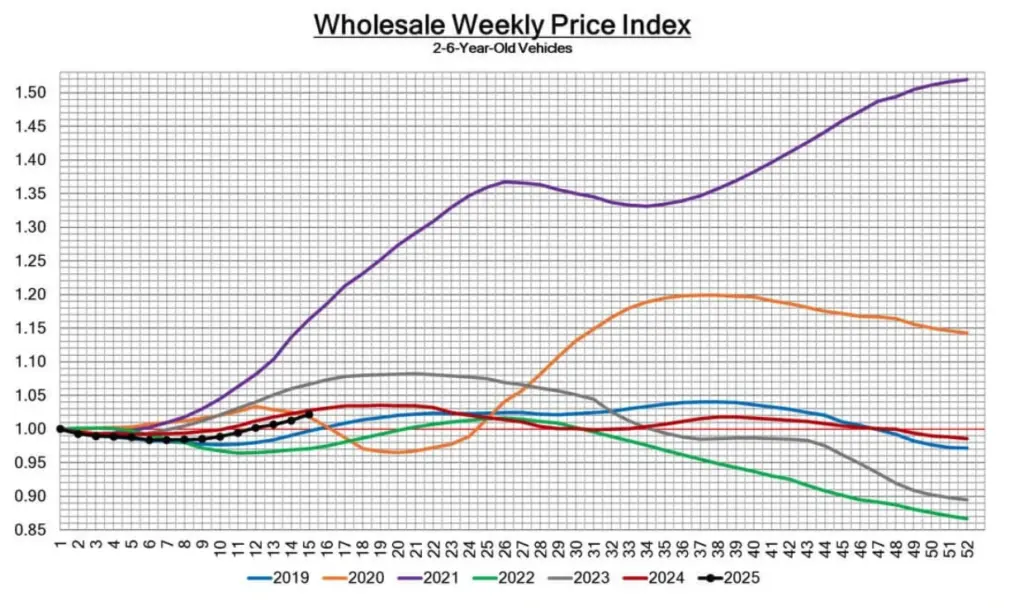

In April 2025, the U.S. auto market experienced significant shifts as new tariffs impacted vehicle prices and consumer behavior. This article provides a detailed overview of the wholesale and retail market trends, highlighting the effects of recent policy changes and what to expect moving forward.

Wholesale Vehicle Prices Spike as Tariff Effects Ripple Through Market

The announcement of a 25% tariff on imported vehicles led to a notable increase in wholesale prices. Buyers, anticipating reduced availability of new vehicles, turned to auctions to secure inventory, driving up prices across various segments.

Summary of Weekly Price Changes:

| Segment | This Week | Last Week | 2017–2019 Avg (Same Week) |

|---|---|---|---|

| Car Segments | +0.41% | +0.24% | +0.23% |

| Truck & SUV Segments | +0.51% | +0.25% | +0.04% |

| Overall Market | +0.48% | +0.25% | +0.12% |

Car Segments See Rare Across-the-Board Price Gains

Compact and Luxury Segments Lead the Pack

- 0–2-year-old car segments increased by +0.43%.

- All nine car segments experienced value increases, a phenomenon not seen in two years.

- The 0–2-year-old Compact Car segment saw a significant rise of +1.11%, the largest since November 2021.

- The 0–2-year-old Prestige Luxury Car segment experienced its largest single-week increase in three years, rising by +0.34%.

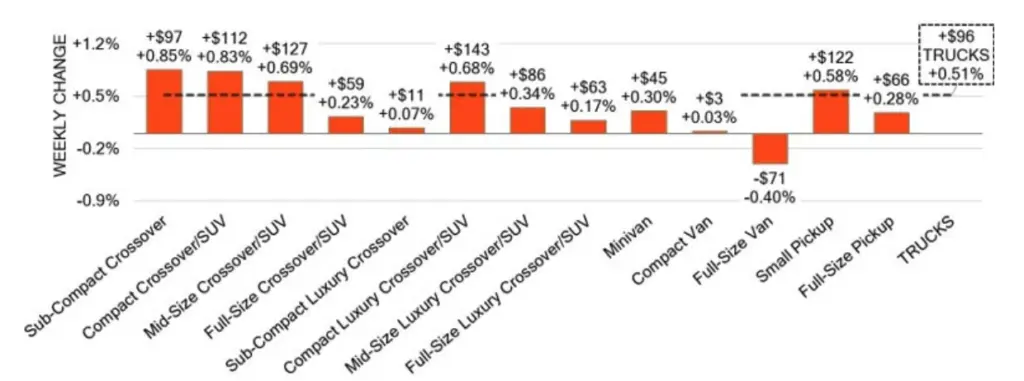

Truck & SUV Prices Surge Across Nearly All Segments

Crossovers and Vans Show Notable Increases

- 0–2-year-old models saw an average increase of +0.55%.

- The 0–2-year-old Mid-Size Crossover/SUV segment increased by +0.77%, while the 2–8-year-old segment rose by +0.69%, marking the largest single-week increases for these segments since June 2021.

- The 2–8-year-old Full-Size Van segment was the only Truck segment to report a decline. However, the older 8–16-year-old segment recorded its largest increase since June 2022, rising by +0.18%.

Retail Market Holding Strong Despite Price Increases

Transparent Pricing Keeps Buyer Interest High

- The Used Retail Price Index shows that transparent, no-haggle pricing continues to appeal to consumers.

- Inventory levels remain stable, with the Used Retail Active Listing Volume Index normalized to the first week of the year.

- The estimated Used Retail Days-to-Turn is now at approximately 40 days, indicating a healthy turnover rate.

Wholesale Market Trends – Canadian Supply Shrinks, OEM Volume Rises

- The number of Canadian vehicles appearing in U.S. auctions has dropped to nearly half of what was observed 30 days ago.

- Prices for these vehicles continue to rise as inventory declines.

- A substantial volume of vehicles are still being offered for sale in the OEM lanes.

- Last week’s auction conversion rate was 65%, indicating strong buyer activity.

Last Week’s Auto Industry Highlights

- President Trump imposed a 25% tariff on all imported cars, including those from Mexico and Canada, effective April 3, 2025.

- Hyundai announced a temporary suspension of some electric vehicle production in South Korea due to slow demand and U.S. tariffs.

- Ford launched a new advertising campaign, “From America, For America,” in response to the new tariffs.

- The U.S. auto industry is experiencing a surge in vehicle sales due to uncertainty sparked by the new tariffs, with consumers rushing to purchase vehicles now.

- Tata Elxsi reported a lower-than-expected profit for the fourth quarter, primarily due to challenges in its transportation segment amid tariff-related uncertainties.