Auto Market Update – January 28, 2025

Crash or Cash?

The 2025 auto market is full of twists—wholesale prices stabilize, minivans plummet, and Georgia’s EV inventory surges. But here’s what really matters: If you’ve had a recent accident, your car’s value is bleeding money—even if it’s repaired. In this week’s Auto Market Update, we dissecto the latest data from Black Book, expose the best and worst-performing segments, and reveal how Georgia drivers can fight back against insurers lowballing diminished value claims. Whether you’re selling, buying, or battling an unfair offer, these insights could save you thousands.

Why Keep Reading?

- Minivan Owners: Values dropped -1.06% this week—act fast to avoid losses.

- EV Shoppers: Georgia’s used EV glut means deals are hiding in plain sight.

- Crash Victims: Discover how to claim $6,800+ in diminished value (even if the accident wasn’t your fault).

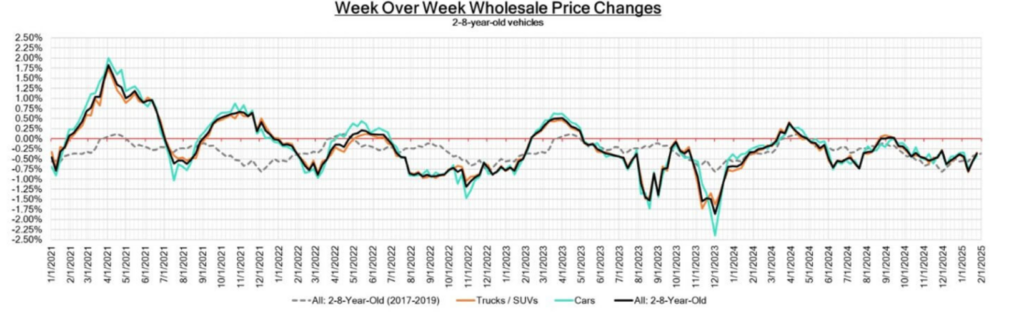

Wholesale Price Trends

Index rose slightly to 1.02 (vs. 1.00 baseline), signaling stabilization

| This Week | Last Week | 2017–2019 Average in Same Week | |

| Car Segments | -0.43% | -0.58% | -0.42% |

| Truck & SUVs Segments | -0.35% | -0.56% | -0.37% |

| Whole Market | -0.37% | -0.57% | -0.39% |

Depreciation slowed across the board this week, signaling market stabilization.

Car segments improved to -0.43% (vs. -0.58% last week) but lagged behind the 2017–2019 average of -0.42%.

Truck/SUV segments outperformed, dropping just -0.35% (vs. -0.56% last week) and beating their historical average (-0.37%).

The overall market declined -0.37%, a notable recovery from last week’s -0.57% and nearing pre-pandemic norms (-0.39%). Trucks/SUVs are driving the rebound, while cars remain slightly weaker historically.

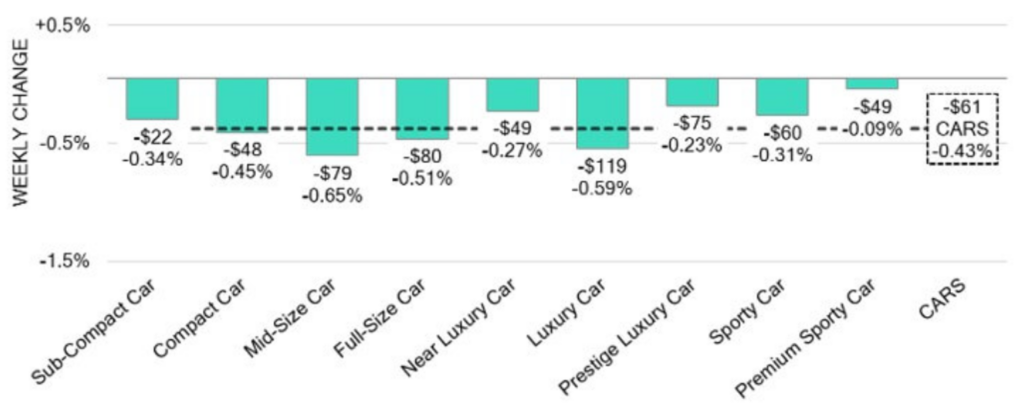

Car Segments

Car Segment Highlights

- Mid-Size Cars: Largest decline at -0.65% (vs. -0.74% prior week).

- Sub-Compact Cars: Depreciation slowed to -0.34% (vs. -1.0%+ in prior weeks).

- Premium Sporty Cars: Minimal decline of -0.09%, outperforming the segment.

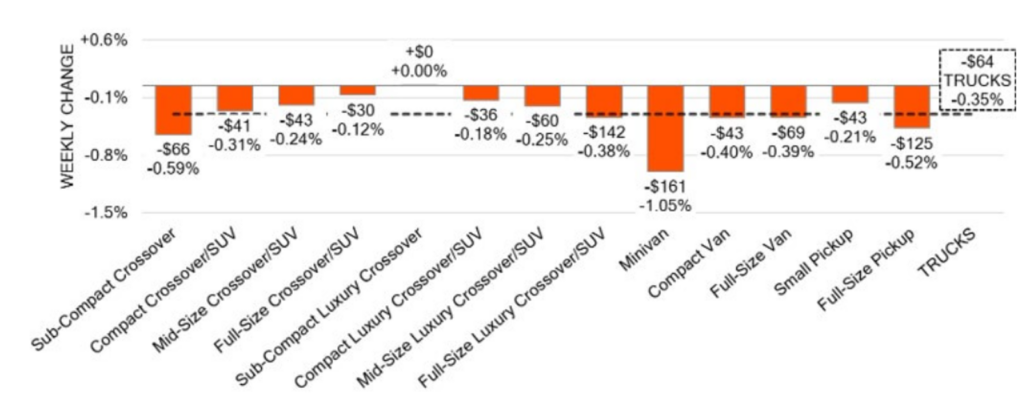

Truck & SUV Segments

Truck/SUV Segment Highlights:

- Compact Van: Remained relatively stable with a modest decline of -0.31%.

- Sub-Compact Luxury Crossovers: Values rose +0.002% (2–8-year-old models).

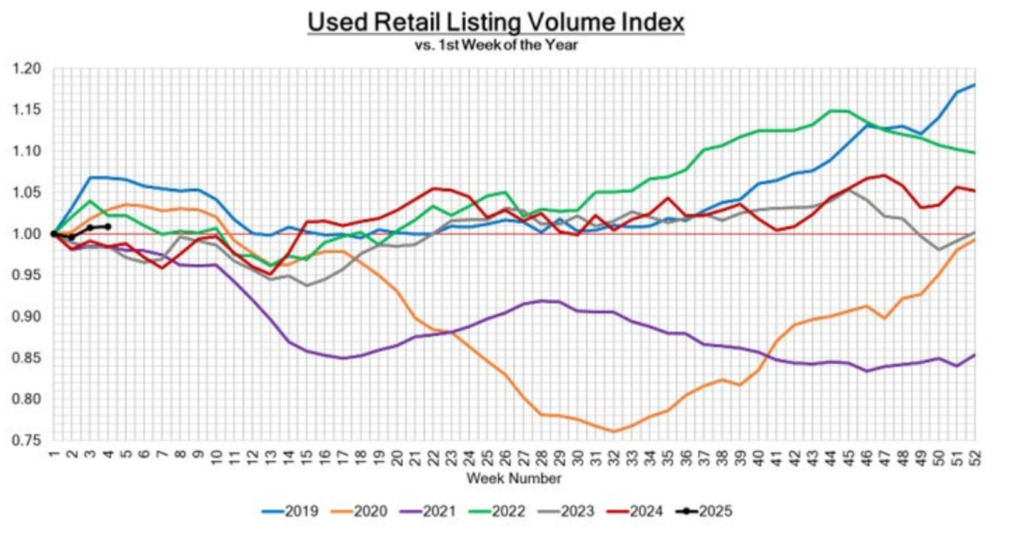

Inventory and Retail Trends

The Used Retail Active Listing Volume Index remained stable, reflecting consistent inventory levels across dealerships.

Used Retail Listing Volume Index

2025: Slightly below 2019–2023 levels, signaling tight inventory.

Used Retail Days-to-Turn Estimate

Improved slightly to an average of 45 days, reflecting efficient inventory management in the retail sector.

Industry News Highlights

1. U.S.-China Trade Tensions Hit Auto Parts

Proposed 10% tariffs on Chinese EVs and batteries threaten repair costs and parts availability. Georgia shops report delays for Volvo/Polestar components (owned by China’s Geely).

2. Tesla’s “Juniper” Model Y Debuts Amid Criticism

The redesigned Model Y launched at $61,630 (fully loaded) but faces backlash for reusing Model 3 parts and lacking 800V charging. Georgia pre-orders are strong, but diminished value risks linger for 2020–2023 models.

3. Ford Extends Free Home Charger Deal

Ford’s promotion now runs through March 2025, boosting F-150 Lightning sales. Pair with Georgia’s 5,000EVtaxcreditfor∗∗5,000EVtaxcreditfor∗∗12,500+ total savings**.

Conclusion

The 2025 auto market is a jungle—wholesale prices tease stability, minivans nosedive, and EVs flood Georgia lots. But knowledge is power: Armed with this week’s data, you can dodge depreciation traps, spot hidden deals, and force insurers to pay what your car’s worth.

Remember:

- Minivans and mid-size cars are bleeding value—sell before spring.

- EV buyers have leverage—haggle hard on older models like the Chevy Bolt.

- Crash victims—don’t let insurers steal your car’s value. Get a free appraisal and fight for every dollar.

Stay ahead with next week’s Auto Market Update—subscribe now for real-time alerts. Georgia drivers deserve fair deals, and we’re here to deliver them.