Auto Market Update – January 13, 2025

As we step into 2025, the automotive market is experiencing notable developments across various segments. Here’s a comprehensive overview of the latest trends and industry news.

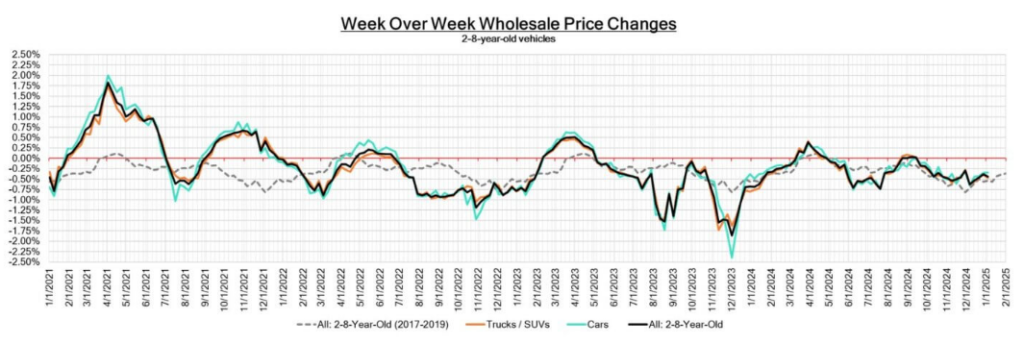

Wholesale Price Trends

In the final week of 2024, wholesale vehicle prices exhibited stability across both car and truck/SUV segments.

Car segments experienced a modest depreciation of -0.35%, consistent with the previous week’s trend. The truck and SUV segments saw a slightly higher decline of -0.47%. This steadiness occurred despite increasing auction inventories and improved conversion rates post-holiday, indicating a balanced market as auction activities resumed.

| This Week | Last Week | 2017–2019 Average in Same Week | |

| Car Segments | -0.35% | -0.35% | -0.60% |

| Truck & SUVs Segments | -0.47% | -0.40% | -0.50% |

| Whole Market | -0.44% | -0.38% | -0.54% |

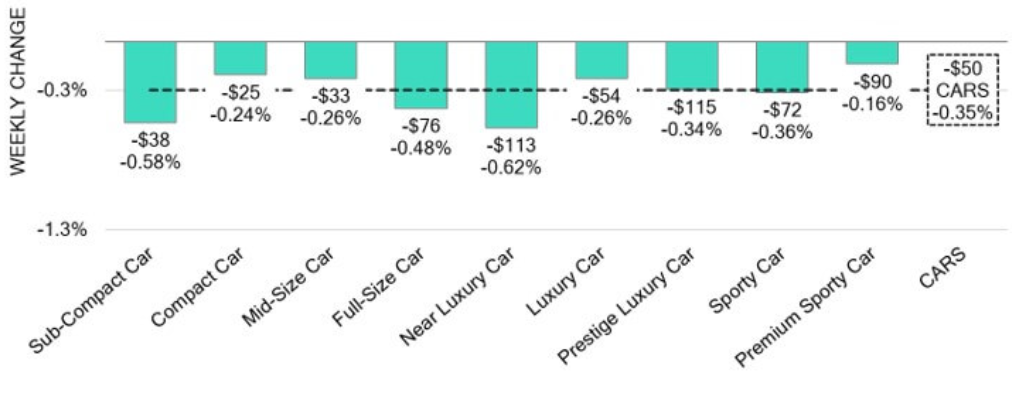

Car Segments

- Near Luxury Cars: This segment experienced the highest depreciation at -0.62%.

- Sub-Compact Cars: Continued their consistent depreciation pattern, averaging a decline of -0.58%.

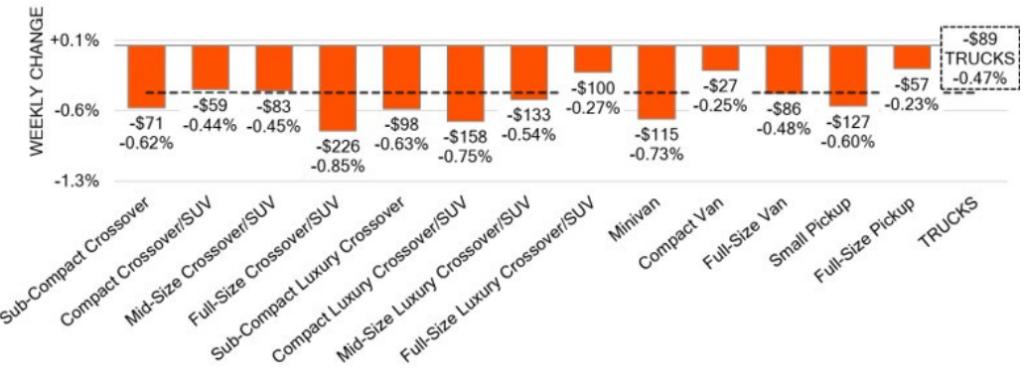

Truck & SUV Segments

- Full-Size Crossovers/SUVs: Saw the sharpest drop at -0.85%.

- Full-Size Pickups: Remained relatively stable with a modest decline of -0.23%.

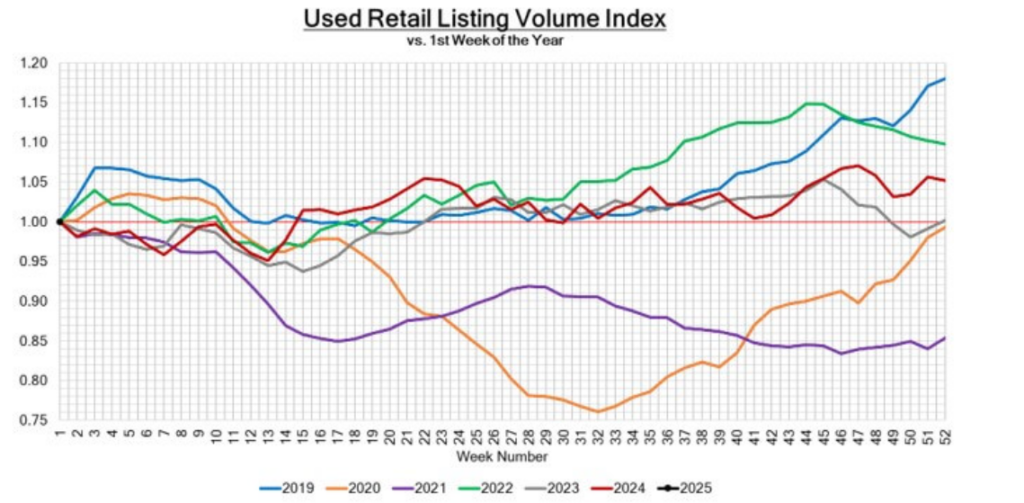

Inventory and Retail Trends

Used Retail Listing Volume Index

Remained stable, indicating balanced supply and demand across dealerships.

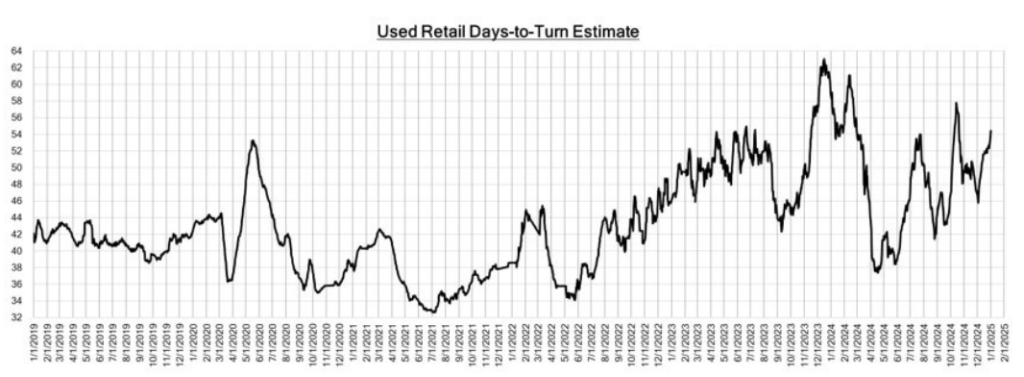

Used Retail Days-to-Turn Estimate

Improved slightly to an average of 55 days, reflecting efficient inventory management in the retail sector.

Industry News Highlights

1. Declining Sales for Foreign Automakers in China

Porsche and BMW have reported significant sales declines in China for 2024, with reductions of 28% and 13.4%, respectively. This downturn has negatively impacted Porsche’s global deliveries, which fell by 3% despite growth in other markets. The intensified competition from local Chinese carmakers, such as BYD and Xiaomi, offering high-tech electric vehicles at competitive prices, has been a pivotal factor. In response, foreign automakers are recalibrating their strategies, including reducing investments and forming local partnerships to regain market share.

2. Foxconn’s Ambitious Entry into the Electric Vehicle Market

Foxconn, renowned for its role as an iPhone manufacturer, is making significant strides into the electric vehicle (EV) sector. Collaborating with partners like Taiwan’s Yulon Motor Co., Foxconn unveiled its Model B EV at the Consumer Electronics Show (CES) in Las Vegas. With an ambitious vision to produce 40% of global EVs in the future, Foxconn has invested $1.3 billion in automotive acquisitions over the past decade.This move underscores the convergence of technology and automotive industries, as tech giants leverage their expertise to enter the burgeoning EV market.

3. Projected Slowdown in China’s Vehicle Export Growth

Projections for 2025 indicate a deceleration in China’s vehicle export growth.The China Association of Automobile Manufacturers (CAAM) anticipates a 5.8% increase, reaching 6.2 million units, a notable slowdown from the 19.3% growth observed in 2024. This trend reflects the maturation of China’s automotive export market and the challenges posed by global economic conditions and trade policies.

Conclusion: Stability Amid Seasonal Changes

The automotive market remains relatively steady as we enter the new year, with depreciation rates showing only minor fluctuations across segments.News of major brand transitions and partnerships highlights the industry’s rapid evolution toward a more electrified future.

As always, our analysis remains focused on trends shaping the automotive market. Stay tuned for next week’s update as we continue to monitor developments in 2025.