Auto Market Update – December 14, 2024

As we near the end of 2024, the automotive market continues to show steady depreciation patterns across key segments. This week, wholesale vehicle depreciation was slightly higher than the previous week, indicating market stabilization after consistent declines in recent months. Auction sales and retail inventory have remained stable, reflecting balanced buyer and seller activity.

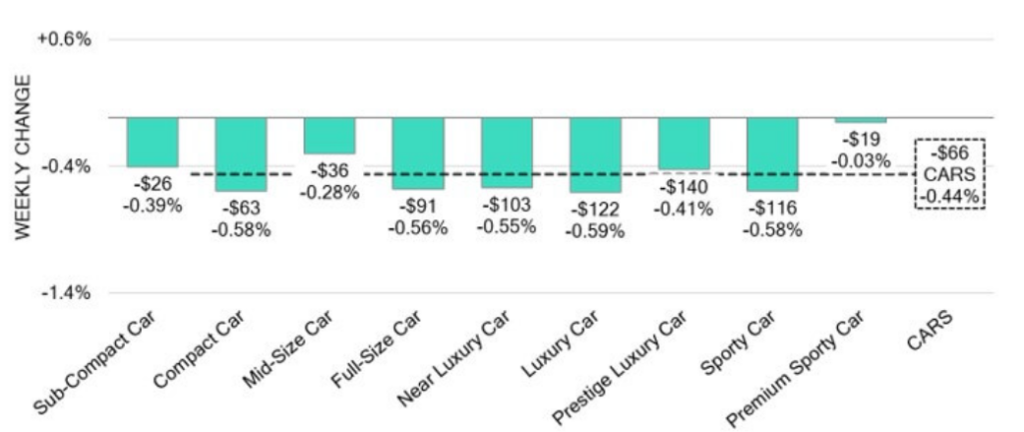

Car Segments

- Cars aged 8 to 16 years saw the largest depreciation this week at -0.63%, with luxury compact cars seeing the highest drop at -0.77%.

- Compact cars continued their consistent depreciation pattern, averaging a decline of -0.50%.

- Electric cars remain steady, reflecting growing consumer interest in this market despite seasonal fluctuations.

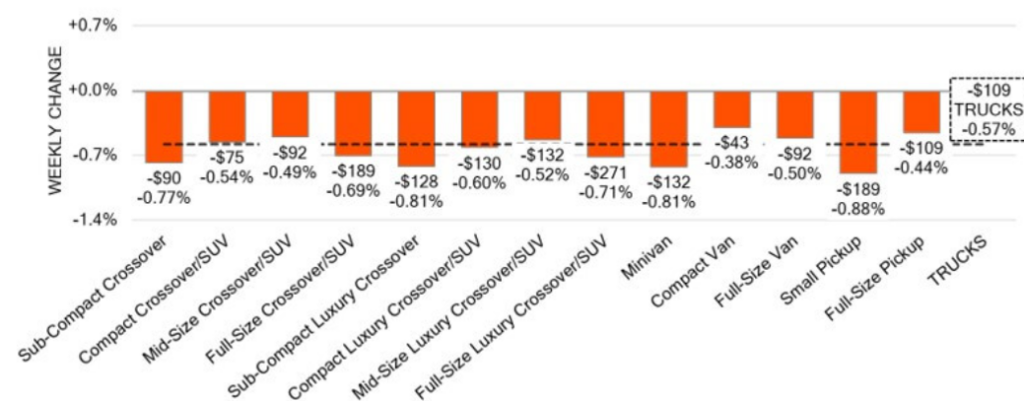

Truck & SUV Segments

- Trucks and SUVs had an average depreciation of -0.30%, slightly lower than car segments.

- Subcompact SUVs saw the sharpest drop this week at -0.64%, while larger full-size trucks remained stable with a modest decline of -0.18%.

- Increased auction activity in this segment signals healthy inventory turnover as 2024 wraps up.

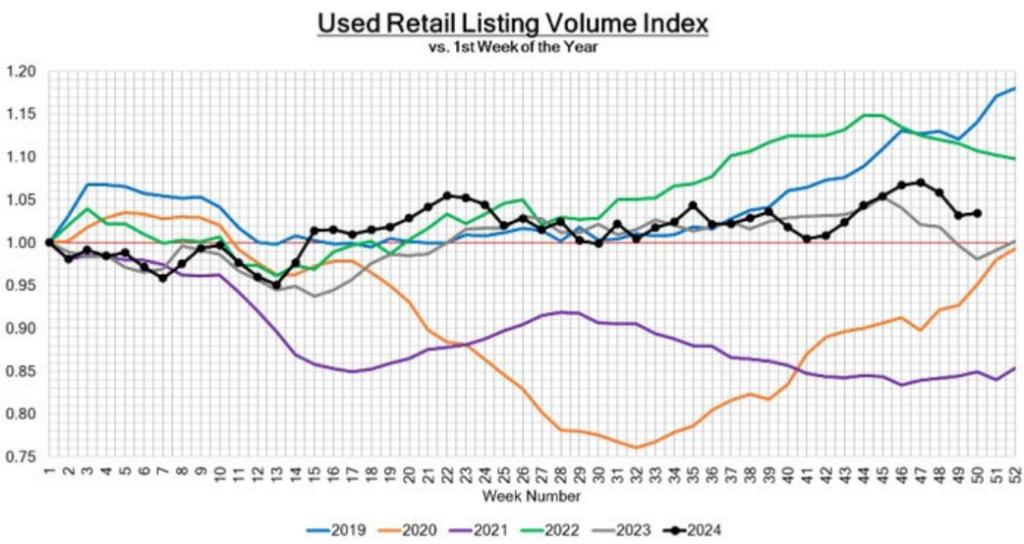

Inventory and Retail Trends

Used Retail Listing Volume Index

Used Retail Days-to-Turn Estimate

Industry News Highlights

1. VW Reaches Wage Deal for 120,000 Workers

Volkswagen has secured a wage agreement for 120,000 German workers, avoiding plant closures and layoffs through 2030. The deal includes a reduction of over 35,000 jobs via early retirements and buyouts, helping VW save €1.5 billion annually. Production of the Golf will shift to Mexico, while Wolfsburg and Osnabrück plants will downsize operations.

2. Potential Honda-Nissan Merger Could Create a New Giant

Honda and Nissan are reportedly exploring a merger that could result in a combined annual sales output of over 7 million vehicles. While the focus of the potential partnership will be on EVs, experts have expressed skepticism about whether this merger could truly revive both brands’ market standing amid fierce competition from Chinese automakers.

3. Popular Models Discontinued as Industry Shifts Focus

Several beloved car models are being phased out as the industry pivots toward EVs. Toyota confirmed the discontinuation of the Venza hybrid SUV, with production ending after 2024 to make room for the Toyota Crown Signia. Other notable exits include the Ford Edge, Chevrolet Camaro, and Nissan’s GT-R and Infiniti Q50 sedan. These changes reflect the broader industry move toward electrification and evolving consumer preferences.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

Conclusion: Stability Amid Seasonal Changes

The market remains relatively steady as we approach the end of the year, with depreciation rates showing only minor fluctuations across segments. News of major brand transitions and partnerships highlights the industry’s rapid evolution toward a more electrified future.

As always, our analysis remains focused on trends shaping the automotive market. Stay tuned for next week’s update as we wrap up 2024.