Understanding Diminished Value Claims

What Is Diminished Value?

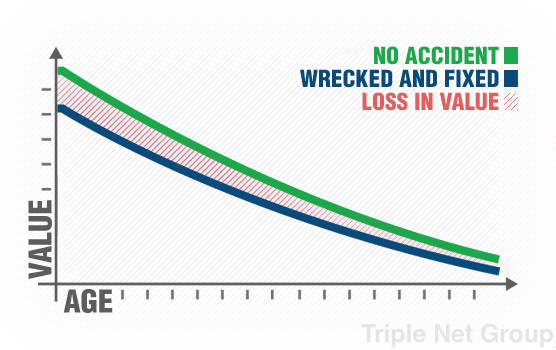

Diminished value is the reduction in your car’s market value after it’s been in an accident, even if all the repairs are done properly. Most buyers are hesitant to pay the same amount for a vehicle with a history of damage, seeing it as less reliable or valuable compared to similar cars without accident records.

Insurance companies like Travelers often don’t mention that you have the right to claim diminished value. And even when they do, 80% of the time, the payout is usually lower than expected, as they might rely on estimates that don’t fully account for the true loss in value. Knowing how diminished value works is key to making sure you get the compensation you deserve through your Travelers diminished value claims process.

How Diminished Value Impacts Your Vehicle’s Resale Value

Not all vehicles that experience damage will qualify for Travelers diminished value claims. If the car’s pre-accident value was already low or the damage from the accident was minor, the loss in value might not be significant enough to pursue. Diminished value matters most when a car with a higher market value suffers noticeable damage, even after repairs.

This list includes several circumstances which may disqualify you from making a diminished value claim for your car:

- Your vehicle does not have a substantial market value (cars under $7,000)

- You’ve already signed a release of liability form

- The accident caused minimal damage (usually under $500)

- The vehicle has excessive mileage (more than 30K miles per year)

- Your vehicle is too old (normally 10 years or older)

- Your vehicle has a branded title (salvage or rebuilt)

- Your vehicle had multiple previous accidents with greater damage

- Your vehicle was declared a total loss

- The statute of limitation has lapsed

- If you’re outside Georgia and courts have ruled against DV

For vehicles in this situation, the accident history can lead to a drop in resale value. Buyers often hesitate to pay full price for a car that’s been in an accident, even if it’s been fixed.

In fact, cars with a history of accidents can sell for as much as 20-30% less than similar cars with clean records.

Filing a diminished value claim with Travelers can help recover some of that lost value, compensating you for the reduced worth of your vehicle.

Travelers Insurance and Diminished Value Policies

How Travelers Handles Diminished Value Claims

Travelers Insurance, like many other insurers, approaches diminished value claims with specific guidelines and procedures. Their focus is often on minimizing the payout, which means they may undervalue the loss in your car’s market value after an accident. Travelers may use their own assessment tools or third-party evaluations to determine how much your car’s worth has decreased.

To succeed in Travelers diminished value claims, it’s crucial to understand their process and be prepared with solid evidence that clearly shows the impact on your vehicle’s value. This knowledge can help you counter low settlement offers and negotiate a fairer payout.

Factors Travelers Consider in Diminished Value Assessments

When evaluating travelers diminished value claims, Travelers takes into account several factors that affect the amount they might offer. Some of the key elements they typically review include:

- Extent of Damage: The severity and type of damage to your vehicle, even after repairs, play a significant role in determining its value loss.

- Vehicle Age: Older vehicles may see less compensation due to natural depreciation over time.

- Mileage: Cars with higher mileage are generally valued lower, as they are more prone to wear and tear.

- Pre-Accident Condition: The condition of your vehicle before the accident can impact the assessed diminished value.

- Market Demand: The demand for your specific make and model in the used car market can also influence the claim amount.

Understanding these factors can help you better prepare your case when filing a diminished value claim with Travelers. It allows you to present evidence that directly addresses their criteria, increasing your chances of a fair settlement.

The Role of the Appraisal Clause in Travelers Policies

The appraisal clause in Travelers Insurance policies can be a valuable tool if you disagree with the insurer’s assessment of your vehicle’s diminished value. This clause allows you to request an independent appraisal if you believe their offer doesn’t accurately reflect your car’s loss in value.

Here’s how it typically works:

- You and Travelers each select an independent appraiser to evaluate the diminished value of your vehicle.

- If the two appraisers disagree, they usually bring in a third-party umpire to make the final decision.

- The outcome determined by the umpire is binding, meaning both you and Travelers must accept their decision.

Invoking the appraisal clause can be a strategic move when you’re faced with a low settlement offer. It helps level the playing field by bringing in unbiased evaluations of your car’s market value after an accident.

How to File a Diminished Value Claim with Travelers

Filing a diminished value claim with Travelers can be a straightforward process if you follow these steps:

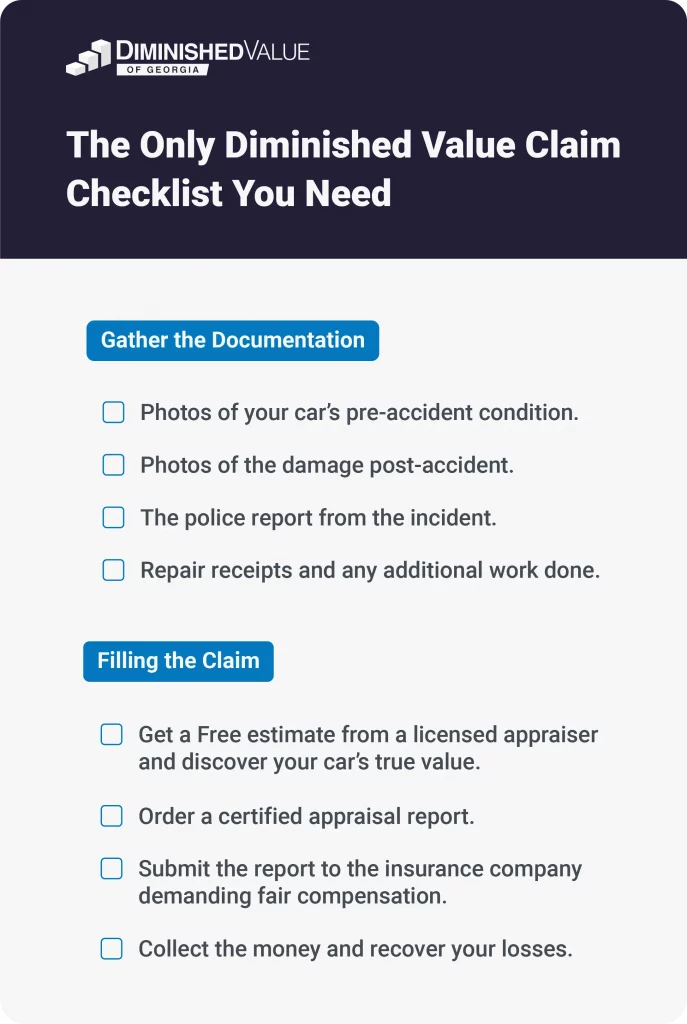

1. Gather Comprehensive Documentation

The strength of your diminished value claim relies on solid documentation. Before filing your claim with Travelers, make sure to gather all the necessary evidence, including:

- Photos of your vehicle’s condition before the accident.

- Detailed photos of the damage immediately after the incident.

- A copy of the police report from the accident.

- All repair invoices and receipts, including any additional work performed.

Having thorough documentation makes it much harder for Travelers to dispute the validity of your claim.

2. Get an Independent Diminished Value Appraisal

One of the most critical steps in the process is to get an independent appraisal of your vehicle’s diminished value. Instead of relying solely on Travelers’ assessments, which may not always be impartial, hiring a professional appraiser ensures a more accurate evaluation of your car’s true loss in value.

Independent appraisers provide unbiased estimates that reflect the actual impact on your vehicle’s market value, strengthening your claim with reliable evidence.

3. Avoid Common Claim Pitfalls

Filing a diminished value claim can come with potential challenges. Here are a few common mistakes to avoid:

- Delaying the Claim: If you wait too long to file, Travelers might argue that the loss in value is due to normal depreciation rather than the accident itself.

- Accepting the First Offer: Travelers may offer a low initial settlement, hoping you’ll accept it quickly. Never settle without first getting an independent appraisal and researching the true value of your claim.

Being aware of these pitfalls can help you navigate the claim process more effectively and avoid undervaluing your vehicle’s loss.

4. Understand Your Policy and State Laws

Knowing the details of your insurance policy and state laws is crucial when filing a diminished value claim with Travelers. Some states allow both first-party and third-party claims, while others limit you to filing against the at-fault driver’s insurance.

Outside of Georgia, for example, you can only file a diminished value claim against the at-fault driver’s insurance, as there is no law that allows first-party (comprehensive) diminished value claims.

Understanding your rights and the specifics of your state’s regulations can make a significant difference in how much you can recover for your diminished value claim.

5. Navigating the Appraisal Process Bias

While the appraisal clause in your Travelers policy is designed to resolve disputes, it can sometimes be biased in the insurer’s favor. Travelers might choose an appraiser who frequently sides with them, making it difficult to get a fair assessment of your car’s loss in value.

Hiring your own independent appraiser is a smart move to counter this potential bias. With an independent appraiser on your side, you increase your chances of reaching a balanced and fair outcome in the appraisal process.

Why You Need an Appraiser for Your Travelers Diminished Value Claim

Hiring an independent appraiser is one of the most effective ways to strengthen your diminished value claim with Travelers. While the insurance company’s appraisers may provide their own estimate, they often lean toward minimizing the payout. An independent appraiser offers a neutral evaluation that better reflects the true loss in your vehicle’s market value.

Here’s why working with an independent appraiser can make a difference:

- Unbiased Assessment: Independent appraisers don’t have a conflict of interest, so they’re more likely to provide an accurate valuation of your car’s diminished value.

- Stronger Negotiation Position: Presenting a fair and unbiased appraisal gives you leverage in negotiations with Travelers, increasing your chances of a better settlement.

- Expert Witness: If your claim escalates to a legal dispute or requires further evaluation, an independent appraiser can serve as a credible witness to validate your claim.

By bringing in an independent expert, you help ensure that your diminished value claim is based on realistic numbers, not just what the insurer deems acceptable.

Challenges in Travelers Diminished Value Claims

Common Reasons for Claim Denials

Filing a diminished value claim with Travelers can sometimes be challenging, and there are several common reasons why these claims get denied or undervalued. Knowing these reasons can help you prepare a stronger case:

- Insufficient Evidence: Without solid documentation, like photos, repair estimates, and independent appraisals, Travelers may argue that your claim lacks proof of value loss.

- Low Damage Severity: If the damage to your vehicle was minor or cosmetic, the insurer might claim that the loss in value is too insignificant to warrant compensation.

- Delay in Filing: Filing a claim too long after the accident can lead to denial, as Travelers may argue that the vehicle’s decreased value is due to normal depreciation rather than the collision.

- Release of Liability: If you’ve already signed a release of liability form after the initial settlement, it may prevent you from filing a diminished value claim later.

Understanding these common obstacles can help you avoid mistakes and build a more compelling case when negotiating your diminished value claim with Travelers.

Options for Responding to Claim Denials and Appeals

If Travelers denies your diminished value claim or offers a low settlement, it’s important to know that you still have options. Here are steps you can take to challenge their decision and push for a fairer resolution:

- Review the Denial Letter: Carefully read the denial letter from Travelers to understand the specific reasons they rejected your claim. This will help you address any gaps or issues in your evidence.

- Gather Additional Evidence: If your claim was denied due to insufficient proof, consider collecting more detailed documentation. This could include updated photos, a second independent appraisal, or a vehicle history report highlighting the impact of the accident.

- Negotiate Directly: Contact Travelers to discuss the denial and present any new evidence you have. Be clear about your position and use the independent appraiser’s findings to support your argument for a higher payout.

- Invoke the Appraisal Clause: If negotiations don’t lead to a satisfactory outcome, consider invoking the appraisal clause in your policy. This allows both you and Travelers to appoint independent appraisers to assess the vehicle’s diminished value and, if necessary, involve an umpire for a binding decision.

- Seek Legal Advice: If all else fails, consulting with a lawyer experienced in insurance claims may be your best option. They can guide you through the process and help ensure you receive the compensation you’re entitled to.

Taking these steps can significantly improve your chances of overturning a denial and securing a fair diminished value settlement with Travelers.

Conclusion

Filing a diminished value claim with Travelers can be challenging, but understanding the process and taking the right steps can significantly improve your chances of a fair settlement. Start by gathering comprehensive evidence, including detailed photos and repair estimates, to support your claim. Hiring an independent appraiser can provide an unbiased assessment of your vehicle’s loss in value, giving you leverage in negotiations.

Be aware of common pitfalls like delayed filing or accepting low initial offers without doing your own research. If you disagree with Travelers’ assessment, don’t hesitate to invoke the appraisal clause to bring in a neutral evaluation. If the claim process becomes overwhelming, consider seeking help from professionals experienced in Travelers diminished value claims.

With the right approach, you can navigate the claim process confidently and secure the compensation you deserve for your vehicle’s reduced worth.