Another week, another auto market update! This time, with a special month review!

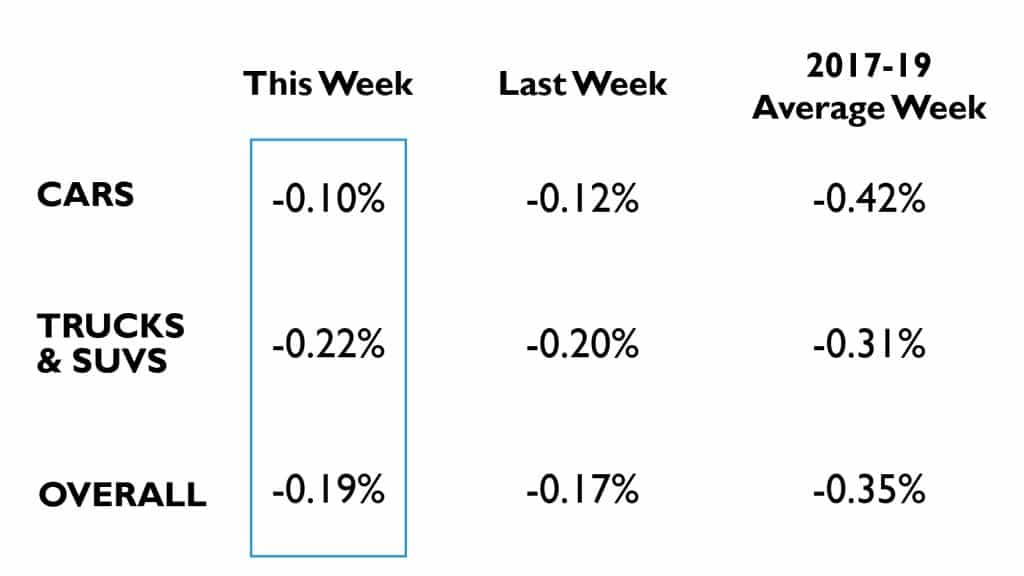

If you’re asking yourself which of those were the most profitable niches and trends, you’re in the right place. Since the start of September, we’ve seen the core aspect of auto sales remain “affordability.” Now, in the last week of the month, we saw a market that decreased steadily.

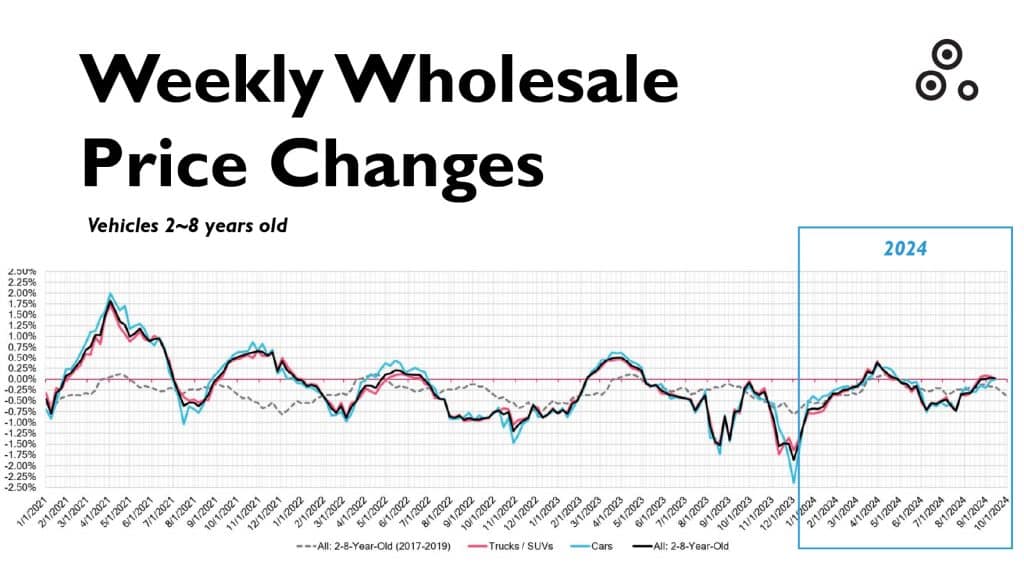

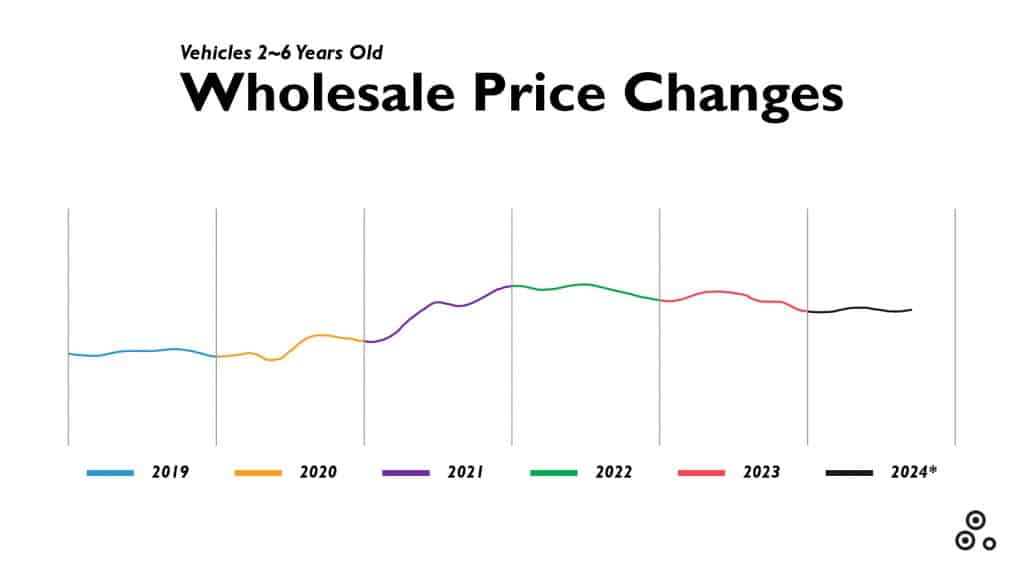

The steady decline starting from mid-2022 suggests that after the pandemic-induced car price inflation, wholesale prices are crashing back to Earth. But right when we thought we were in free fall, prices decided to defy gravity in early 2023 and spike again. Is this a classic “car rebellion” against market predictions? Perhaps the vehicles themselves have gained self-awareness, refusing to be devalued!

Now, if you want the most accepted hypothesis, here it is: the prices of vehicles were so high that no one wanted to buy new cars. The supply and demand law determines that at higher prices, consumers buy less. So, when car value sky rocketed in the pandemic, it was just natural that it would drop.

GET MORE MONEY FROM THE INSURER

Don’t leave money on the table! Order a FREE Claim Review and discover your car’s true value.

Auto Market Update: Cars & Trucks

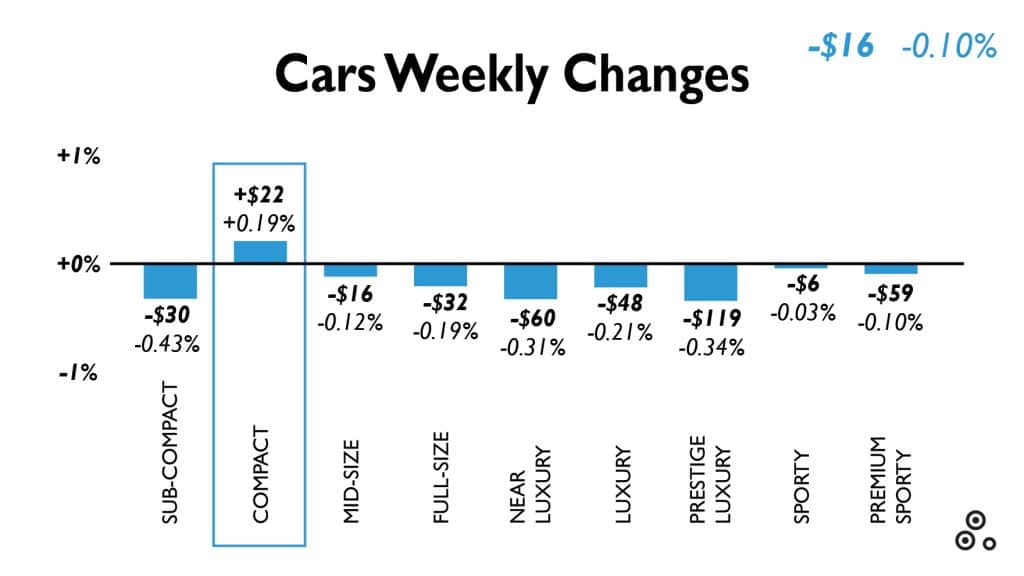

Oh, the volatility here is palpable. Sub-compact cars took a severe beating with a significant drop, while full-size cars followed this trend. Could this signal a growing distaste for small, eco-friendly cars in favor of the more compact models?

On a more mundane note, it’s clear that luxury is getting backlash from its great performances in September. But in this unpredictable market, a $16 price change for the overall cars segment might be the automotive equivalent of flipping a coin—heads, we overpay; tails, we panic.

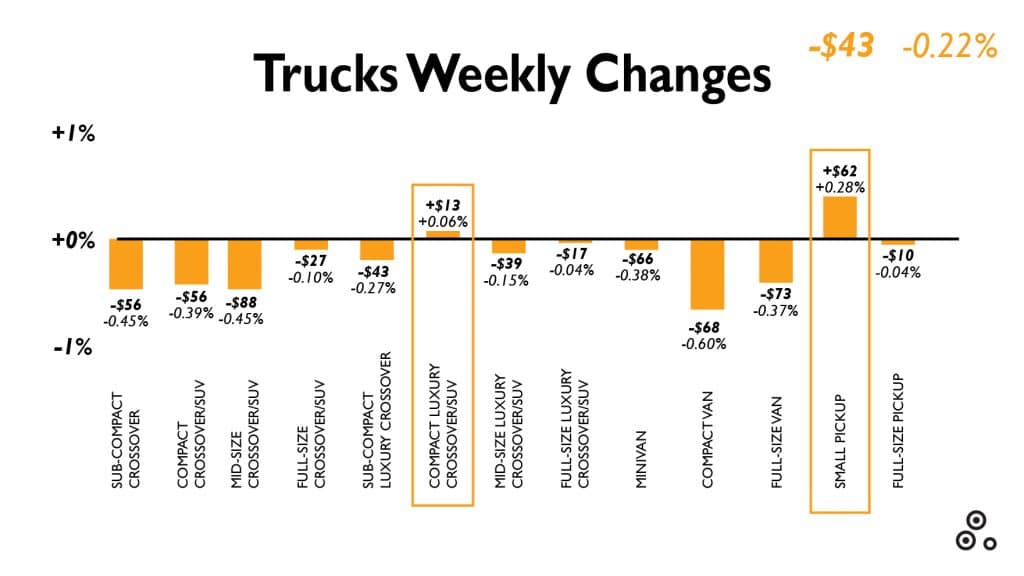

Trucks, on the other hand, seem to be having a minor identity crisis. While some categories are making marginal gains (shoutout to Compact Luxury Crossover/SUV), others, like compact vans, are getting trampled. Are compact vans officially on the endangered species list of vehicles? The $62 increase in Small Pickups could be a harbinger that people are preparing for the impending apocalypse, hoarding goods in their cargo vehicles.

Trucks are becoming the new luxury item of choice—this isn’t just about utility; it’s a full-blown status symbol. Expect the next generation of pickup trucks to have leather interiors, glittery trims, and built-in espresso machines.

Auto Market Update: Wholesale Prices

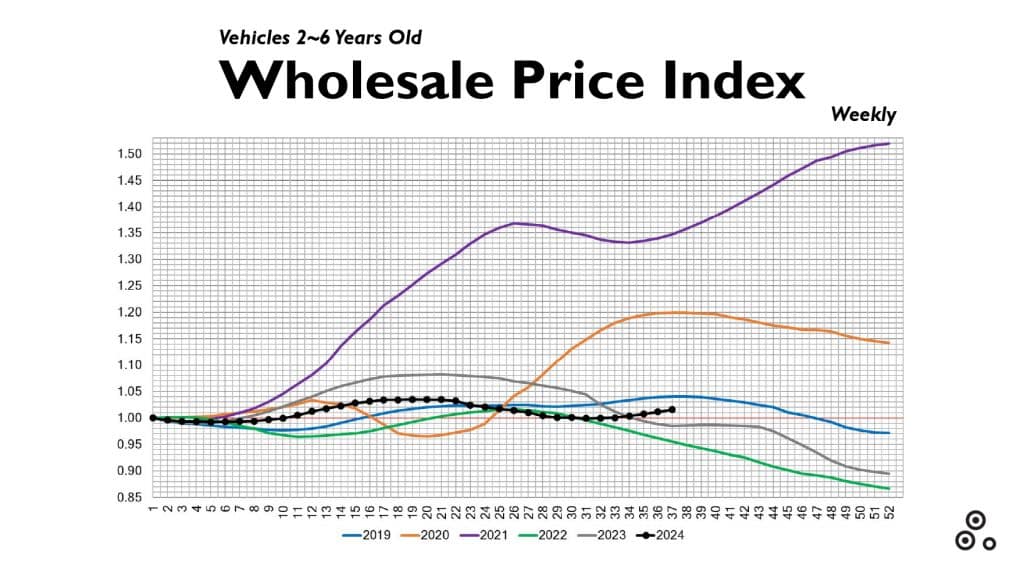

The graphs below are a masterclass in chaos theory. After the absolute calm of 2019, the market erupts with wild movements from 2020 onwards. The pandemic lockdown held the car prices for too long. Now, the market had an increase in prices to balance this freezing in trades. But it is still too volatile, and it seems to remain like this for a little more time.

The 2021 spike is a clear metric of this reaction, and it has only begun to stabilize this year. The 2024 flat curve seems like a post-pandemic, “healed” market.

How about letting our team get you the best value for your insurance claim?

- Discover your car’s true value

- No payment upfront

- Vehicle history report

September 2024 Auto Market Performance Overview

In September 2024, the auto market demonstrated moderate yet noteworthy shifts, reflected across wholesale prices, retail prices, and inventory levels. Here’s a breakdown of these trends:

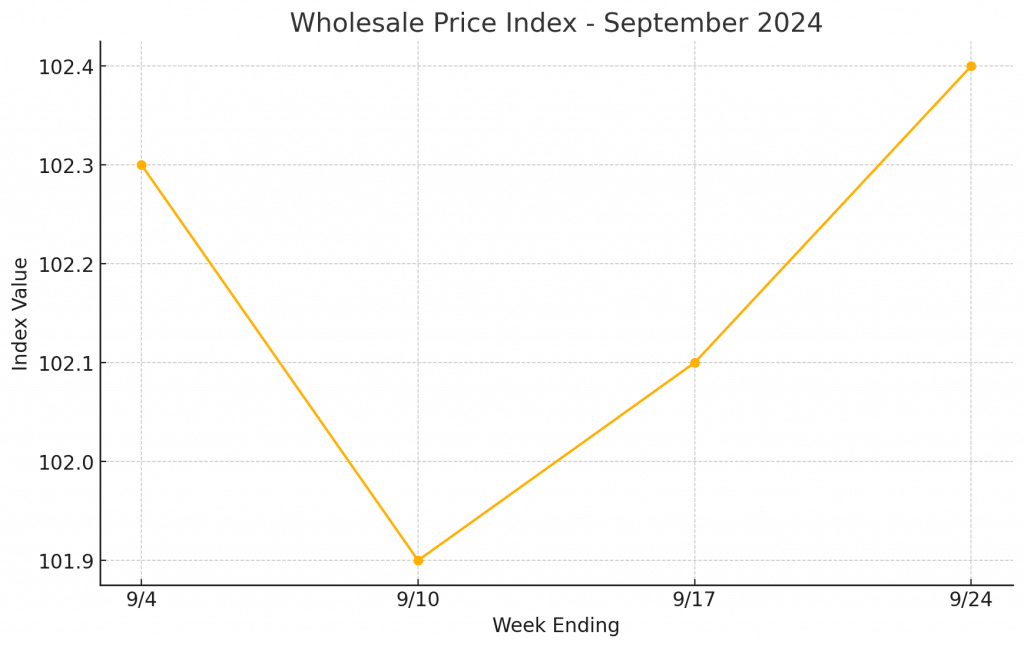

1. Wholesale Price Index

- The wholesale price index started the month at 102.3, dipped slightly to 101.9 by mid-September, and then recovered to reach 102.4 by September 24th.

- Trend Analysis: This movement suggests a minor fluctuation, possibly due to supply chain adjustments or seasonal factors. The mid-month dip followed by a quick recovery indicates that market demand remains strong enough to support price rebounds.

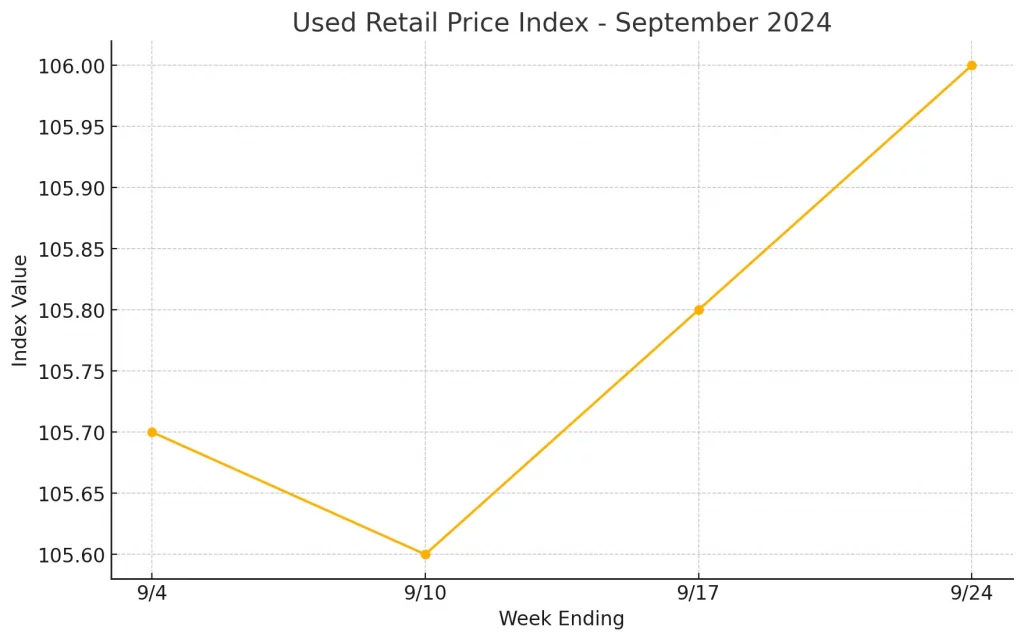

2. Used Retail Price Index

- The retail price index mirrored the wholesale trend, beginning at 105.7, experiencing a minor drop to 105.6, and then rising steadily to 106.0 by the end of the month.

- Trend Analysis: The slight decline followed by steady growth points to resilient consumer demand. The overall upward trend in retail prices suggests that buyers are still willing to pay more for used vehicles, likely due to ongoing supply limitations for new cars.

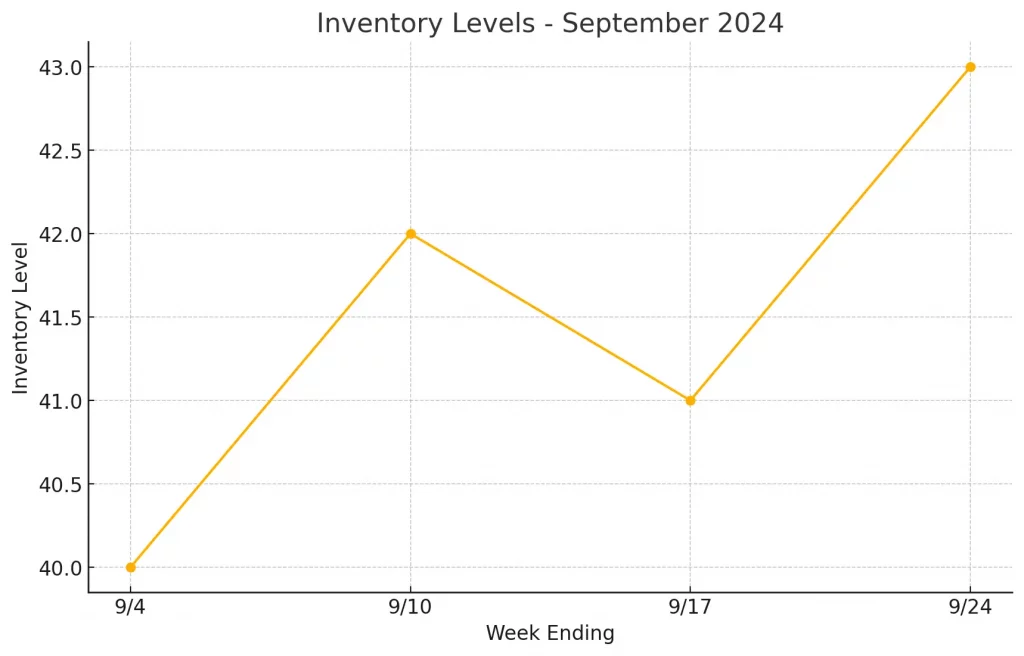

3. Inventory Levels

- Inventory levels started at 40 units, climbed to 42 by September 10th, decreased to 41 on September 17th, and peaked at 43 units by the month’s end.

- Trend Analysis: The increase in inventory indicates that dealers may be adjusting their stock in response to market demands. A higher inventory at the end of the month could imply anticipation of steady consumer interest or preparation for end-of-year sales cycles.

Overall Market Insights

- The mid-month dip across both wholesale and retail indices followed by a recovery signals a stable market with slight pricing adjustments rather than any abrupt shifts.

- The gradual increase in inventory suggests that supply is catching up with demand, which may contribute to more balanced pricing in the coming months.

- This combination of rising prices and increasing inventory indicates a cautious optimism in the market, where demand remains strong but is beginning to align more closely with supply.

These trends reflect a market that is responsive and adaptable, showing resilience even as it faces typical fluctuations. The rise in both wholesale and retail prices throughout September suggests that consumers continue to value used vehicles, which bodes well for dealers as they navigate supply dynamics and prepare for the final quarter of the year.

This September performance overview provides a snapshot of a robust and responsive auto market, setting the stage for strategic adjustments as we head into the last months of 2024.

Final Thoughts

The automotive market is returning to a sense of “normal,” but not the old normal.

Meanwhile, the shift to trucks and SUVs is still going. The demand for reliability and comfort seems to be more than a market trend. They’ve come to stay!

The volatility of the last few years has permanently altered consumer expectations and market dynamics, making traditional vehicle types (trucks, SUVs) even more dominant, but under tighter economic constraints.

With volatility still in play, how do you think consumer preferences will shape the auto market’s next big shift?