After an accident, even with perfect repairs, your car’s market value decreases. This financial loss, known as diminished value, can be claimed by insurance companies like Allstate.

Filing a diminished value claim ensures you’re compensated for this loss. This guide walks you through the process, focusing on how to navigate Allstate’s diminished value claims and get a fair payout.

What is a Diminished Value Claim?

Understanding Diminished Value

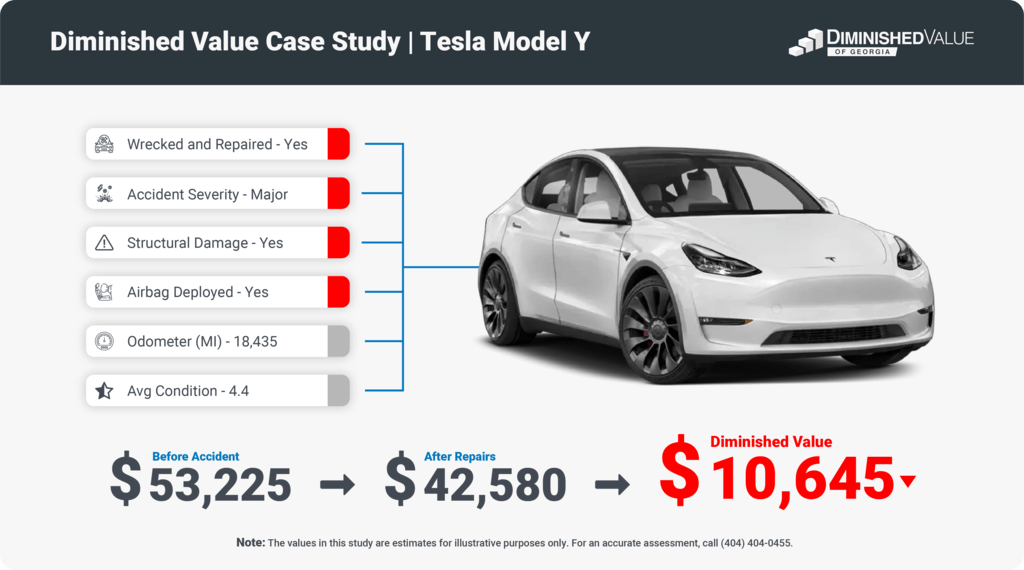

Diminished value refers to the loss in market value after your car has been damaged and repaired. Buyers typically value accident-free cars higher, meaning your vehicle will likely sell for less, even if it looks and runs like new. This loss is where diminished value claims come in—ensuring you’re compensated for this depreciation.

Why Diminished Value Matters After an Accident

You might think a well-repaired car should retain its pre-accident value, but most buyers won’t agree. They prefer vehicles without a history of damage. This makes diminished value a crucial element to consider after an accident, especially when your car is newer or higher in value.

Insurance companies such as Allstate may not prioritize informing you of this. If they do, they might lowball your claim, so it’s important to take action on your own.

How Allstate Handles Diminished Value Claims

Allstate’s Claim Process

Allstate evaluates diminished value claims based on various factors, but it’s not always in the policyholder’s favor. Their claims process often involves formulas designed to minimize payouts. This makes it essential to know the steps involved and how to counter lowball offers.

Factors Allstate Considers When Evaluating Your Claim

Allstate typically assesses your claim based on:

- The age and mileage of your vehicle

- The severity of the damage from the accident

- The quality of the repairs completed

- The vehicle’s value before the accident

These factors heavily influence how much they offer. Keep in mind that Allstate may rely on internal calculations that don’t fully represent the true diminished value.

GET MORE MONEY FROM THE INSURER

Don’t leave money on the table! Order a FREE Claim Review and discover your car’s true value.

To be eligible for diminished value, there are specific circumstances that may disqualify you from making a diminished value claim for your car:

- Your vehicle does not have a substantial market value (cars under $7,000)

- You’ve already signed a release of liability form

- The accident caused minimal damage (usually under $500)

- The vehicle has excessive mileage (more than 30K miles per year)

- Your vehicle is too old (normally 10 years or older)

- Your vehicle has a branded title (salvage or rebuilt)

- Your vehicle had multiple previous accidents with greater damage

- Your vehicle was declared a total loss

- The statute of limitation has lapsed

- If you’re outside Georgia and courts have ruled against DV

→ Learn more: Do I Qualify for Diminished Value?

Common Delays and Denials in Allstate Claims

Expect delays or lowball offers from Allstate. Many claimants face hurdles such as rejected claims due to incomplete documentation or claims that are undervalued. Knowing the process can help you prepare for these challenges, so you’re ready to push back with facts and evidence.

Step-by-Step Process for Filing an Allstate Diminished Value Claim

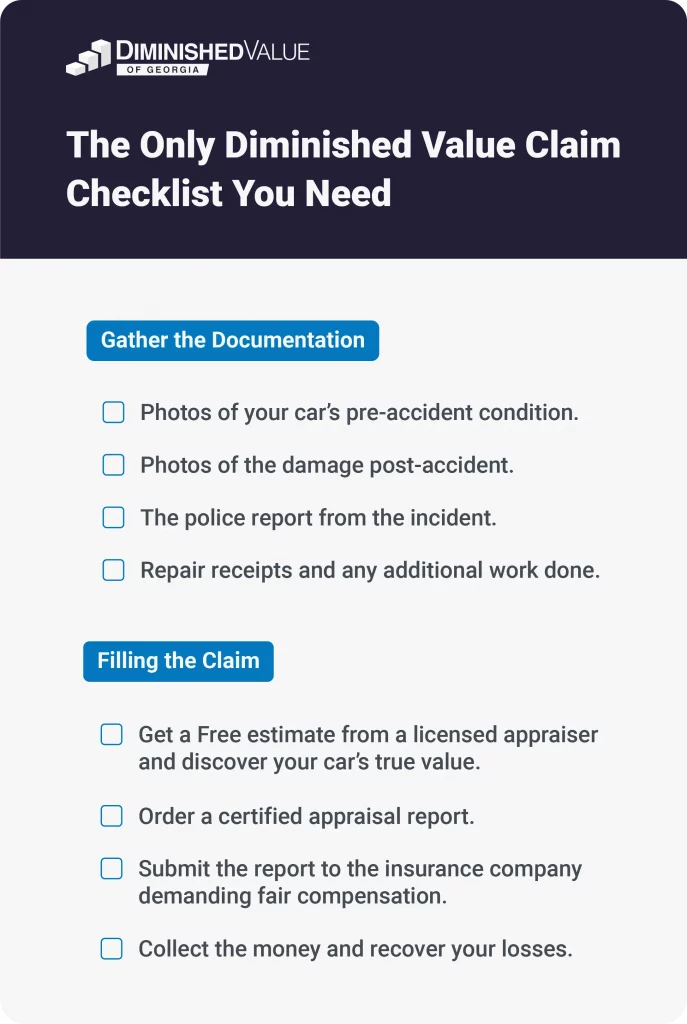

1. Collecting Documentation

Gather all the necessary paperwork before filing. This includes your repair invoices, accident reports, and any related documentation that shows the extent of the damage. You’ll need these to support your claim and establish that the vehicle’s value has diminished post-accident.

2. Calculating Your Diminished Value

Rather than relying on the 17c formula (often used by insurance companies like Allstate to minimize payouts), it’s best to seek a professional, licensed appraiser. They will assess the true market value of your vehicle after repairs, giving you an accurate understanding of your car’s diminished value.

Appraisers use detailed methodologies that account for more than the generalized formulas employed by insurers, helping you push back against unfair offers.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

3. Submitting Your Claim to Allstate

Once you have your documents and appraiser’s report, you can submit your claim. Be prepared for back-and-forth negotiations. Allstate may initially offer a lower settlement, so it’s critical to provide evidence from your appraiser to counter their offer.

→ Learn more: How to File a Diminished Value Claim After a Car Accident?

Why You Need an Appraiser for Your Allstate Diminished Value Claim

Hiring a professional appraiser can significantly increase the chances of receiving a fair payout. An appraiser conducts an independent evaluation of your vehicle, which is essential when negotiating with Allstate. They calculate the diminished value using more comprehensive methods, as opposed to the insurance company’s 17c formula, which often undervalues vehicles.

An appraiser’s report is invaluable in the negotiation process. Without one, Allstate may provide an offer based on their internal metrics, which can be significantly lower than the actual diminished value of your vehicle. A licensed appraiser’s detailed analysis helps counter these low offers and ensures you get what you’re entitled to.

Bringing an appraiser on board can make a world of difference for your diminished value claim. Here’s why:

- Expertise: These pros have the expertise to accurately assess the diminished value of your car, maximizing your claim.

- Credibility: Their detailed reports bolster your claim, making it tough for insurance companies to lowball you.

- Leverage: Armed with a professional appraisal, you’ve got the upper hand when negotiating with insurers.

Tips for Maximizing Your Allstate Diminished Value Claim

- Get an Independent Appraisal: Avoid relying on Allstate’s in-house valuation. Independent appraisers provide a more accurate assessment of your vehicle’s diminished value.

- Document Everything Thoroughly: Keep records of all repairs, damage reports, and any other relevant paperwork. This will be crucial when negotiating with Allstate.

- Don’t Accept the First Offer: Allstate’s initial offer will likely be lower than what you deserve. Be prepared to negotiate or contest their offer with a professional appraisal.

- Be Persistent: Insurance companies may delay or deny claims, so patience and persistence are key. Stick to your evidence and push for a fair payout.

FAQs About Allstate Diminished Value Claims

Can You File a Diminished Value Claim if You’re at Fault?

In Georgia, you can file a first-party diminished value claim even if you’re at fault in the accident. Unlike most states, Georgia law allows drivers to pursue diminished value claims through their own insurance company.

This gives Georgia drivers an opportunity to recover losses even in accidents where they are to blame, making it a unique exception to typical insurance practices. If you’re in Georgia, it’s important to understand this right and take advantage of it when applicable.

What if Allstate Offers Less Than My Appraiser’s Estimate?

You can dispute their offer. Provide your appraiser’s detailed report and request a reevaluation. If necessary, consider escalating the claim with legal assistance.

How Does Allstate’s 17c Formula Affect My Claim?

Allstate uses the 17c formula, which often undervalues vehicles by focusing on a limited set of factors. Having an independent appraisal can challenge their formula and provide a more accurate valuation.

How Long Does It Take to Settle a Diminished Value Claim with Allstate?

Settlement timelines can vary, but the process often takes several weeks to months, especially if negotiations are involved. Providing thorough documentation upfront can help speed up the process.

What if My Car is Deemed Totaled? Can I Still File a Diminished Value Claim?

No. If your vehicle is totaled, diminished value claims do not apply. Instead, focus on ensuring Allstate provides a fair payout based on your car’s pre-accident market value.

Can an Appraiser Help Me Negotiate with Allstate?

Yes. An appraiser provides a detailed and unbiased report that can be used to counter Allstate’s initial offer. Their expertise often leads to a higher settlement amount than what Allstate first proposes.

Conclusion: Is Filing an Allstate Diminished Value Claim Worth It?

Filing a diminished value claim with Allstate can be a lengthy process, but it’s often worth it if you’ve experienced significant loss in value after an accident. A fair settlement can make a big difference, especially when it comes to selling or trading your car in the future.

By understanding the process, gathering proper documentation, and working with a licensed appraiser, you can maximize your chances of receiving the compensation you deserve.

Have you filed a diminished value claim with Allstate before?

What were your experiences, and what advice would you give to others?