In 2024, the automotive world is witnessing a seismic shift, and Nissan dealerships are at the epicenter of this turbulence. If you’re wondering why nearly 40% of Nissan dealerships across the United States are finding themselves in the red, you’re not alone. The challenges they’re facing are not just about the cars on the lot but a complex web of market dynamics, consumer preferences, and strategic missteps.

Why Nearly 40% of Nissan Dealerships Are Losing Money (PDF)

The Profit Plunge: A Look at the Numbers

The cold, hard facts are alarming. In the first half of 2024, the average Nissan dealership saw its profits nosedive by 70% compared to the same period in 2023. This drop marks the lowest level of profitability for Nissan dealerships in nearly 15 years. Imagine running a business where profits have shrunk so drastically—it’s a scenario that would make any owner nervous.

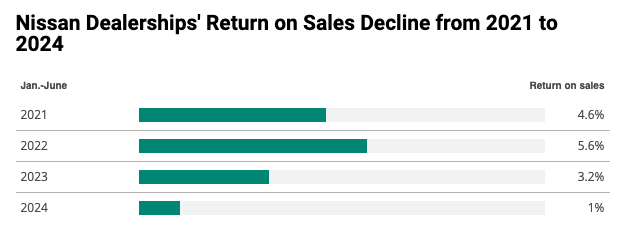

To visualize this dramatic decline, take a look at the data below, which shows the steep fall in return on sales for Nissan dealerships over the past four years:

As the image illustrates, Nissan dealerships’ return on sales—a key measure of profitability—has slumped from 4.6% in 2021 to just 1% in the first half of 2024. This sharp decline paints a clear picture of the financial pressures these dealerships are under.

Market Share Erosion: Nissan’s Losing Ground

One of the key reasons behind this financial struggle is Nissan’s slipping market share. In the first half of 2024, Nissan’s share in the U.S. market fell to 5.8%, a significant drop from the 7.7% they held five years ago. When you’re losing ground this quickly, it’s not just a matter of fewer cars being sold—it’s also about the ripple effect that reduced sales have across the entire dealership.

Nissan dealerships rely heavily on new car sales to feed other profit centers, such as financing, service, and parts. When sales volume is down, these areas suffer as well. In some regions, Nissan dealers are selling less than half the volume of their competitors, including Honda, Toyota, and Hyundai. It’s a tough spot to be in when your rivals are pulling ahead.

The Hybrid Hiccup: Missing Out on a Market Shift

Another crucial aspect of Nissan’s struggle is its slow response to the hybrid and electric vehicle (EV) revolution. While competitors like Toyota and Honda have embraced hybrids, accounting for a significant portion of their sales, Nissan has been slow to join the party. As of now, Nissan doesn’t offer any mild or plug-in hybrid vehicles in the U.S.—a gap that’s becoming more glaring as consumers increasingly favor these eco-friendly options.

The hybrid trend isn’t just a fad; it’s a massive shift in consumer preference. As other automakers capitalize on this trend, Nissan’s absence in this segment is costing its dealerships dearly.

Overdealered and Underperforming

Adding to the financial woes is the issue of an overextended dealership network. With more than 1,070 franchises in the U.S., Nissan’s network is built for a market share of 7% to 10%. But with market share dipping below 6%, many dealerships simply aren’t seeing enough foot traffic to justify their existence. Some industry experts believe that Nissan needs to trim its dealership network by up to 40% to match its current market realities.

When you have too many dealerships chasing too few customers, it’s a recipe for disaster. Many of these stores are struggling to stay afloat, unable to reach the sales volumes necessary to cover their overheads.

Rising Costs, Falling Margins

Let’s not forget the economic pressures adding fuel to the fire. Higher interest rates, rising floorplan expenses, and shrinking per-vehicle margins are all squeezing profitability. In an industry where margins are already razor-thin, these additional costs can tip the scales from profit to loss.

Nissan dealerships are feeling this pinch acutely. Unlike other brands that have managed to maintain or even grow their margins, Nissan’s dealerships are watching their returns on sales shrink dramatically—from 4.6% in 2021 to just 1% in the first half of 2024.

A Glimmer of Hope?

Nissan isn’t sitting idle, though. The brand is rolling out new products and initiatives aimed at revitalizing its U.S. presence. Redesigned models like the Kicks, Armada, and Murano are expected to draw more customers into showrooms. Additionally, Nissan plans to introduce its e-Power hybrid system to the U.S. in the coming years, which could help it catch up to its competitors in the hybrid market.

However, these efforts may take time to bear fruit, and the road ahead is far from certain. Nissan’s leadership is optimistic, projecting a 20% sales increase in fiscal 2024, but many dealers remain skeptical. They’ve heard promises before, and with profits down and competition fierce, it’s understandable that they’re cautious about the future.

Conclusion: Can Nissan Turn the Tide?

The challenges facing Nissan dealerships in 2024 are significant, but they’re not insurmountable. With strategic adjustments, better market positioning, and a more competitive product lineup, there’s a path forward. However, the clock is ticking, and dealerships can’t afford to wait much longer for a turnaround.

As the automotive industry continues to shift and reshape, a pressing question looms: Can Nissan pivot swiftly enough to rescue its dealerships from deepening financial woes, or are we on the brink of seeing even more of them shut their doors permanently?