Have you ever wondered how an accident affects your car’s value, even after perfect repairs? Let’s dive into the world of diminished value, focusing on a real-world case study of the 2024 GMC Savana. You’ll uncover insights often overlooked and learn why an appraiser can be your best ally.

2024 GMC Savana Diminished Value Case Study (PDF)

What is Diminished Value?

Diminished value is essentially the difference in your car’s market value before and after an accident. Even if your Buick Envision is repaired to the highest standards, the fact that it was in an accident will often lower its resale value. Buyers and dealers typically view a vehicle with an accident history as less desirable, which translates into a lower offer.

→ Read: How to File a Diminished Value Claim After a Car Accident?

Was Your 2024 GMC Savana in an Accident?

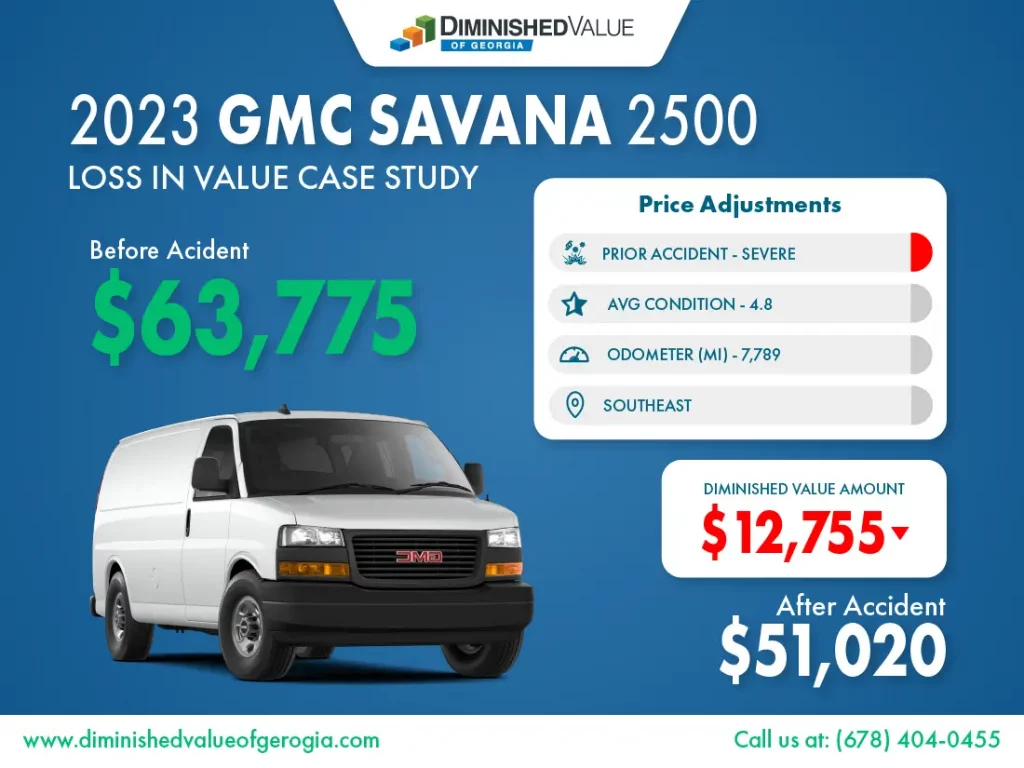

Using a detailed analysis, we can determine the diminished value of your 2024 GMC Savana. Here’s a breakdown of the essential figures:

| Diminished Value Calculator | |

| Before Accident Cash Value | $63,775 |

| After Accident Cash Value | $51,020 |

| Diminished Value | $12,755 |

These numbers are not just pulled out of thin air. They’re derived from a combination of comparable market data, the quality of repairs, and the vehicle’s condition before the accident. This calculated approach ensures a realistic representation of your car’s loss in value.

Why Do You Need an Appraiser?

Bringing an appraiser on board can make a world of difference for your diminished value claim. Here’s why:

- Expertise: These pros have the know-how to precisely gauge your car’s diminished value.

- Credibility: Their detailed reports bolster your claim, making it tough for insurance companies to lowball you.

- Leverage: Armed with a professional appraisal, you’ve got the upper hand when negotiating with insurers.

Fill out the form below to get a FREE Claim Review or call (678) 404-0455 and receive the compensation you deserve. Discover how much your car lost in value for free.

"*" indicates required fields

Digging Deeper: What Most Appraisers Don’t Tell You

While many articles cover the basics of diminished value, there are several critical aspects they often miss:

1. The Impact of Repair Quality

Not all repairs are equal. High-quality repairs using original manufacturer parts can minimize diminished value but won’t eliminate it. Conversely, subpar repairs can drastically reduce your vehicle’s market value.

2. The Role of Market Perception

Market perception plays a massive role in diminished value. In some regions, buyers are more forgiving of accident histories, while in others, any blemish can significantly lower value. Understanding your local market can help set realistic expectations.

3. Comprehensive vs. Collision Coverage

Did you know that the type of insurance coverage you have can affect your claim? Collision coverage usually helps with repairs, but comprehensive coverage might influence how your diminished value claim is handled. It’s crucial to read the fine print of your policy.

4. The Importance of Documentation

Detailed documentation of the accident, repairs, and appraisals can make or break your claim. Keep every piece of paperwork and photograph the damages extensively before and after repairs.

Wrapping It Up

The diminished value of a vehicle like the 2024 GMC Savana is a significant but often overlooked aspect of car ownership and insurance. By understanding the ins and outs of diminished value, from the quality of repairs to market perception, and leveraging professional appraisals, you can ensure you’re adequately compensated.

Have you checked your car’s value recently?