Hey there, car enthusiasts and market watchers! Buckle up, because we’ve got the latest scoop on the auto market for the week ending June 15, 2024. This week, while the market continued its downward trend, the rate of depreciation has thankfully slowed down a bit. So, let’s dive into the nitty-gritty details you won’t find on most other websites.

Auto Market Update Week Ending June 15, 2024 (PDF)

Market Overview: A Glimpse at the Numbers

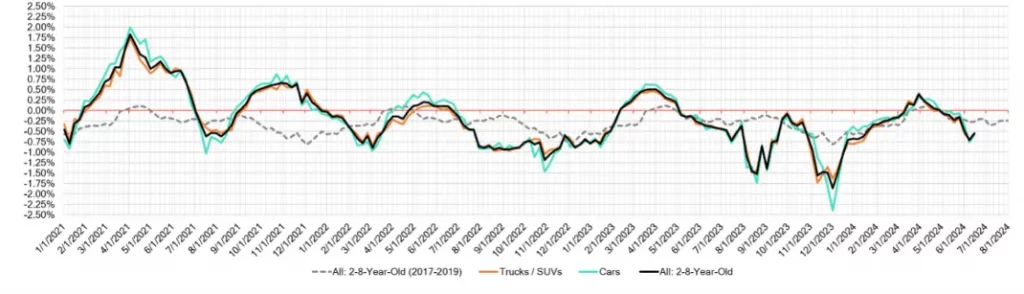

The market experienced a depreciation of -0.55%, showing a modest improvement from the previous week’s -0.71%. Yet, this rate remains above the pre-pandemic seasonal average of -0.27%. Here’s a brief overview:

| Segment | This Week | Last Week | 2017-2019 Average (Same Week) |

|---|---|---|---|

| Car segments | -0.58% | -0.76% | -0.35% |

| Truck & SUV segments | -0.54% | -0.69% | -0.22% |

| Market | -0.55% | -0.71% | -0.27% |

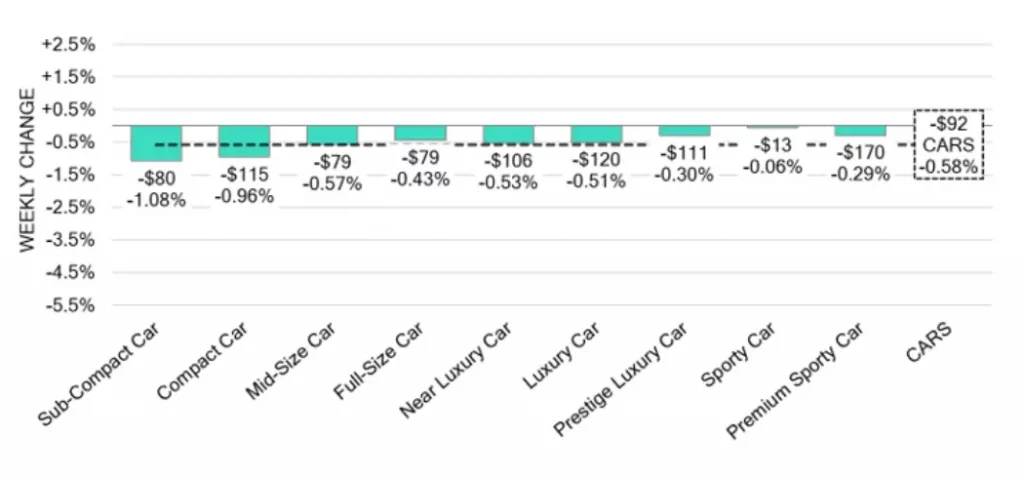

Car Segments: A Closer Look

For car segments, the overall depreciation was -0.58% on a volume-weighted basis, a slight shift from the -0.34% decrease the previous week. The youngest (0-to-2-year-old) car models were down by -0.40%, while the older (8-to-16-year-old) models decreased by -0.31%.

Interestingly, all nine car segments reported increased depreciation last week. The Sub-Compact Car segment experienced the largest decline, dropping by 1.08%—the biggest fall since mid-January. Yet, amidst the declines, the older models in the Premium Sporty Car segment bucked the trend with a 0.23% gain, continuing their impressive fourteen-week streak of increases.

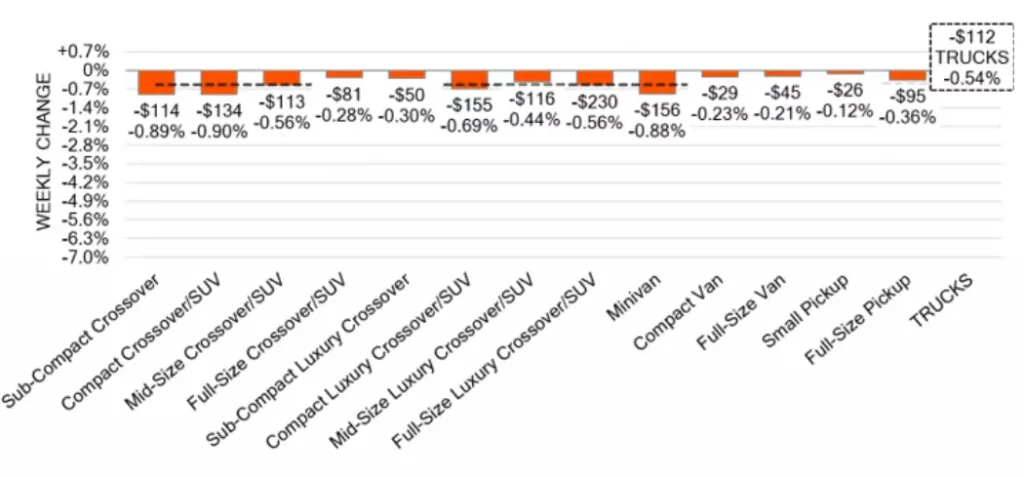

Truck and SUV Segments: The Breakdown

The Truck and SUV segments also saw a slowdown in depreciation, with an overall drop of -0.54%, compared to the prior week’s -0.69%. The newer (0-to-2-year-old) models dipped by -0.45%, while the older (8-to-16-year-old) models saw a smaller decline of -0.20%.

All thirteen truck segments reported declines, with Sub-Compact (-0.89%), Compact (-0.90%), and Minivan (-0.88%) segments facing the steepest drops. The Minivan segment, in particular, has been on a rapid descent, averaging a -0.80% drop per week over the last three weeks. However, newer used Small Pickups (0-to-2 years old) saw a slight uptick of +0.04%, marking the smallest decline in the older models in the past month.

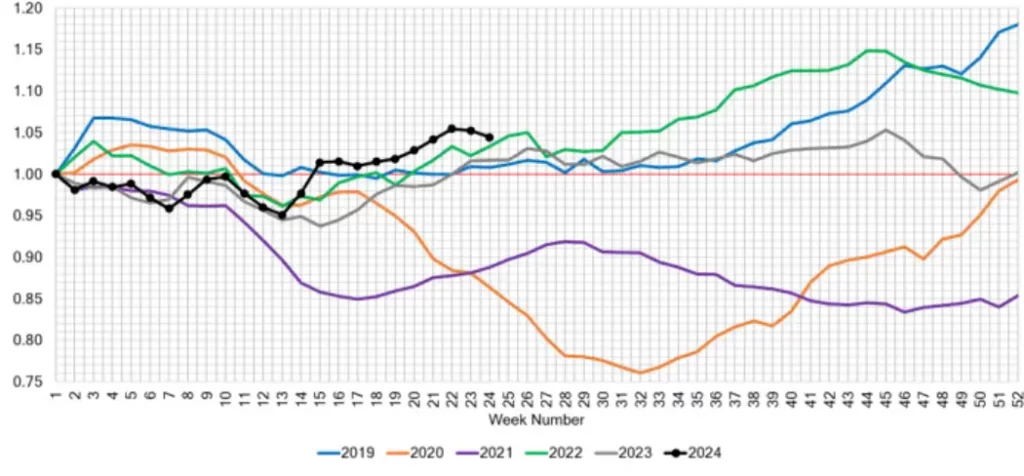

Used Retail Dynamics

Shifting gears to the used retail market, the Active Listing Volume Index offers a comprehensive view of inventory at independent and franchised dealerships across the U.S. Normalized to the first week of the year, this index tracks annual market movements and provides valuable insights.

Wholesale Market Trends

In the wholesale market, the overall depreciation slowed across both car and truck segments. The subcompact car category stood out with the most significant decline, dropping by -1.08%. Despite this, the general slowing of depreciation hints at a stabilizing market.

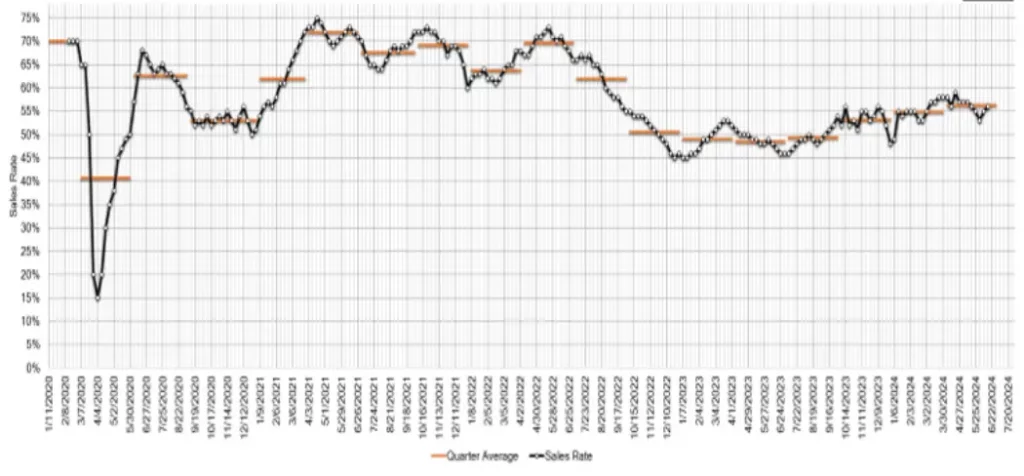

Our team of analysts remains vigilant, constantly monitoring the market for new trends and insights. Notably, the average auction sales rate rose to 56% this week, up by 1% from the previous week, indicating a slight uptick in market activity.

Wrapping It Up

So, there you have it—the latest from the auto market for the week ending June 15, 2024. While depreciation continues, the pace is slowing, which might just signal a more stable market on the horizon. Keep your eyes peeled for more updates as we track these trends and their potential impacts.

Got any thoughts on where the auto market is heading next?