The landscape of the US auto dealership industry has seen some interesting shifts over the past year. From strategic expansions to evolving customer preferences, the top players have navigated these changes with varying degrees of success. In this article, we’ll take a close look at the rankings of the leading auto dealership groups, comparing their performance in 2022 and 2023.

US Auto Dealership Group Rankings 2022 vs 2023 (PDF)

Overview of the Auto Market in 2023

The auto market in 2023 has been characterized by a mix of challenges and opportunities. Supply chain disruptions, fluctuating consumer demand, and advancements in automotive technology have all played significant roles. Dealerships that adapted quickly to these changes, leveraging digital sales channels and focusing on customer satisfaction, have fared better than others.

/im

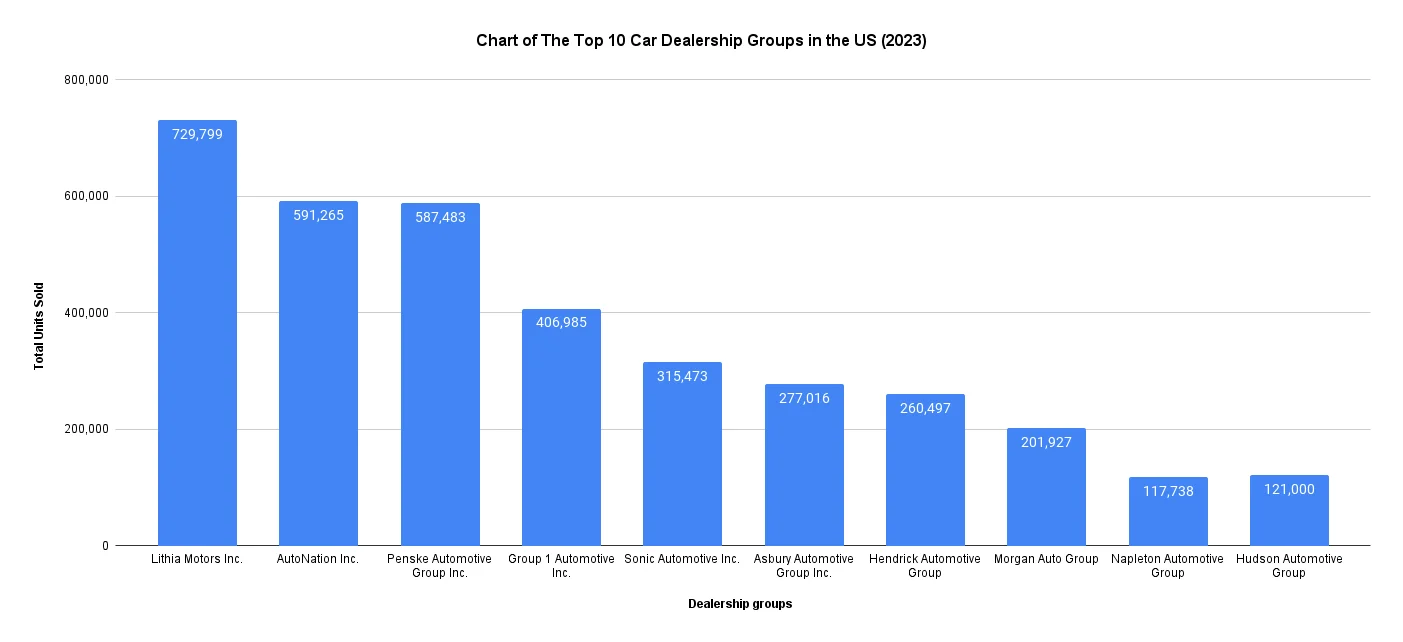

List of the Top 10 Car Dealership Groups in the US by Total Units Sold (2023)

- Lithia Motors Inc. – 729,799

- AutoNation Inc. – 591,265

- Penske Automotive Group Inc. – 587,483

- Group 1 Automotive Inc. – 406,985

- Sonic Automotive Inc. – 315,473

- Asbury Automotive Group Inc. – 277,016

- Hendrick Automotive Group – 260,497

- Morgan Auto Group – 201,927

- Napleton Automotive Group – 117,738

- Hudson Automotive Group – 121,000

Total Units Sold Analysis

In 2023, the performance of the top auto dealership groups in the US showcased significant trends in the industry. Lithia Motors Inc. led the pack with an impressive 729,799 total units sold, a substantial increase from the previous year. AutoNation Inc. followed closely with 591,265 units, demonstrating steady growth. Penske Automotive Group Inc. also showed strong performance, selling 587,483 units.

Group 1 Automotive Inc. and Sonic Automotive Inc. secured their places in the top five, with total units sold reaching 406,985 and 315,473, respectively. Asbury Automotive Group Inc. followed with 277,016 units, while Hendrick Automotive Group sold 260,497 units.

Morgan Auto Group, Napleton Automotive Group, and Hudson Automotive Group rounded out the top ten, each showing notable sales figures that reflect their competitive strategies and market reach.

These numbers highlight the competitive nature of the auto dealership market and the importance of strategic growth and customer engagement. The increase in total units sold across these groups indicates a positive trend for the industry, despite the challenges faced in recent years.

As we look forward to the future, it will be fascinating to observe how these groups continue to adapt and thrive in an ever-changing market.

Top 10 US Car Dealership Groups by NEW Units Sold (2022 vs. 2023)

| Dealership Group | Rank 2023 | Rank 2022 | Total New Units sold in 2023 | Total New Units sold in 2022 |

| Lithia Motors Inc | 1 | 314,116 | 271,596 3 | |

| AutoNation Inc. | 2 | 244,546 | 229,971 2 | |

| Penske Automotive Group Inc | 3 | 229,942 | 185,831 | |

| Group 1 Automotive Inc. | 4 | 175,566 | 154,714 | |

| Asbury Automotive Group Inc. | 5 | 149,509 | 151,179 | |

| Sonic Automotive Inc. | 6 | 107,257 | 101,168 | |

| Hendrick Automotive Group | 7 | 100,073 | 89,974 | |

| Morgan Auto Group | 8 | 75,880 8 | 59,378 | |

| Ken Garff Automotive Group | 9 | 57,127 | 54,371 | |

| Staluppi Auto Group | 10 | 49,680 | 49,547 |

Insights from the Rankings

The consistent performance of the top three groups—Lithia Motors Inc., AutoNation Inc., and Penske Automotive Group Inc.—highlights their strong market strategies and ability to adapt to changing conditions. Lithia Motors Inc., in particular, has seen significant growth, reinforcing its position as the industry leader.

Dealerships like Sonic Automotive Inc. and Morgan Auto Group have also demonstrated impressive growth, indicating their successful adaptation to market demands and effective customer engagement practices. These rankings reflect the importance of agility, innovation, and customer-centric approaches in the highly competitive auto dealership industry.

Final Thoughts

The auto market in 2023 has proven resilient despite numerous challenges. The top dealership groups have demonstrated that with strategic growth, customer-centric approaches, and adaptability, it is possible to thrive in a competitive environment

As we look ahead, the continued evolution of the auto industry promises exciting opportunities for those ready to embrace change and innovate.

FAQs

Q: Which car dealership group sold the most units in 2023?

A: Lithia Motors Inc. led the market with 729,799 total units sold in 2023.

Q: What are some key trends shaping the auto market in 2024?

A: Key trends include the adoption of electric vehicles, digital transformation, supply chain optimization, a focus on customer experience, and sustainability initiatives.

Q: How has the digital transformation affected car sales?

A: Digital transformation has enabled dealerships to reach a broader audience, streamline the buying process, and enhance customer engagement, leading to increased sales.

Q: Why is customer experience important in the auto industry?

A: A positive customer experience fosters loyalty, encourages repeat business, and generates positive word-of-mouth, which are crucial for a dealership’s success.

Q: What challenges did the auto market face in 2023?

A: The market faced supply chain disruptions, fluctuating consumer demand, and rapid advancements in automotive technology.