In this week’s update, we’re diving deep into the nuances of the auto market as of May 11, 2024. The pulse of the market is steady—unfaltering yet revealing subtleties that predict future shifts. Here, we go beyond the typical metrics to uncover the less-discussed details that shape the automotive landscape.

Auto Market Update Week Ending May 11, 2024 (PDF)

Stability with a Hint of Motion

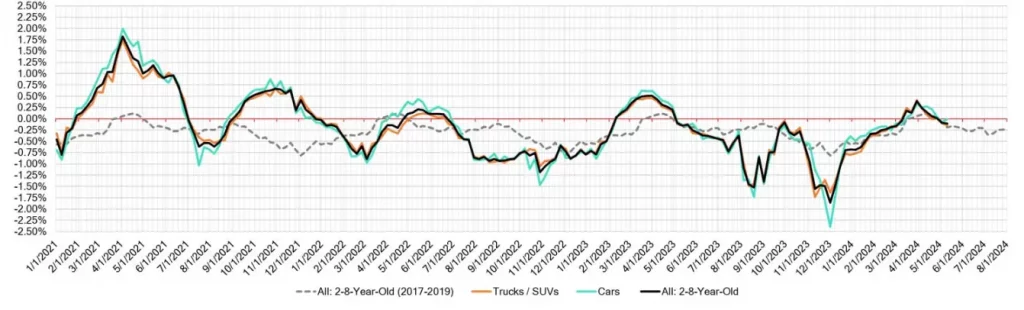

This past week, the market echoed sentiments of stability, flatness, and unchangeability. A superficial glance might suggest a dull market, but beneath the surface, there’s a slow and consistent dip following the conclusion of the Spring market period.

Notably, the segments for 2-to-8-year-old Cars held steady, while the newest and oldest vehicles saw slight upticks, increasing by +0.03% and +0.10%, respectively. Conversely, all age categories within the Truck market experienced mild declines.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.01% | -0.06% | -0.23% |

| Truck & SUV segments | -0.14% | -0.10% | -0.18% |

| Market | -0.11% | -0.09% | -0.20% |

A Deeper Look at the Numbers

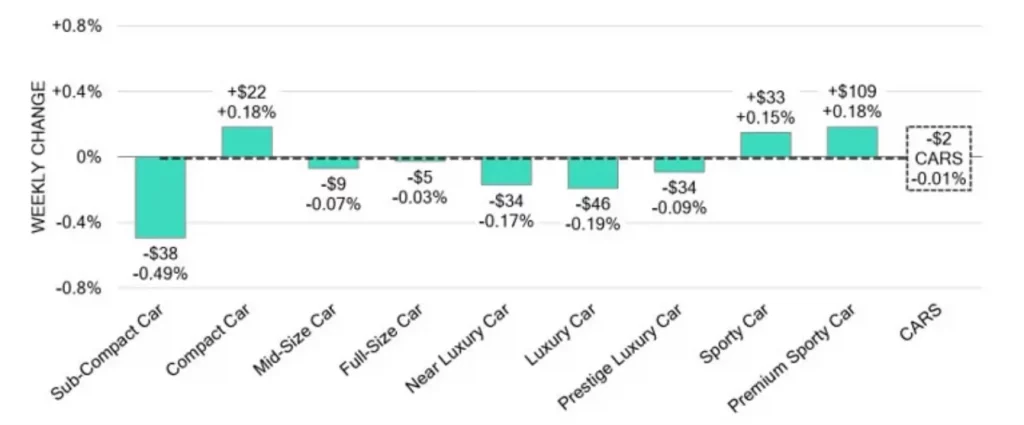

- Car Segments: Despite an overall minor decrease of -0.01%, it’s intriguing to observe that the 0-to-2-year-old Car segments and 8-to-16-year-old Cars are resisting the trend with increases of +0.03% and +0.10%. It’s worth noting that the Sporty Car segment has been enjoying a seven-week streak of growth, averaging a +0.33% weekly increase.

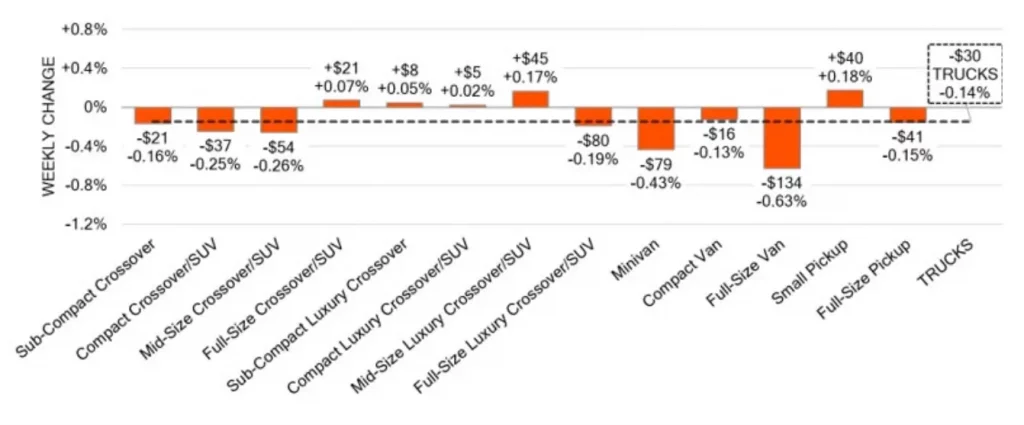

- Truck and SUV Segments: These segments recorded a -0.14% dip. The 0-to-2-year-old models and the 8-to-16-year-olds showed declines of -0.06% and -0.23%, respectively. Despite the overall decline, there’s a moderated pace in the Full-Size Vans’ depreciation, signaling a potential plateauing or even a forthcoming rebound.

Observations from the Retail and Wholesale Sectors

Used Retail Insights

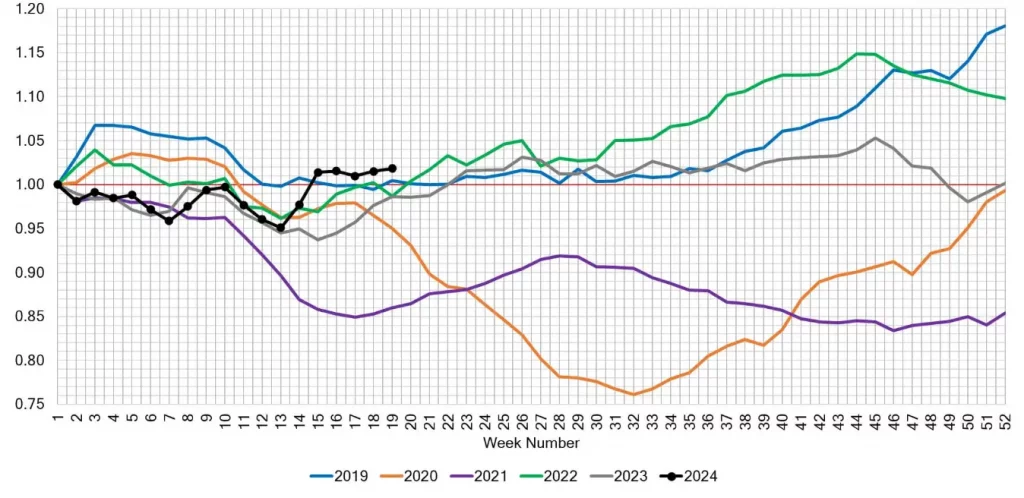

The Used Retail Active Listing Volume Index offers a lens into the inventory dynamics at numerous independent and franchised dealerships across the US. By normalizing this to the first week of the year, we gain insights into the annual market movements, capturing a macro view of the trends affecting retail auto sales.

Wholesale Market Dynamics

In the wholesale arena, the absence of dramatic price shifts underscores a period of equilibrium. However, segments like Sub-Compact Cars and Full-Size Vans bucked the trend with notable declines. A reduction in auction inventory at some major auctions hints at emerging shifts in market dynamics, potentially influenced by seasonal variations, changing dealer strategies, or broader economic conditions.

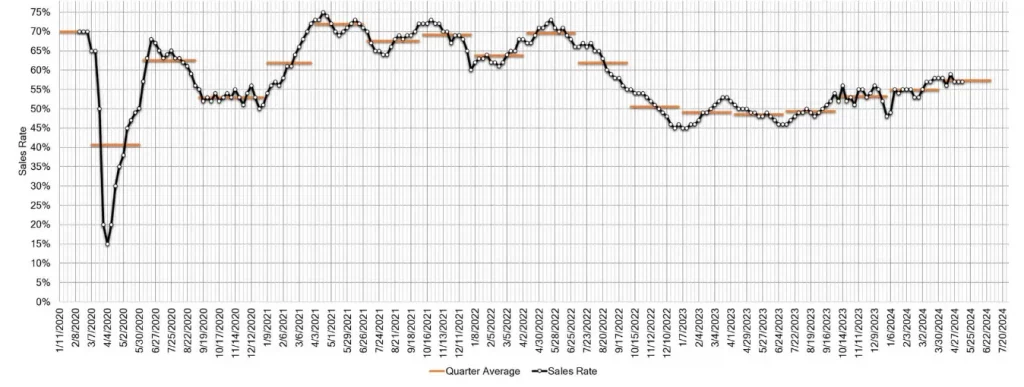

The average auction sales rate holding steady at 57% further underscores a market that is balancing itself, potentially gearing up for more dynamic changes as we move deeper into the year.

Wrapping Up

As we continue to analyze and report on these trends, our aim isn’t just to present numbers but to provide a narrative that encapsulates the underlying forces at play. The automotive market is a complex system influenced by myriad factors, from economic conditions to consumer behaviors, and each week brings its own story.

This week’s narrative is one of subtle movements within a facade of stability. As we look ahead, it’s essential to ask: What will the next turn in the market bring, and are we ready for it?