Once upon a recent week, the auto market, a vast expanse of shimmering metal and polished paint, buzzed with the gentle hum of transactions and exchanges. As dealers and buyers danced their delicate dance of negotiation and purchase, the numbers whispered the tale of an ever-evolving saga.

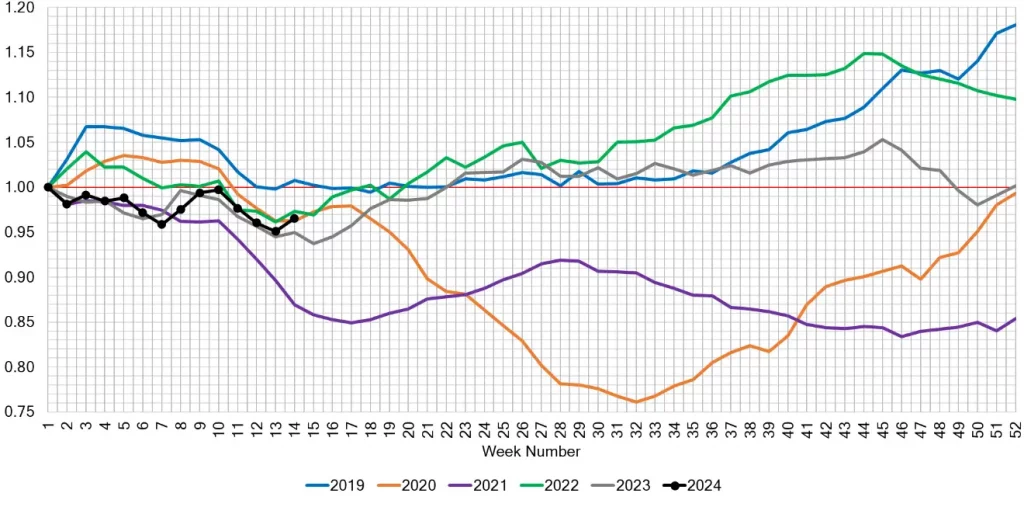

The week ending April 6th, 2024, unfurled a narrative of slight ascents and strategic pauses, with the industry’s pulse felt through the fluctuation of wholesale prices. Amidst a world constantly seeking the new, the overlooked story of resilience and adaptability within the auto market beckons a closer look.

Auto Market Update Week Ending April 06, 2024 (PDF)

The Unfolding of Prices

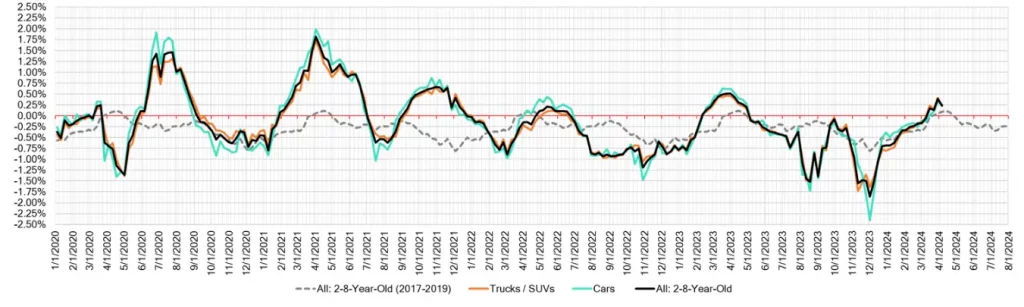

Last week, the theater of the wholesale market illuminated an uptrend, albeit with a moderated tempo. Prices edged up by +0.24%, a subtle deceleration from the previous week’s +0.39%. This gentle increase, while still a step forward, signifies a thoughtful stride rather than a hurried sprint, especially when juxtaposed against the pre-pandemic times’ modest +0.09%.

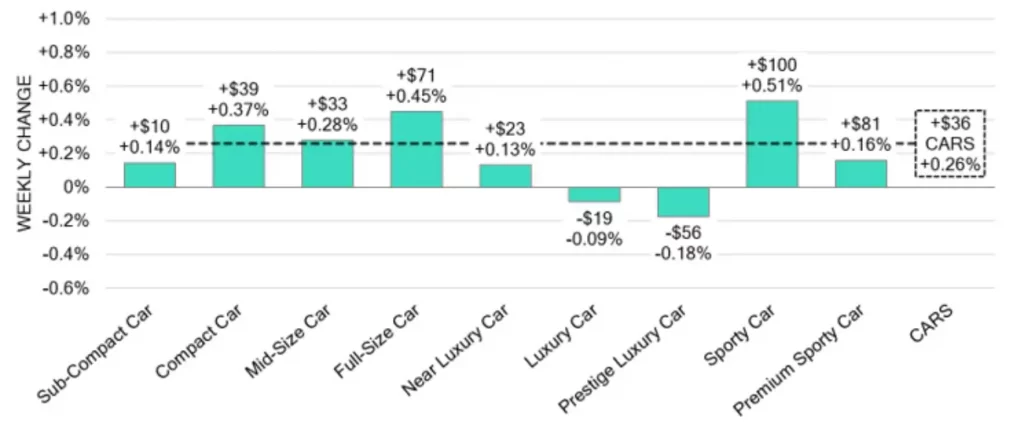

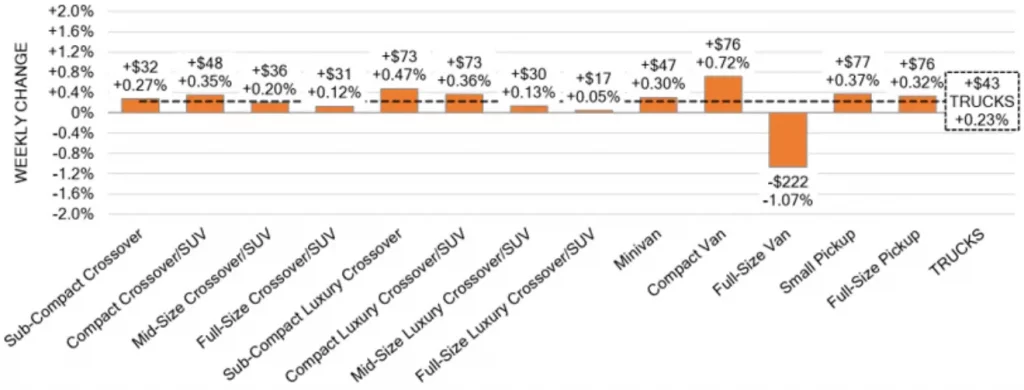

Delving into the details, the car segments witnessed a +0.26% rise, slightly down from the preceding week’s +0.33%, but still above the 2017-2019 average. Trucks and SUVs shared this tempered enthusiasm, marking a +0.23% increase, a step back from their prior +0.41%, yet still significantly surpassing their historical average.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.26% | +0.33% | +0.18% |

| Truck & SUV segments | +0.23% | +0.41% | +0.03% |

| Market | +0.24% | +0.39% | +0.09% |

Spotlight on Segments

The stage of car segments shone on the Sporty Car, racing ahead with a +0.51% gain, defying its recent past of declines. However, not all shared this spotlight. The Prestige Luxury Car segment continued its descent, albeit at a slowed pace of -0.18%, suggesting a potential stabilizing in its value.

The narrative in the truck and SUV segments unfolded with its own twists and turns. While most truck segments experienced growth, the Full-Size Van segment encountered a steeper decline of -1.07%. In contrast, Compact Vans leaped forward with the week’s most significant growth of +0.72%, a tale of resilience and demand amidst broader trends.

The Retail Perspective

On the retail stage, the Used Retail Active Listing Volume Index provided a backdrop of stability, with days-to-turn hovering around 43 days. This metric, a critical pulse of market health, indicates a steady pace in the lifecycle of used retail vehicles.

The Wholesale Insight

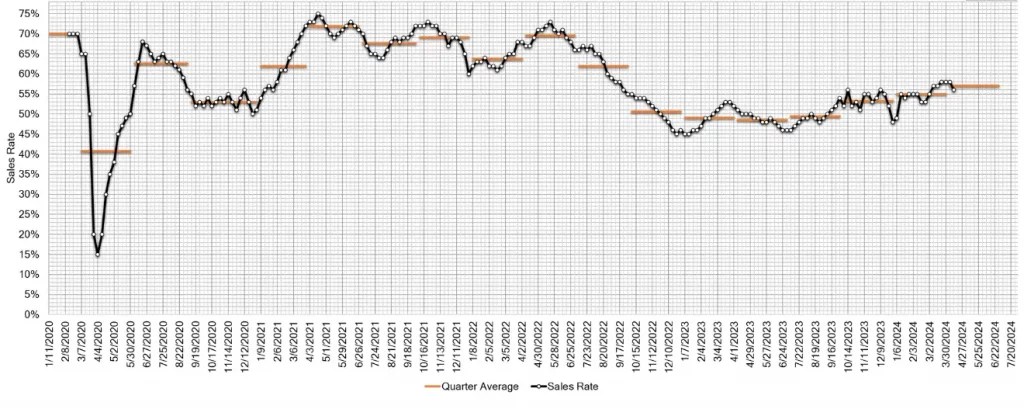

As the curtain falls on the first week of April, the wholesale market’s upward trend underscores a strong demand, keeping prices buoyant. However, the slight dip in auction conversion rates whispers hints of a market perhaps starting to catch its breath, as buyers exhibit increased selectiveness amidst climbing prices.

A Story Continues

As we wrap up this week’s market update, it’s clear that the auto industry is not just about numbers and trends; it’s about stories of adaptability, resilience, and the constant quest for balance. The subtle shifts and changes reflect a market that, while forward-moving, remains attentively tuned to the rhythms of demand and supply.

As our analysts keep their eyes on the horizon, watching for the next wave of developments, we’re reminded that every percentage point and every trend has a story behind it, a story of people, decisions, and moments. Isn’t it fascinating to think about what stories next week might tell?