Imagine, if you will, a vast ocean, its surface mirroring the ever-changing skies above. This ocean is not filled with water, but with cars and trucks, each wave representing the fluctuations of the automotive market.

Just like sailors navigating through calm and stormy weather, dealers and investors keep a keen eye on these tides. As we delve into the week ending February 24th, 2024, we embark on a journey through the latest shifts in wholesale prices, uncovering stories that lie beneath the surface, beyond the usual statistics.

Auto Market Update Week Ending Feb 24, 2024 (PDF)

The Currents of Change

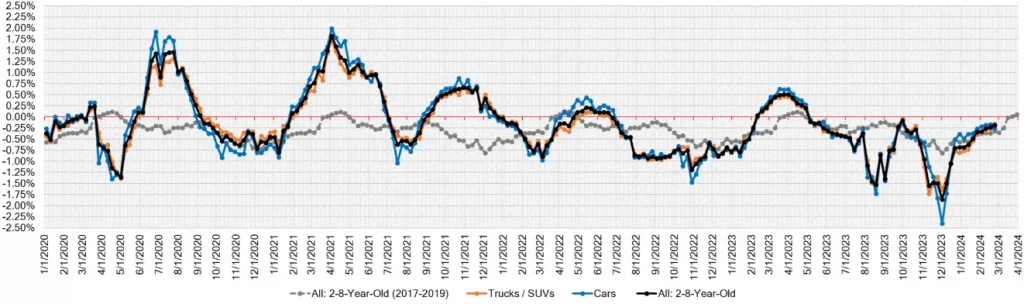

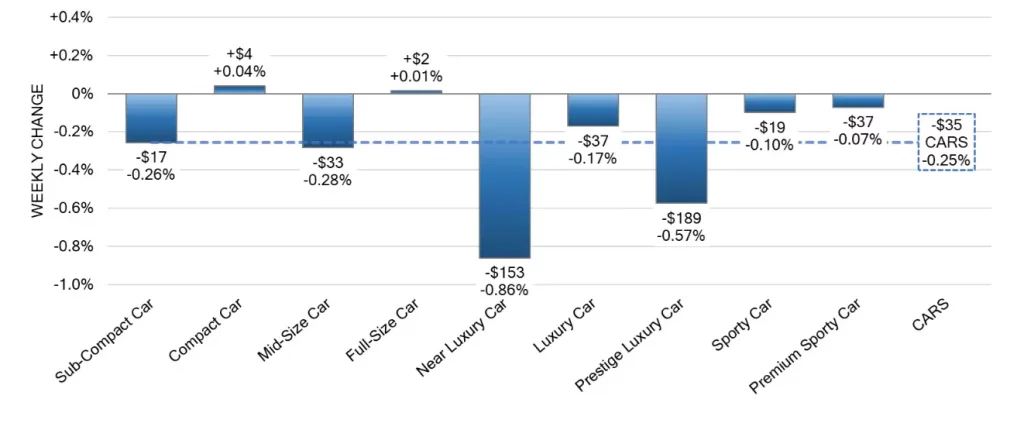

This past week, the automotive market witnessed subtle yet telling movements. The overall Car segment experienced a slight decrease of -0.25%, a minor dip from the -0.17% observed in the preceding week.

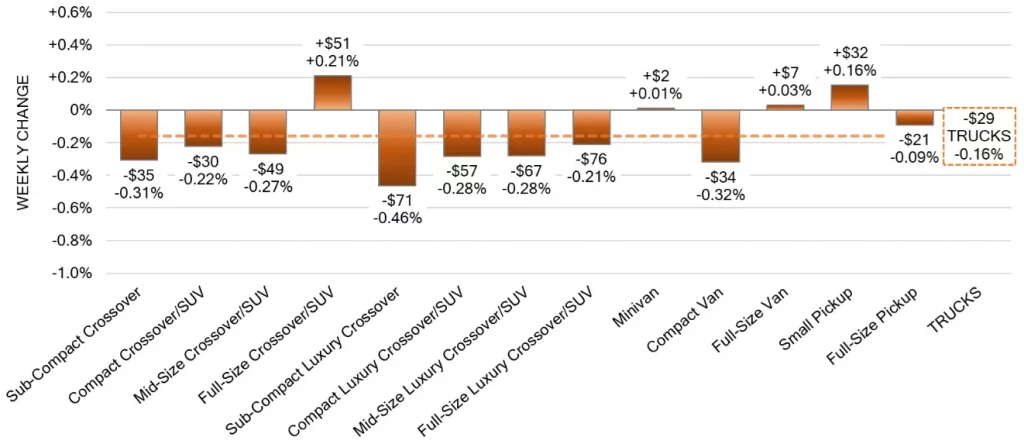

This change, though seemingly small, is part of a larger narrative of fluctuation within the Car and Truck segments. Notably, Near Luxury Cars and Sub-Compact Luxury Crossovers/SUVs saw significant declines.

However, amidst these downward trends, areas of growth emerged, shining a light on the dynamic nature of the market. The Compact Car segment, for example, celebrated its seventh consecutive week of gains, albeit at a slower pace, highlighting a resilient streak in specific categories.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.25% | -0.17% | -0.34% |

| Truck & SUV segments | -0.16% | -0.26% | -0.29% |

| Market | -0.19% | -0.23% | -0.32% |

A Closer Look at the Figures

- Car Segments: The volume-weighted decrease of -0.25% this week in the Car segment comes against a backdrop of previous declines, with a notable drop in the Near-Luxury Car category by -0.86%—the largest one-week fall since December 2023. Yet, the Compact Car segment’s persistent growth, with a +0.04% increase, tells a story of steady demand in certain niches.

- Truck / SUV Segments: The Truck segment saw a decrease of -0.16%, with the Full-Size Crossover/SUV segment bucking the trend by rising +0.21%, marking four consecutive weeks of growth. This contrast between the general downtrend and specific segment growth illustrates the market’s complexity.

- Market Movements: With the market’s overall decrease of -0.19%, we see a landscape of varying performance across different vehicle categories. Interestingly, the Used Retail Active Listing Volume Index offers insight into the broader market dynamics, hinting at emerging spring market trends.

The Ripple Effects

These fluctuations in wholesale prices are more than just numbers; they reflect the underlying currents of supply and demand, technological advancements, and shifting consumer preferences.

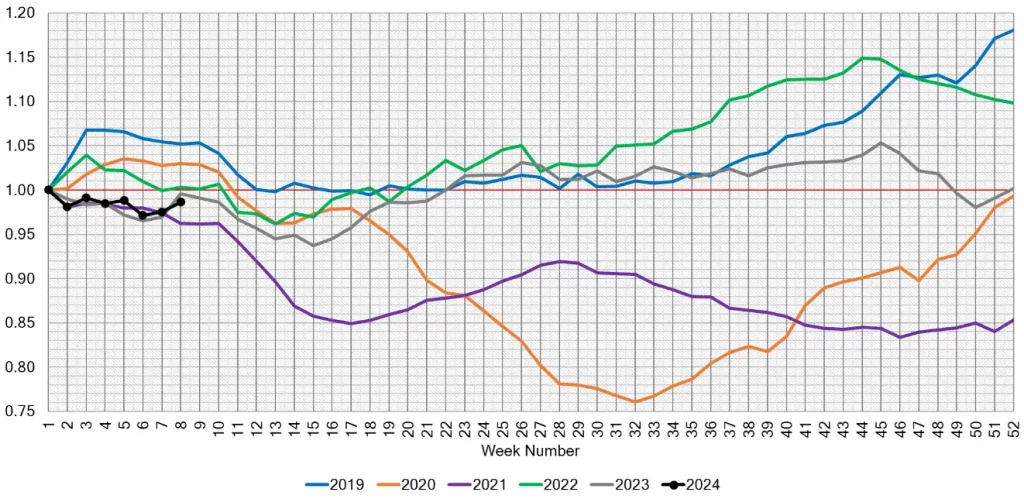

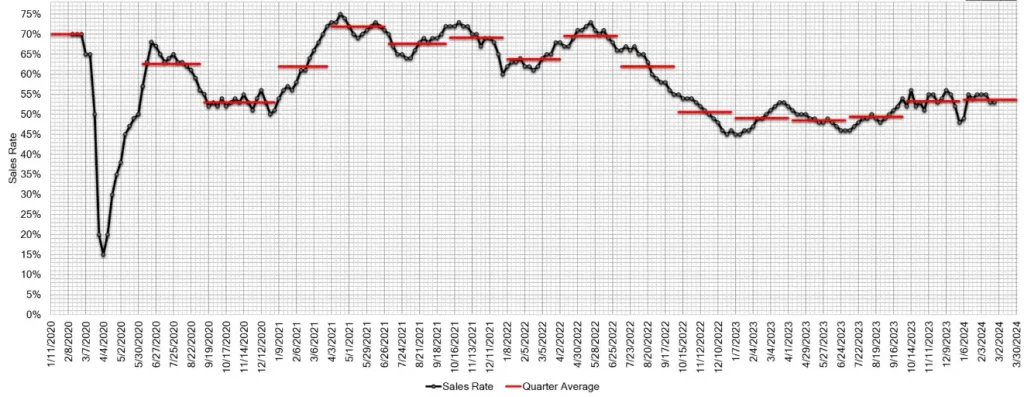

For instance, the resilience seen in the Compact Car and Full-Size Crossover/SUV segments may indicate a growing consumer interest in fuel efficiency and versatility. Furthermore, the slight drop in auction inventory and the stable Estimated Average Weekly Sales Rate at 53% suggest a cautious optimism among dealers as they navigate the early signs of a spring market revival.

Conclusion: Steering Through the Tides

As we sail through the vast ocean of the automotive market, it’s clear that understanding the nuances of weekly wholesale price changes offers invaluable insights. These insights not only help in navigating the present but also in forecasting future trends.

With each wave of data, we gain a clearer view of the horizon, enabling dealers, investors, and enthusiasts to make informed decisions.

As we ponder the journey ahead, one question remains: How will the emerging trends of the spring market shape the future landscape of the automotive industry?