In the complex world of insurance claims, disputes over the value of a loss are not uncommon. When policyholders and insurers find themselves at an impasse, the appraisal clause is a critical component of the insurance policy designed to resolve such disagreements.

This provision allows for an unbiased review by independent appraisers and, if necessary, an umpire. However, confusion often arises regarding the procedural steps, particularly around the sequence of appraising the loss and selecting an umpire. This article aims to clarify these procedures, using a recent communication as a reference point.

Understanding the Appraisal Clause in Insurance Agreements (PDF)

What is the Appraisal Clause?

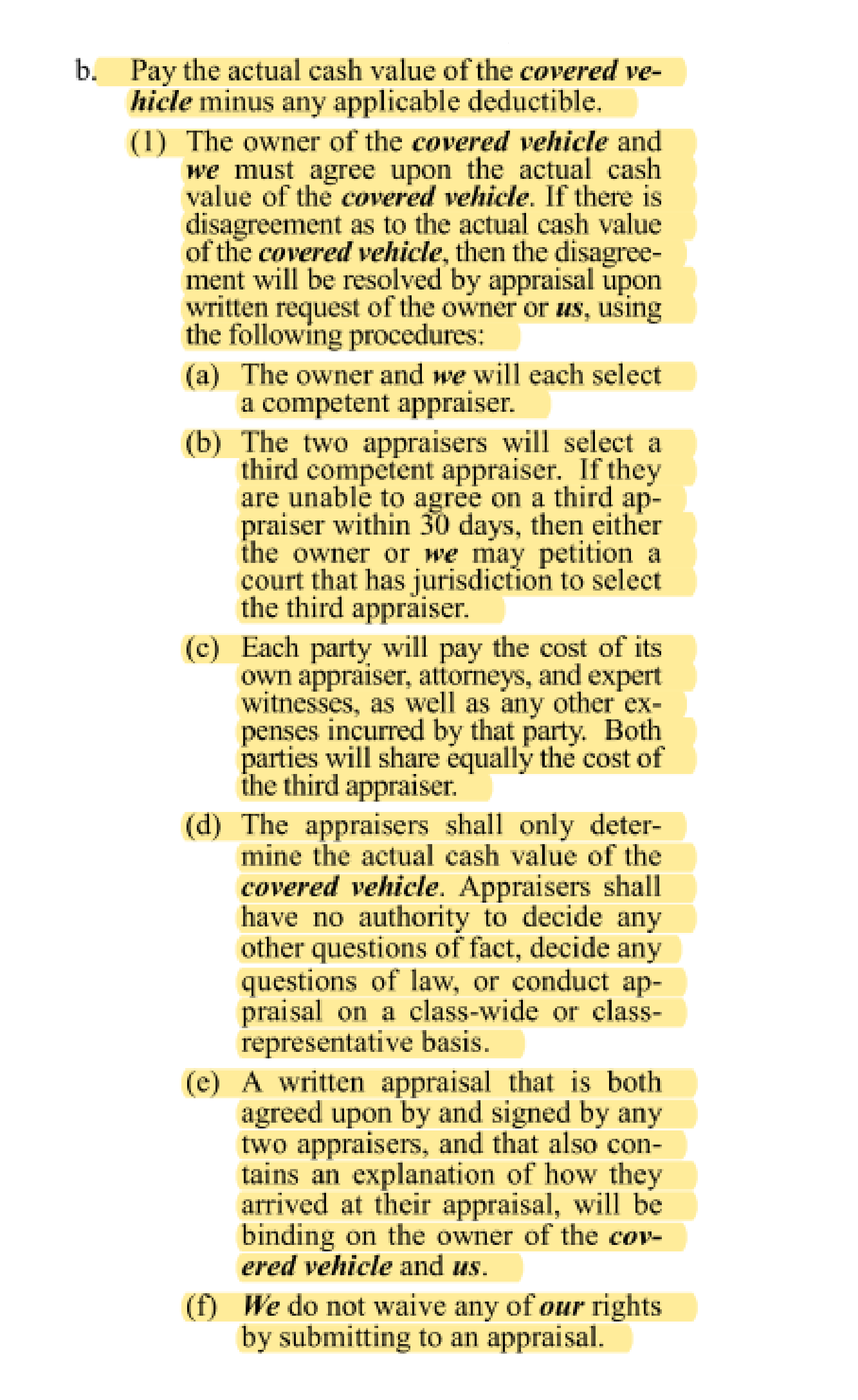

The appraisal clause is a feature present in numerous insurance agreements, providing a mechanism to settle conflicts regarding the valuation of a claimed loss. This clause comes into play when there is a disagreement between the insurance provider and the policy owner on the loss’s value. In such instances, either side has the right to invoke the appraisal process. This involves each party choosing an unbiased and qualified appraiser to independently evaluate the damage or loss.

Should these appraisers present differing valuations, they are obliged to seek a consensus. If a mutual agreement remains elusive, the selection of an umpire becomes necessary. This umpire is tasked with delivering the conclusive judgment. The intention behind the appraisal clause is to offer an equitable and effective alternative to legal action for dispute resolution.

The Sequence of Events: Appraisals First, Umpire Second

One frequently asked question revolves around the timing of the umpire’s selection in relation to the submission of the appraisers’ reports. To clear any confusion: it is customary for each side to first present their appraisal findings. The step to appoint an umpire is only considered if these initial evaluations conflict and the appraisers themselves fail to bridge their differences.

This approach prioritizes the umpire’s input as a measure of last recourse, activating only if the appraisers, despite their honest efforts, cannot find common ground. The aim is for the appraisers to independently conclude on the valuation, showcasing their skill and neutral judgment of the damage or loss.

Case in Point

Consider a scenario where one party has submitted their appraisal report, but the opposing party has not, under the pretext that an umpire must be agreed upon first. This misunderstanding or misinterpretation of the appraisal clause can stall the resolution process.

As illustrated in a recent communication, one party requested the submission of the opposing party’s appraisal report, highlighting a common misinterpretation of the clause’s requirements.

The insistence on following the correct sequence—submitting appraisals before selecting an umpire—is not just about adhering to procedural formalities but ensuring a fair and unbiased resolution to the dispute.

The Importance of Compliance

Complying with the sequence stipulated by the appraisal clause is crucial for several reasons. It underscores the commitment of both parties to resolve disputes amicably and according to the terms of the insurance policy. It also ensures that the involvement of an umpire, which can add to the cost and duration of the dispute resolution process, is truly a measure of last resort.

Conclusion

The appraisal clause serves as a vital mechanism for resolving valuation disputes in the insurance domain. Understanding and adhering to the correct sequence of events—submitting appraisals first and resorting to an umpire only if necessary—can significantly streamline the resolution process.

This approach not only aligns with the intent of the appraisal clause but also promotes a fair, efficient, and amicable resolution of disputes, minimizing the need for further escalation or litigation.