A Tale of Modest Recovery and Surprising Trends

Once upon a time, in the bustling automotive market of 2024, a curious phenomenon began to unfold. As we neared the end of January, the car industry, like a seasoned storyteller, narrated a tale of subtle yet meaningful change.

For those navigating the labyrinth of car sales and valuations, this story is not just about numbers; it’s about understanding the pulse of a market that’s always on the move.

Auto Market Update Week Ending Jan 27, 2024 (PDF)

The Heartbeat of the Market: Decelerating Depreciation

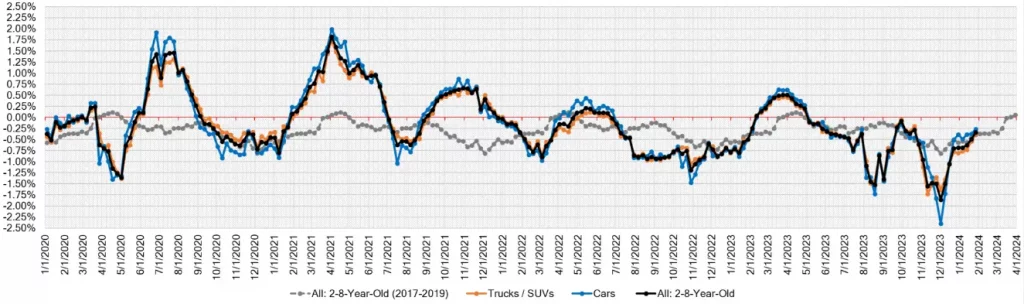

This week, ending January 27, 2024, the wholesale prices revealed a heartening deceleration in the depreciation rate. Compared to the pre-pandemic average of -0.39%, this week saw a decline of just -0.33%.

It seems the market is taking a gentle breath after the frenzied pace of previous years. Particularly noteworthy is the performance of vehicles aged 8 to 16 years, displaying a ‘spring in their step’ with five segments showing increases.

Delving into the Details:

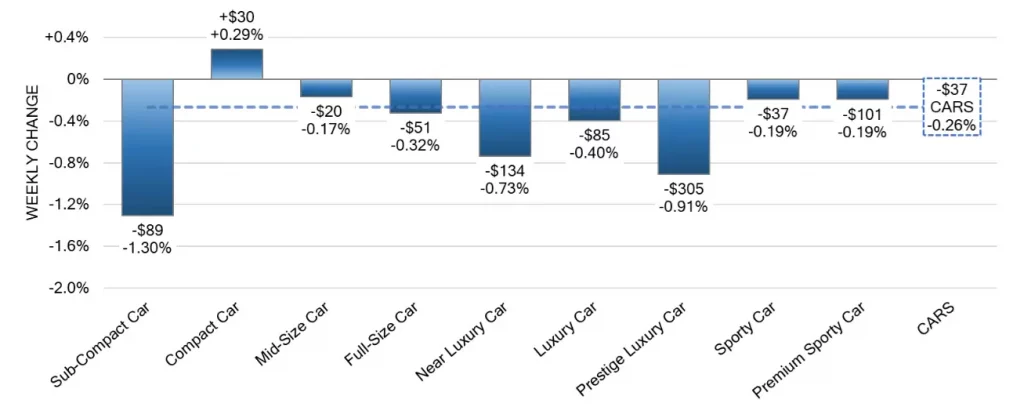

- Car Segments: The overall Car segment decreased by -0.26% on a volume-weighted basis, a slight improvement from the -0.37% seen the previous week. The Compact Car segment, interestingly, increased for the third consecutive week.

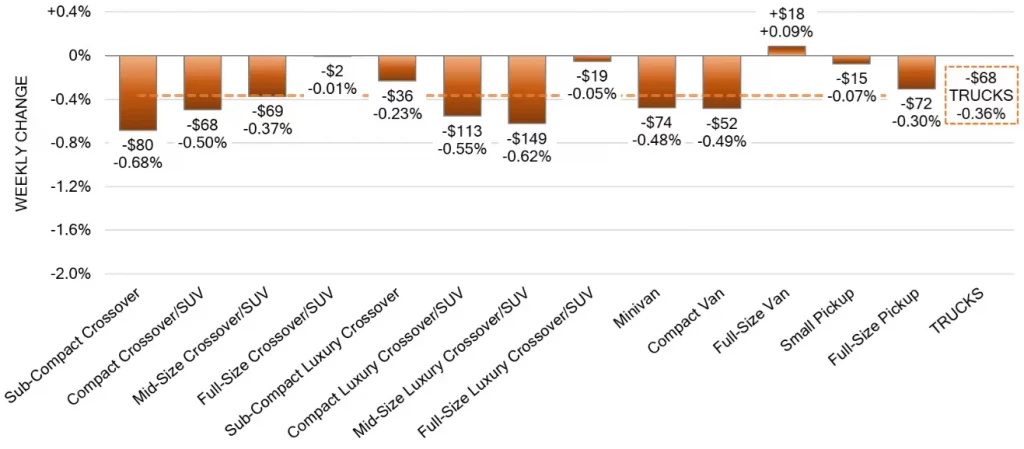

- Truck & SUV Segments: These segments experienced a -0.36% decrease. However, the Full-Size Van segment showed an unexpected appreciation, a first since July 2022.

A Look at the Numbers:

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.26% | -0.37% | -0.42% |

| Truck & SUV segments | -0.36% | -0.53% | -0.37% |

| Market | -0.33% | -0.49% | -0.39% |

The Retail Perspective: Used Retail and Wholesale Insights

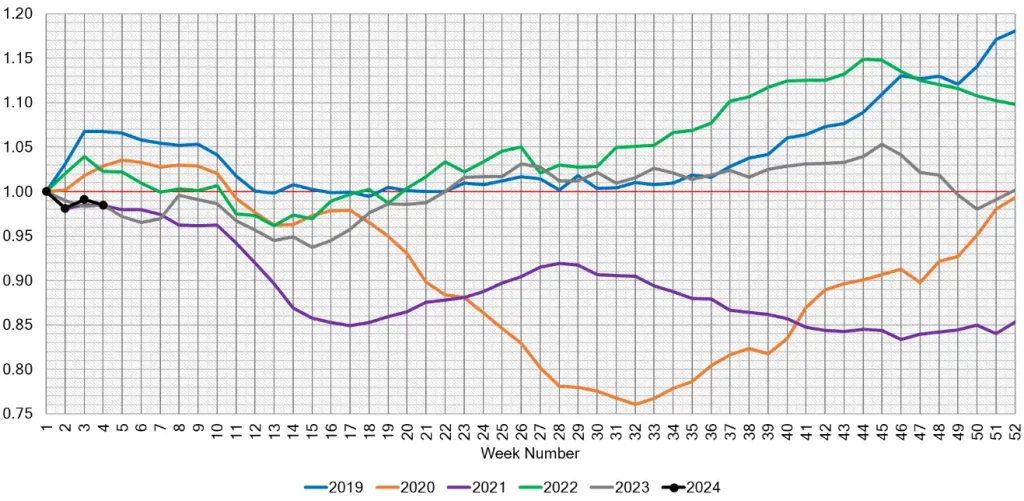

- Used Retail: The Active Listing Volume Index and Days-to-Turn estimate, which reflect inventory analysis across US dealerships, suggest a steady market with an average turnaround of 54 days at the beginning of 2024.

- Wholesale Market: For three weeks in a row, the wholesale market has shown a slowdown in depreciation rates for both car and truck segments. The Sub-Compact Car category, however, bucks the trend with the largest decrease.

Deciphering the Trends: What Does It All Mean?

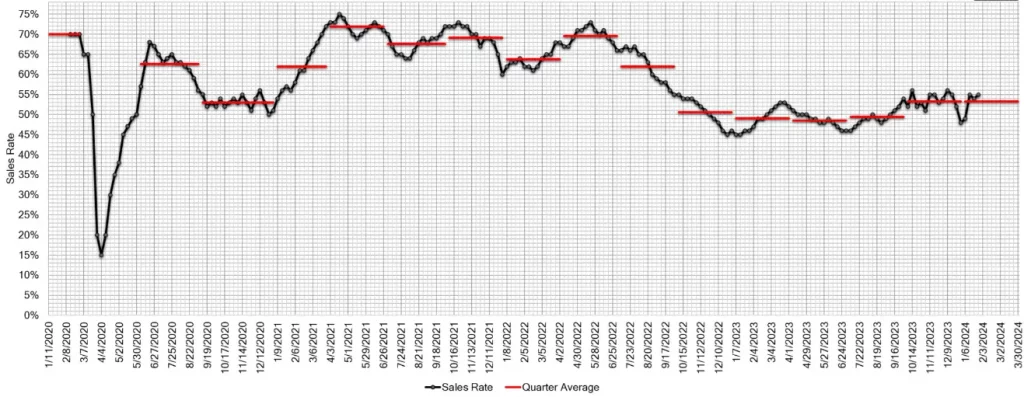

The auto market’s current state, with its reduced depreciation rates and sporadic segment increases, might signal the onset of an early spring market. The increasing auction conversion rates and a slight uptick in the Average Weekly Sales Rate to 55% further bolster this interpretation.

As we cruise through 2024, the automotive market continues to offer surprises and insights, much like a road with unexpected turns. For car appraisal professionals, dealers, and enthusiasts, understanding these shifts is crucial. It’s not just about the figures; it’s about reading between the lines to anticipate what’s next.

So, as we gear up for the coming months, one question lingers: How will these trends shape the landscape of the automotive market in 2024?