Detroit Three Strike Creates Headwinds, but October Sees a Silver Lining

October Auto Sales Surge Expected Despite Industry Challenge (PDF)

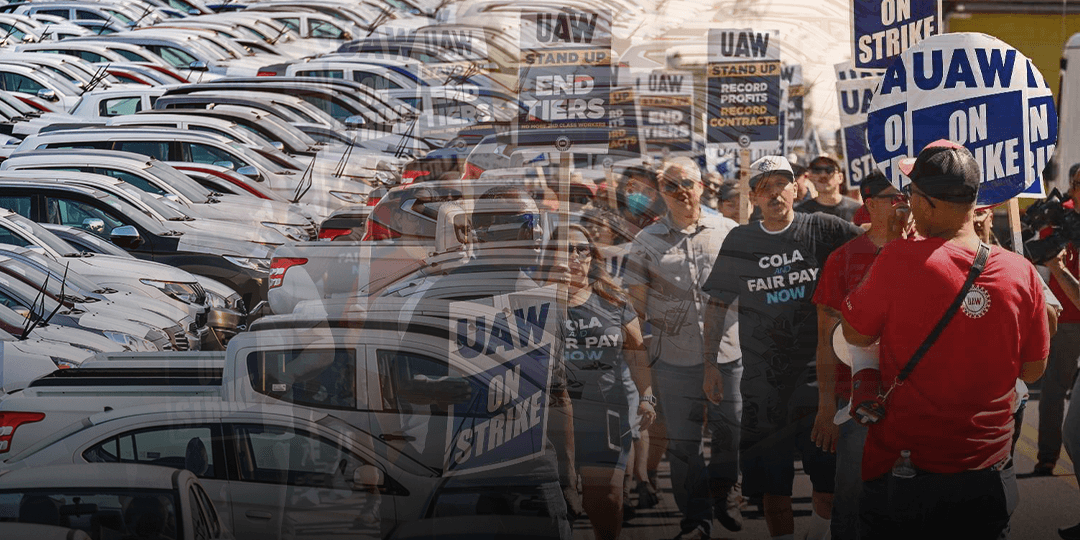

The U.S. automotive industry is navigating choppy waters, with the latest reports indicating that auto sales are poised to rise in October. However, the overarching uncertainties stemming from the ongoing auto workers strike at Detroit’s Big Three automakers, Ford, General Motors, and Stellantis, are casting a shadow of doubt over the industry’s performance for the remainder of the year.

According to a recent report from S&P Global Mobility, the surface-level data indicates a promising scenario. The projected seasonally adjusted annual rate (SAAR) for October stands at 15.7 million units, suggesting a robust month for auto sales. Furthermore, the report estimates that new total light vehicle sales for October will reach 1.22 million units, reflecting a 3.3% year-over-year increase.

Chris Hopson, the Principal Analyst at S&P Global Mobility, astutely observes, “While the projected SAAR result of 15.7 million units may suggest a robust October for auto sales, a closer examination of the automotive landscape unveils concealed challenges that could cast a shadow over sales growth in the months to come.”

Underlying Challenges and Headwinds

One of the primary concerns is the affordability of vehicles, which continues to burden potential buyers. In addition to this, there is an impending risk of an economic slowdown that could dampen consumer confidence and spending. The report also highlighted the severe constraints in inventory levels as an additional drag on auto sales.

However, what looms largest on the horizon is the auto workers strike at Detroit’s major automakers. Over 45,000 union members are currently on strike at key facilities of Ford, General Motors, and Stellantis. The strike has disrupted production lines, leading to a halt in the manufacturing of popular SUVs and pickup trucks.

According to the report, “By the week ending October 22, the toll of the ongoing plant strikes has amounted to nearly 150,000 units of lost vehicle production.” While the impact of the strike on sales remained relatively contained throughout September, the reverberations of production disruptions are anticipated to persist into October and potentially extend into November, casting a lingering influence on the sales performance of the Detroit Three.

The Ongoing Detroit Strike’s Impact

Despite these challenges, the automotive industry has shown resilience and adaptability in the face of adversity. The prospects for October indicate that, even in the midst of these uncertainties, the American auto market remains dynamic and responsive to shifts in consumer preferences.

Automakers and dealers are exploring innovative strategies, such as digital sales and contactless services, to maintain customer engagement in an era of uncertainty. With the holiday season approaching, there is still potential for a year-end rally in auto sales, but it will largely depend on the resolution of the Detroit Three strike and broader economic trends.

In conclusion, the U.S. auto sales landscape for October reflects a mixed picture. On the one hand, promising SAAR figures and year-over-year growth signal a robust month. However, the challenges posed by affordability concerns, economic slowdown, limited inventory, and the ongoing auto workers strike create an aura of uncertainty.

The resilience of the industry and its ability to adapt to changing circumstances remain pivotal in determining the trajectory of auto sales for the remainder of the year.