The Removal of the Appraisal Clause: A Detriment to State Farm’s Auto Policyholders (PDF)

State Farm, one of the largest insurance providers in the United States, recently implemented a significant change to its Alabama auto insurance policies by removing the appraisal clause provisions. This decision has sparked concerns and raised questions among policyholders and industry experts alike.

In this comprehensive analysis, we will explore the implications of State Farm’s removal of the appraisal clause and how it detrimentally impacts their policyholders, potentially eroding trust in the company.

What is the Appraisal Clause?

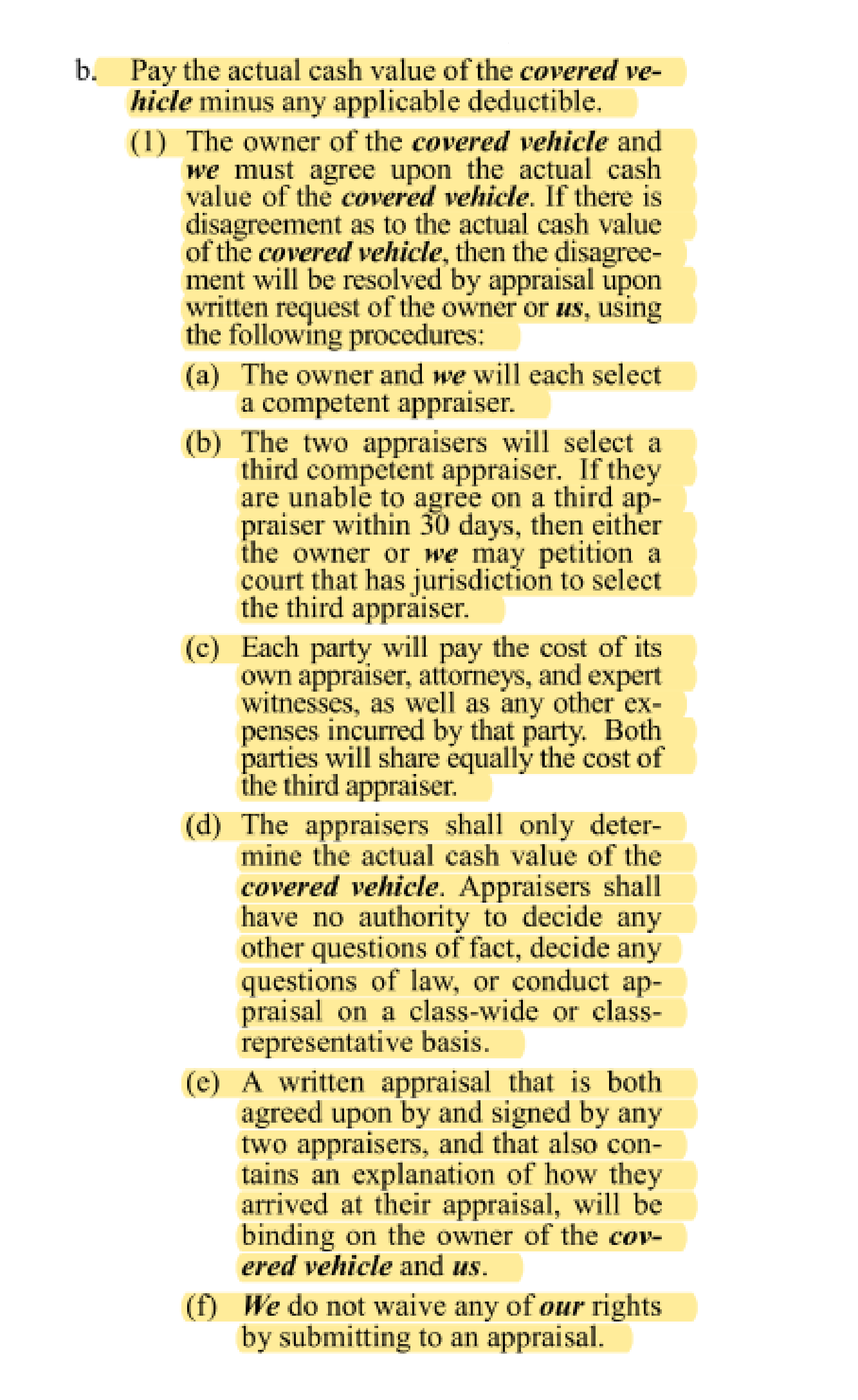

Before delving into the reasons why the removal of the appraisal clause provisions is concerning, it is crucial to understand what this clause entails. The appraisal clause is a standard provision found in many insurance policies, including auto insurance.

It serves as a mechanism to resolve disputes between policyholders and their insurance companies over the value of a claim. When a policyholder and the insurer cannot agree on the amount to be paid for a claim, either party can invoke the appraisal clause.

This clause typically involves the appointment of an independent appraiser to assess the damage and determine a fair settlement amount. The decision of the appraisers is binding and helps expedite the claims process.

Alabama State Farm Policy – 9800A Policy 2015 (PDF) – Old

Alabama State Farm Policy – 9800A Policy 2023 (PDF) – New

Why is the Removal Detrimental to Policyholders?

The primary concern with the removal of the appraisal clause is the potential loss of fairness and transparency in the claims settlement process. Without this provision, policyholders may find themselves at a significant disadvantage when negotiating the value of their claims.

Insurance companies, including State Farm, have their own financial interests to protect, and this change may tilt the balance of power in their favor. Policyholders may now have limited recourse to dispute an unfair settlement offer.

- Increased Risk of Undervaluation:

The removal of the appraisal clause increases the risk of policyholders receiving undervalued claim settlements. Insurance companies often use their in-house adjusters to assess claims, and these adjusters may have an incentive to minimize payouts. In contrast, the appraisal clause provided an impartial third-party assessment, ensuring that policyholders received a fair evaluation of their claims. Removing this clause may result in policyholders settling for less than what they are entitled to. - Delayed Claims Processing:

The appraisal clause served as a dispute resolution mechanism that expedited the claims process. By removing this provision, policyholders may experience delays in getting their claims settled. Disputes over claim amounts may lead to lengthy negotiations or even legal action, further frustrating policyholders during an already stressful time. - Erosion of Trust:

Trust is a cornerstone of the insurance industry. Policyholders rely on their insurance companies to provide fair and prompt claim settlements when they need them the most. The removal of the appraisal clause may erode the trust that State Farm policyholders have placed in the company. They may perceive this change as a move to prioritize profits over their best interests.

Tips for State Farm policyholders in Alabama

- Shop around for auto insurance – There are many other auto insurance companies that offer fair total loss settlements. Policyholders should shop around and compare quotes before renewing their policies with State Farm.

- Consider purchasing gap insurance – Gap insurance covers the difference between the actual cash value of the vehicle and the amount of the loan or lease in the event of a total loss. This can help policyholders avoid having to pay out of pocket for the remaining balance of the loan or lease.

- Be prepared to negotiate – If State Farm offers a low total loss settlement, policyholders should be prepared to negotiate. Policyholders should have documentation of the value of the vehicle, such as recent appraisals or Kelley Blue Book values. Policyholders should also be prepared to walk away from the negotiation if State Farm is not willing to offer a fair settlement.

Conclusion

The removal of the appraisal clause provisions from State Farm’s Alabama auto insurance policy raises valid concerns about fairness, transparency, and policyholder rights. As a result, Policyholders may now face an uphill battle when disputing claim values, potentially resulting in undervalued settlements and delays in claims processing. Additionally, this change could damage the trust that policyholders have in their insurers.

In the end, it is essential for insurance companies to prioritize the interests of their policyholders to maintain a strong and ethical reputation in the industry. The removal of the appraisal clause provisions appears to work against this principle and should be reconsidered for the benefit of State Farm’s policyholders.