Auto Market Update Week Ending August 19, 2023: Wholesale Price Trends and Insights (PDF)

In the dynamic landscape of the auto market, the week ending August 19th showcased intriguing shifts, as reflected by the wholesale price data. This update encapsulates the trends, fluctuations, and notable observations within the realms of car segments, truck & SUV segments, as well as the broader market sentiment. Buckle up as we delve into the insights from this week’s numbers.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -1.73% | -1.35% | -0.19% |

| Truck & SUV segments | -1.43% | -1.49% | -0.21% |

| Market | -1.52% | -1.45% | -0.21% |

Wholesale Auto Market Performance

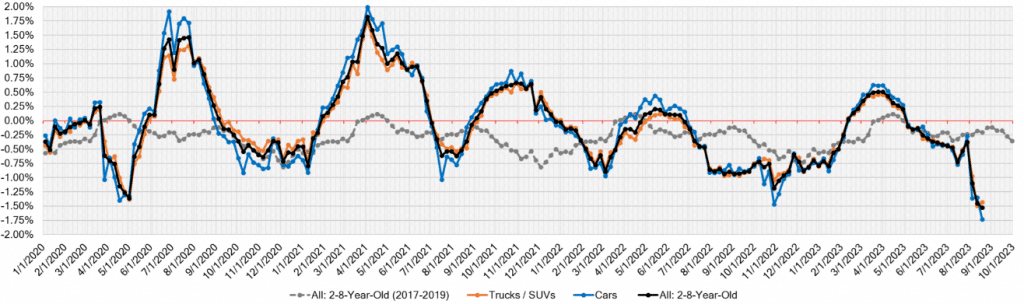

The trend of record declines persisted for a third consecutive week in the wholesale market. Prices across some of the mainstream segments plummeted by over 2%, painting a striking picture of market dynamics. However, a contrasting narrative emerged in the realm of used retail listed prices, which maintained their ground without substantial decreases.

Segment-Level Performance

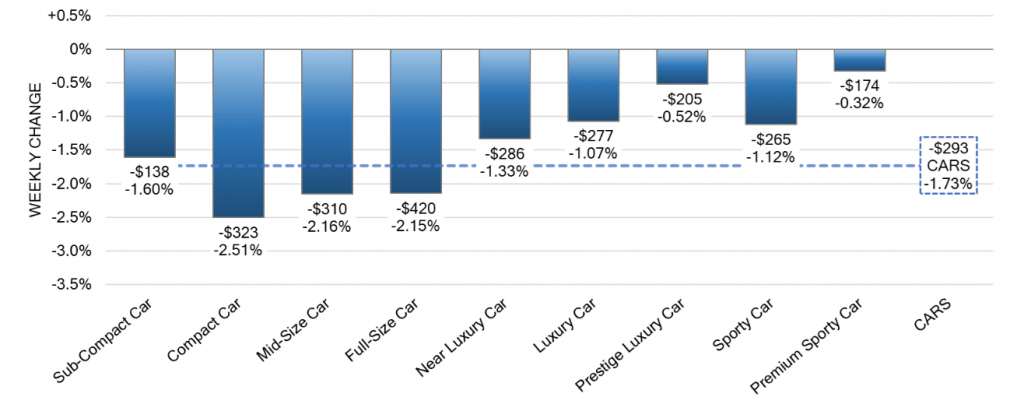

Car Segments:

In the realm of car segments, the numbers spoke volumes. The overall car segment experienced a significant decline of -1.73%, surpassing the depreciation of the previous week (-1.35%). This dip even exceeded the largest single-week depreciation witnessed at the onset of the pandemic, standing at -1.40%. A closer look at specific age ranges revealed a decline of -1.20% for 0-to-2-year-old car segments and a more pronounced -1.90% dip for 8-to-16-year-old cars.

All nine car segments witnessed decreases last week, with seven of them registering declines exceeding the 1% mark. Noteworthy were the declines in the Compact (-2.51%), Mid-Size (-2.16%), and Full-Size (-2.15%) car segments, each reporting drops surpassing 2%. An intriguing trend emerged as the Compact Car segment marked its third consecutive week of single-week depreciation exceeding the 2% threshold. However, segments like Premium Sporty and Prestige Luxury maintained their typical seasonal depreciation patterns.

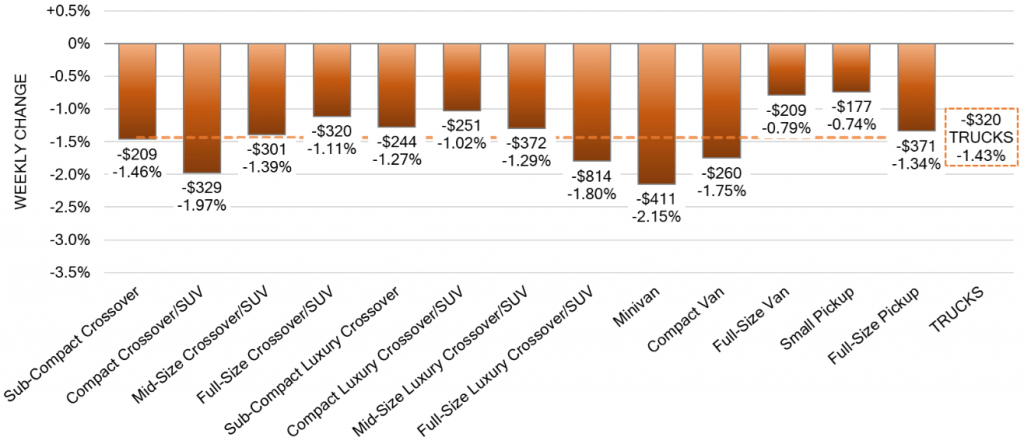

Truck & SUV Segments:

The truck and SUV segments echoed a similar sentiment, with the overall truck segment experiencing a depreciation of -1.43%, mirroring the decline seen in the prior week (-1.49%). Diving into the specifics, 0-to-2-year-old models recorded a decline of -1.20%, while 8-to-16-year-old counterparts experienced a milder dip of -1.10%.

All thirteen truck segments faced declines last week, with eleven of them undergoing drops exceeding 1%. Among these, the Minivan segment stood out, witnessing a decline of -2.15%, making it the sole truck segment to cross the 2% depreciation threshold. However, it’s worth noting that despite the significant dip, this decline was still relatively less severe than some of the drops witnessed in the past year and at the onset of the pandemic.

Used Retail and Wholesale Insights

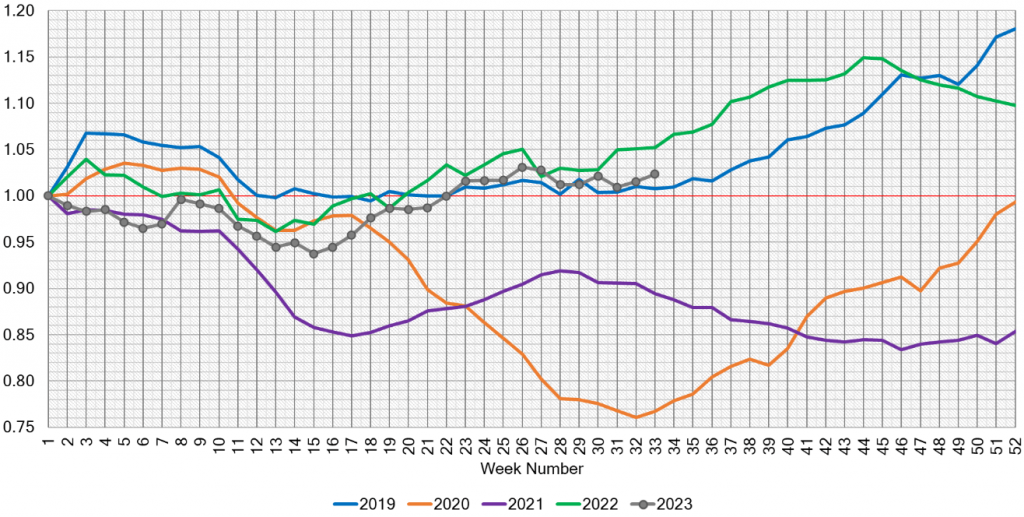

In the realm of used retail, the Active Listing Volume Index currently rests at 1.02 points, reflecting the current state of offerings and inventory.

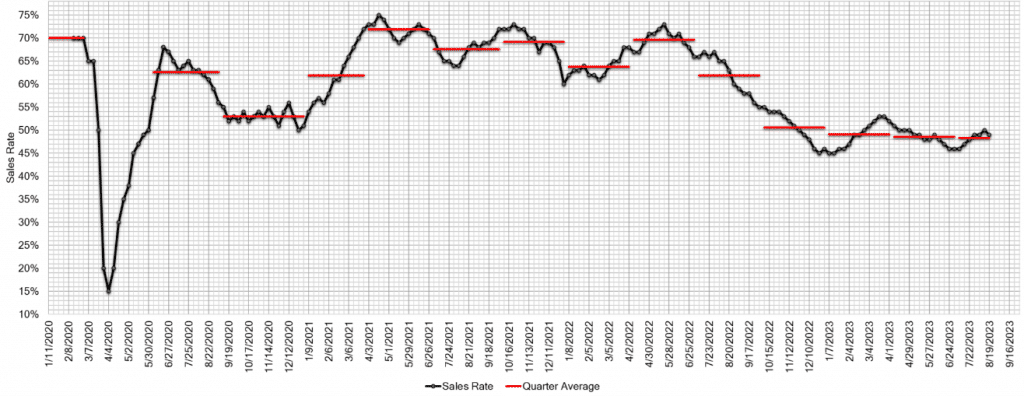

In the wholesale domain, the trend of steep declines continued for the third successive week in both car and truck segments. Notably, auction conversion rates took a dip by 1%, breaking the pattern of improvement seen over the previous two weeks. The market’s landscape now showcases a sense of hesitancy among buyers, who are now more cautious when allocating funds for inventory. Both buyers and sellers appear to be in a “wait and see what happens next” mode, exemplifying the cautionary stance. The estimated Average Weekly Sales Rate followed suit, declining to 49%.

Auto Market Summary

The week ending August 19th has offered a glimpse into the ever-evolving dynamics of the automotive market. With record declines persisting in the wholesale arena and nuanced patterns emerging in various segments, the landscape remains intriguingly dynamic. As buyers and sellers tread cautiously, the coming weeks will undoubtedly shed more light on the trajectory of the market. Stay tuned for more updates as we navigate the evolving auto market terrain.