Auto Market Update Week Ending Jul 22, 2023 (PDF)

Welcome to our weekly Auto Market Update, where we delve into the latest trends and developments in the automotive industry. In this edition, we’ll be focusing on the wholesale prices for the week ending July 22nd, 2023, as well as highlighting notable shifts in the car and truck/SUV segments. Join us as we explore the market’s performance and how it compares to pre-pandemic trends.

Wholesale Prices and Market Performance

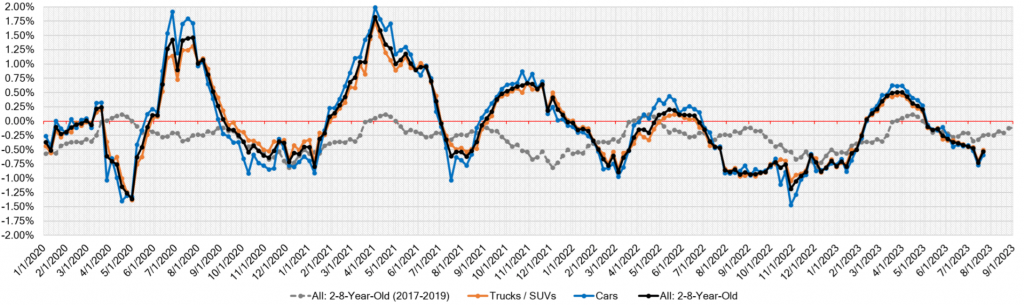

The automotive market continues to face challenges, with an ongoing decline in prices. However, there is a glimmer of hope, as the rate of decline last week (-0.53%) was slightly less than the previous week (-0.73%). Despite this, the overall weekly decline still surpasses the typical pre-pandemic trends for this time of year.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.59% | -0.77% | -0.29% |

| Truck & SUV segments | -0.50% | -0.70% | -0.22% |

| Market | -0.53% | -0.73% | -0.25% |

Car Segments

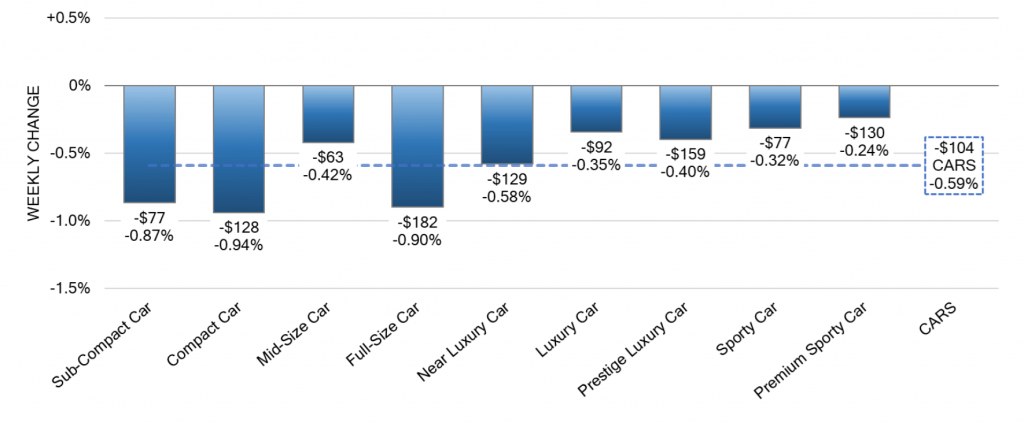

On a volume-weighted basis, the car segments declined -0.59% last week. The 0-to-2-year-old car segment saw a decrease of -0.46%, while the 8-to-16-year-old car segment saw a decrease of -0.56%. This is an improvement compared to the previous week’s decrease of -0.77%. All nine car segments showed a decrease.

The Compact (-0.94%) and Full-Size (-0.90%) car segments encountered the most significant declines, with both experiencing higher depreciation rates compared to the previous week. Conversely, the luxury segments fared slightly better, with the Prestige Luxury Car segment only down by -0.40% compared to the previous week’s -0.71%.

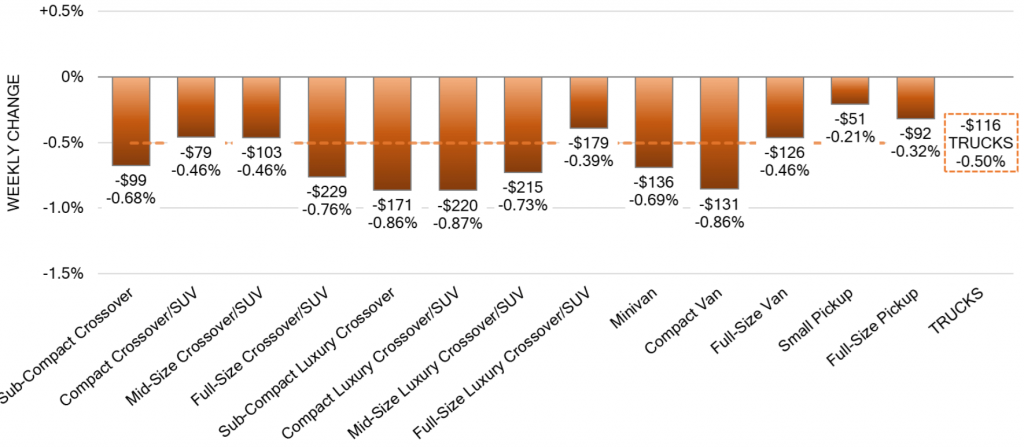

Truck & SUV Segments

Overall, the truck and SUV segments declined by -0.50%, improving from the previous week’s decline of -0.70%. All thirteen truck segments reported declines. The 0-to-2-year-old segment reported a decline of -0.50% while the 8-to-16-year-old segment reported a slight decrease of -0.44%.

Last week, the Compact Luxury Crossover/SUV (-0.87%), Sub-Compact Luxury Crossover/SUV (-0.96%), and Compact Van (-0.86%) segments faced the most substantial declines among truck and SUV categories. Notably, the Full-Size Pickup (-0.32%) segment experienced a decline for the seventh consecutive week, but its rate of depreciation remains lower than the overall market average.

Used Retail and Auction Trends

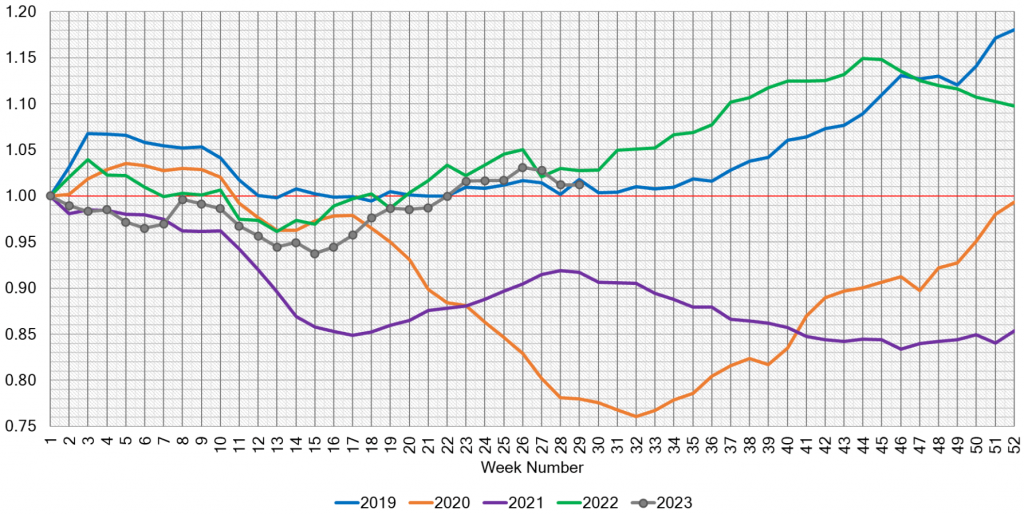

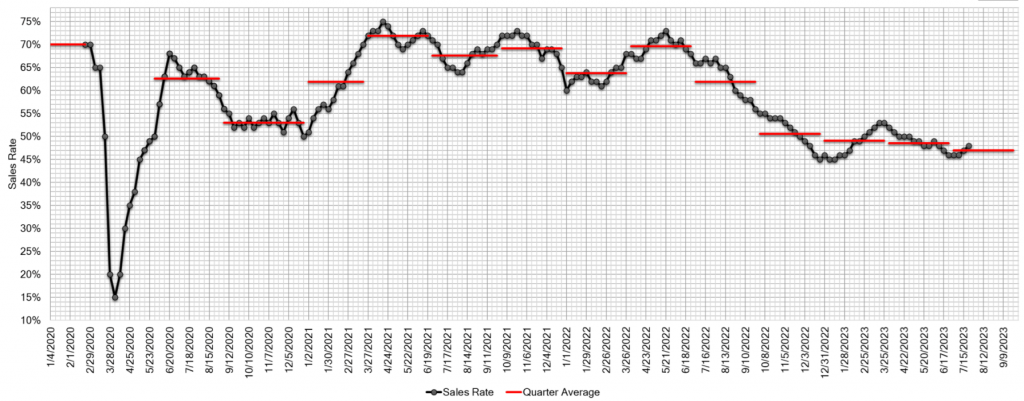

Since the start of 2023, the Used Retail Active Listing Volume Index has reverted back to one, and it stands at 1.01 at present. As sellers adjust their pricing floors, conversion rates have improved in recent weeks despite a surge in no-sale and If bids in the auction lanes.

The auction market is witnessing newer used units experiencing heavier depreciation, particularly in the Truck and SUV segments, as new inventory levels improve. Interestingly, the estimated Average Weekly Sales Rate increased to 48% last week, indicating a positive shift in demand.

Conclusion

The auto market continues to grapple with declining wholesale prices, but the pace of decline has slowed slightly compared to previous weeks. While challenges remain, there are optimistic signs, such as improved conversion rates and the increasing Average Weekly Sales Rate in auctions.

As we move forward, it’s essential to keep a close eye on market trends, consumer behavior, and inventory levels to gauge the industry’s recovery. Stay tuned for our next weekly update as we bring you the latest insights into the ever-evolving auto market.