Auto Market Update Week Ending Apr 22, 2023(PDF)

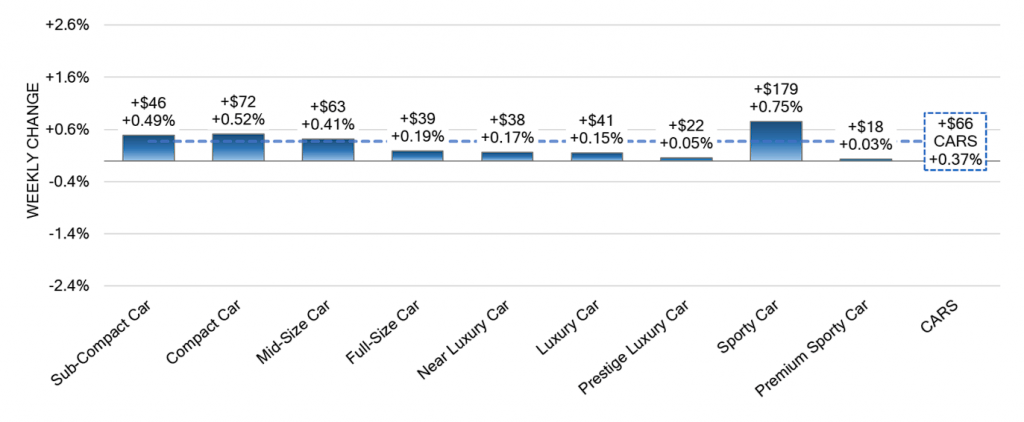

Sporty Cars still reported some of the largest gains last week, while the market continued to report increases. In 2019, the segment had only recorded nine consecutive weeks of gains during the traditional spring market, but this season, the segment has recorded fourteen consecutive weeks of gains.

- Last week, all nine car segments increased.

- Based on volume-weighted data, the overall Car segment increased by +0.37%. For comparison, cars increased by +0.41% the previous week.

- Sporty Car increased again last week, up +0.75%, marking the fourteenth consecutive week of weekly gains.

- Over the past eleven weeks, the Compact Car segment has averaged a weekly increase of +0.55%. The segment has increased +0.52% in each of the past eleven weeks.

- The Premium Sporty Car index gained 0.03% for the second week in a row.

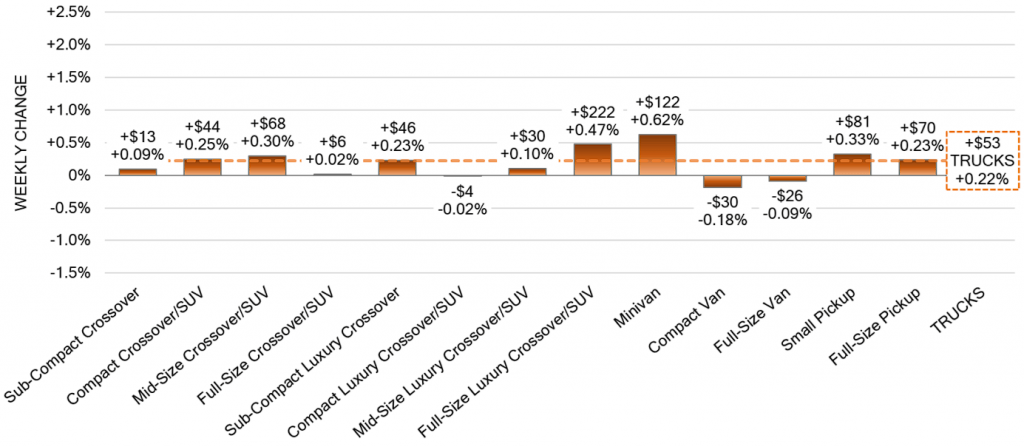

- Last week, ten of the thirteen truck segments reported increases.

- Compared with the prior week, the volume-weighted Truck segment increased +0.22%.

- With a -0.02% decline, Compact Luxury Crossovers ended eight weeks of consecutive gains.

- In the last five weeks, minivans gained the most week-over-week at +0.62%, but this was the smallest single-week increase in the segment.

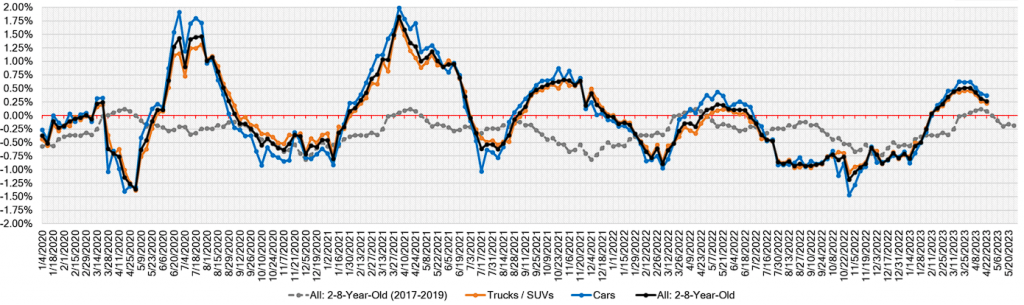

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | +0.37% | +0.41% | +0.17% |

| Truck & SUV segments | +0.22% | +0.27% | +0.02% |

| Market | +0.27% | +0.31% | +0.08% |

Retail (Used and New) Insights

- Earlier this week, Tesla announced another round of price adjustments for the 2023 Model S and Model X, as well as unlimited Supercharging for those who take delivery before June 30, 2023.

- In 2025, Jaguar will introduce its four-door GT model with a price tag of around $124,000, entering the performance all-electric market.

- For the 2024 model year, Lincoln will redesign the Nautilus and move the assembly to a new location. Instead of manufacturing the crossover in Ontario, the redesigned crossover will be imported from China. Electric vehicles will be produced at the Ontario plant.

Wholesale

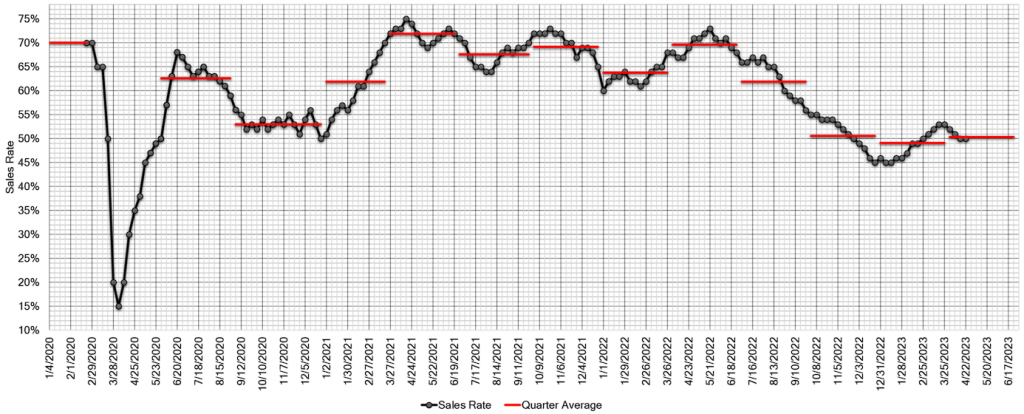

Auction conversion rates remained unchanged last week, with varying lane results depending on location and remarketing approach. This prompts the question of whether the spring market has drawn to a close or if fluctuations will continue. Most people consulted seem to feel that demand at auction will remain high for some time yet. Be sure to follow Black Book for updates on developing trends so you don’t miss out. The Estimated Average Weekly Sales Rate held steady at 50%.