The Road Ahead for Used Car Sales and Prices (PDF)

As the pandemic continues to impact the global economy, the used car market is experiencing a significant shift. According to Laura Wehunt, VP of Automotive Valuations for Black Book, the demand for quality used units remains high, with inventory available at auctions remaining low. As a result, vehicle values at auctions are strong and conversion rates are increasing. However, the lanes with high lower conversion rates are not for a lack of interest, but rather due to sellers setting high floor prices and holding firm on their floors.

In contrast, Alex Yurchenko, Chief Data Science Officer at Black Book, noted that while most of the wholesale market is increasing at higher-than-seasonal rates, electric vehicles (EVs) are declining due to the reduction of MSRPs of new models.

Supply and Demand Challenges Impacting Inventory and Pricing

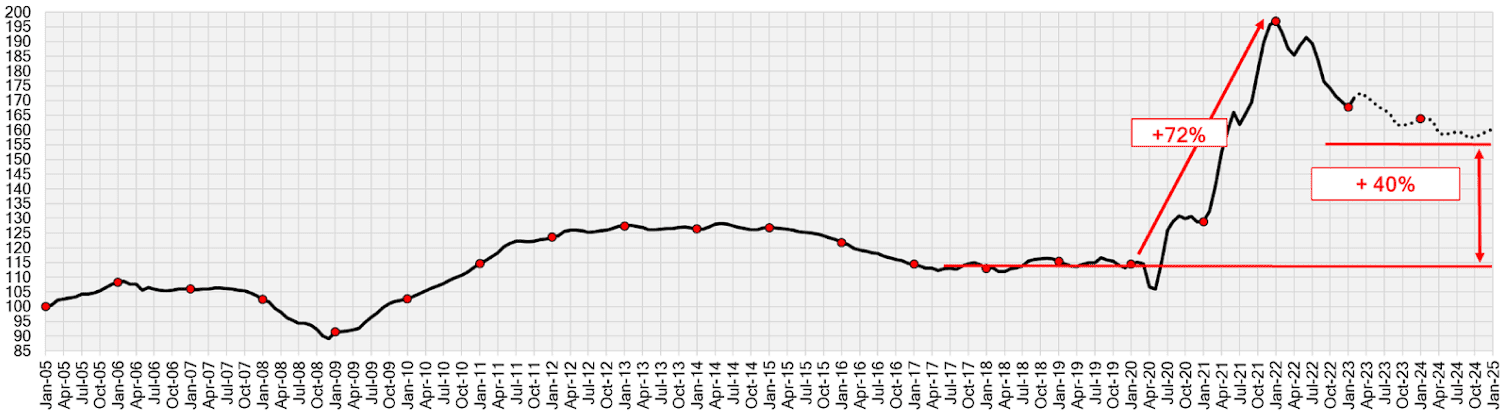

The market for used cars is booming, which unfortunately has resulted in higher prices. Typically, it takes about four to eight weeks for changes in used-car prices to be reflected in retail prices. American consumers should thus expect further price increases this month. Manheim’s February numbers show a 4.3% increase which marks the biggest since 2009, whilst Black Book noted a 0.46% increase over the week ending March 11 – the largest single-week jump since November 2021.

Several factors have been identified as possible causes of the surge in retail sales of used vehicles. A relatively mild winter, low inventory levels, a dip from peak pandemic prices, and the likelihood of an impending recession may have contributed to the trend. Additionally, shoppers may have been motivated to buy used models before interest rates began to rise again, and opting for a used-car payment may have been more attractive than taking on the financial burden of a new car payment.

The used car market is experiencing a unique set of circumstances. On one hand, demand for quality used cars is high, but on the other, prices are rising, signaling a reversal of the decline that started last fall. As we move forward, it will be interesting to see how these opposing trends play out and what impact they have on the overall automotive industry.