Top Auto Brands Ranked for Responsiveness to Online Customers Inquiries (PDF)

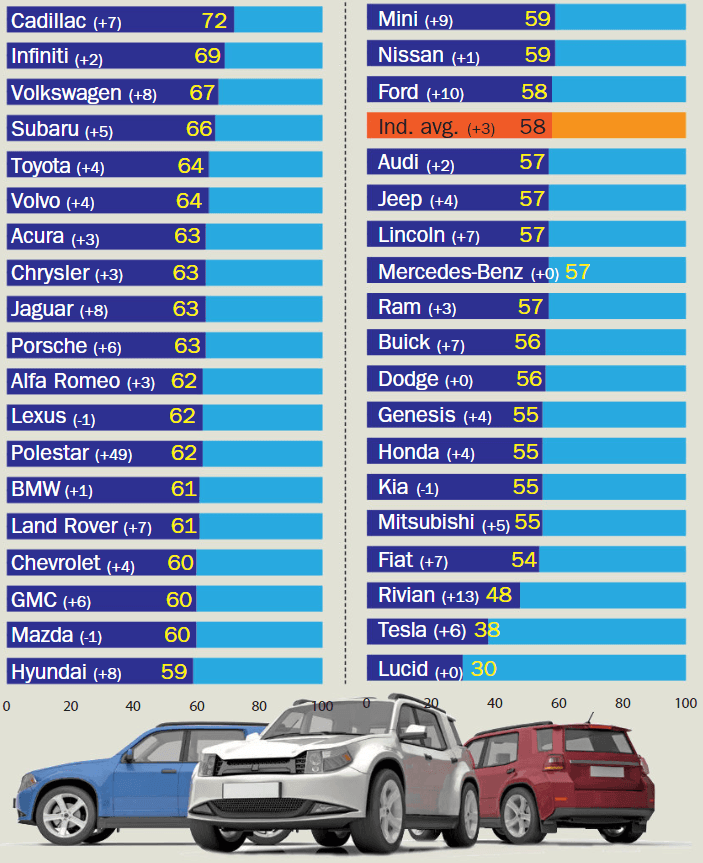

The Pied Piper PSI Internet Lead Effectiveness Study measured how quickly and effectively dealerships responded to Internet customers’ inquiries. As a result of sending specific questions to 5,428 dealership websites, Pied Piper gave each store a score out of 100 based on how well they responded.

In the poll, Cadillac received a score of 72 this year, an increase of seven points over 2022. Infiniti placed second with a score of 69, and Lucid placed last with a score of 30.

| Rank | Auto Brand | Change (2022 – 2023) | Score |

| 1 | Cadillac | +7 | 72 |

| 2 | Infiniti | +2 | 69 |

| 3 | Volkswagen |

+8

|

67 |

| 4 | Subaru |

+5

|

66 |

| 5 | Toyota |

+4

|

64 |

| 6 | Volvo |

+4

|

64 |

| 7 | Acura |

+3

|

63 |

| 8 | Chrysler |

+3

|

63 |

| 9 | Jaguar |

+8

|

63 |

| 10 | Porsche |

+6

|

63 |

| 11 | Alfa Romeo |

+3

|

62 |

| 12 | Lexus |

-1

|

62 |

| 13 | Polestar |

+49

|

62 |

| 14 | BMW |

+1

|

61 |

| 15 | Land Rover |

+7

|

61 |

| 16 | Chevrolet |

+4

|

60 |

| 17 | GMC |

+6

|

60 |

| 18 | Mazda |

-1

|

60 |

| 19 | Hyundai |

+8

|

59 |

| 20 | Mini |

+9

|

59 |

| 21 | Nissan |

+1

|

59 |

| 22 | Ford |

+10

|

58 |

| 23 | Industry average |

+3

|

58 |

| 24 | Audi |

+2

|

57 |

| 25 | Jeep |

+4

|

57 |

| 26 | Lincoln |

+7

|

57 |

| 27 | Mercedes-Benz |

+0

|

57 |

| 28 | Ram |

+3

|

57 |

| 29 | Buick |

+7

|

56 |

| 30 | Dodge |

+0

|

56 |

| 31 | Genesis |

+4

|

55 |

| 32 | Honda |

+4

|

55 |

| 33 | Kia |

-1

|

55 |

| 34 | Mitsubishi |

+5

|

55 |

| 35 | Fiat |

+7

|

54 |

| 36 | Rivian |

+13

|

48 |

| 37 | Tesla |

+6

|

38 |

| 38 | Lucid | +0 | 30 |

Dealerships that score over 80 sell about 50 percent more units for the same number of people coming through the website than those that score below 40, according to Pied Piper CEO Fran O’Hagan.

In 2021, Ford stands out among large-scale brands by a 10-point increase in its ranking to 58. Efforts to address issues highlighted by previous rankings possibly led to improvement. Additionally, the number of dealerships with scores greater than 80 has doubled.

Polestar also saw improvement with a huge 49-point increase. Rivian, Volkswagen, Hyundai, Jaguar, and Mini also improved their results. On the other hand, Mazda, Kia, Lucid, Lexus, Dodge, and Mercedes-Benz were unable to keep up with the overall increase. If the scores show no significant changes, then these brands are not taking any different action.

EV Brands

When brands or dealerships don’t test the effectiveness of their responses online, their customers are the only ones who can measure it. In per-brand performance analyses, Tesla and Rivian EV brands struggled. On average, dealerships responded to website customer inquiries in 30 minutes, less than 30% of the time. Additionally, Tesla and Rivian POSs responded to most calls less than 35% of the time and text messages less than 10% of the total time.

Comparing the overall results, Rivian had 48 points and Tesla 38 which put them at the bottom of the list. We believe these customer service issues will become more and more evident as the EV market becomes more competitive. Those brands that stand out in defending their arguments will be the most successful.

Data shows that text message replies have been increasing in popularity. Currently, 61% of queries receive a response via text message, up from 46% last year. Still, phone calls remain an important method of communication for some brands, with automakers like Subaru and Acura responding to website queries by phone 70% of the time.