Auto Market Update Week Ending Jan 28, 2023 (PDF)

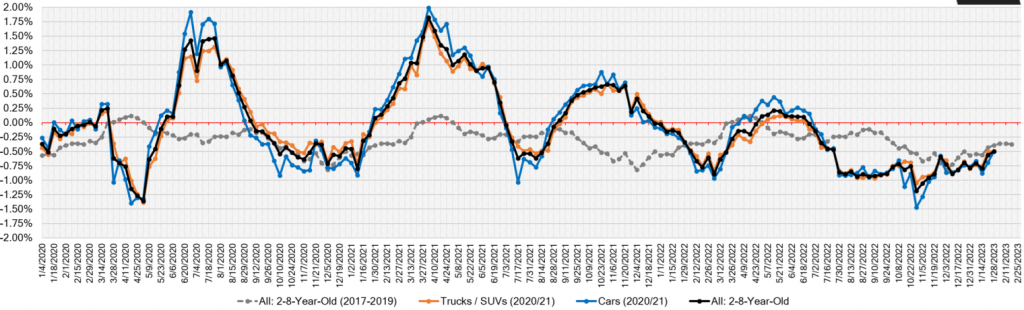

For the second consecutive week, the Sporty Car segment has reported an increase, indicating an early sign of a potential Spring market bump. Additionally, the older, 8-to-16-year-old vehicles report lower depreciation, -0.27%, compared to -0.50% for the 2-to-16-year-olds.

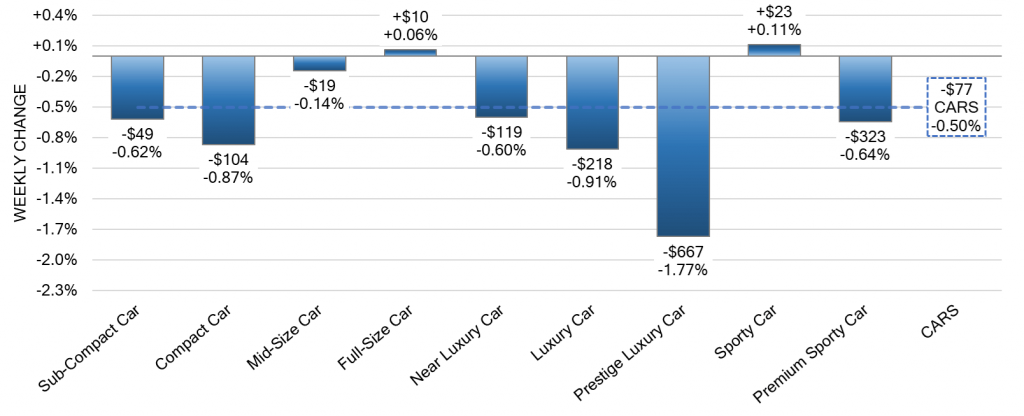

- Compared with the previous week, the overall Car segment decreased -by 0.50% volume-weighted.

- Car sales decreased in seven of the nine segments last week, with only one segment reporting a decline greater than 1% (Prestige Luxury, -1.77%).

- After a +0.03% increase the week before, Sporty Car increased +0.11% this week.

- The Full-Size Car (+0.06%) rose after thirty-two weeks of declines averaging -0.76% per week.

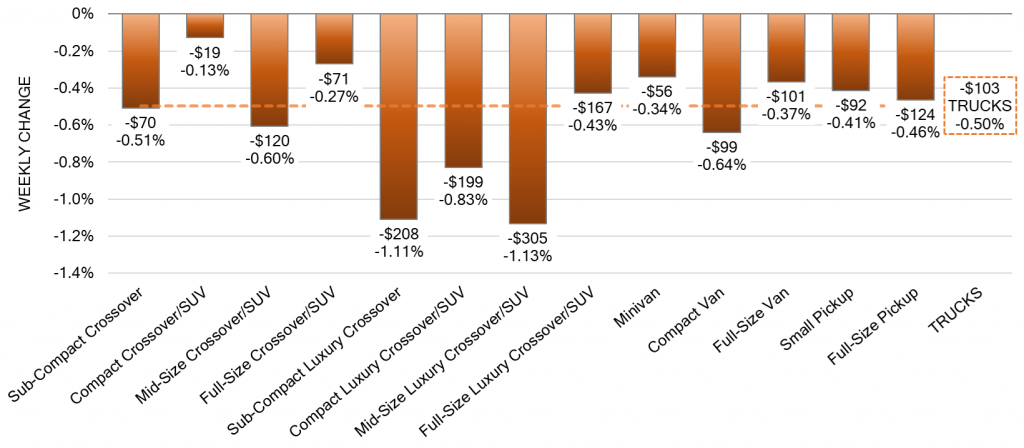

- Volume-weighted, the overall Truck segment decreased -0.50% from the previous week.

- Only two truck segments reported declines greater than 1% (Sub-Compact Luxury, -1.11%; Mid-Size Luxury, -1.13%) last week.

- The Compact Crossover segment (-0.13%) reported its smallest decline since June.

- It was the second consecutive week that full-size vans depreciated more than average. Last week’s depreciation was -0.37%, compared with an average -0.17% decline over the previous six weeks.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.50% | -0.69% | -0.42% |

| Truck & SUV segments | -0.50% | -0.50% | -0.37% |

| Market | -0.50% | -0.56% | -0.39% |

Retail (Used and New) Insights

- In the second half of the year, the 2024 Polestar 2 will be updated with new styling, a permanent magnet electric motor, and updated lithium-ion batteries.

- Drive Pilot, which was initially developed in Germany, has now been approved for initial use in Nevada for the 2024 Mercedes-Benz EQS and S-Class sedans.

- According to Tesla CEO Elon Musk, the Tesla Cybertruck will not be available until next year during the company’s quarterly earnings call. Additionally, the price cuts earlier this month have had the desired effect of increasing orders for Teslas.

Wholesale

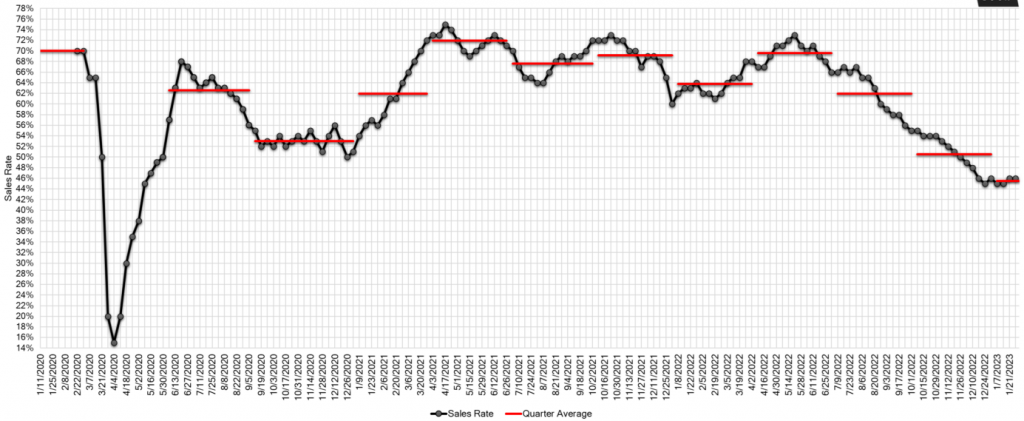

As we bid farewell to the month of January, wholesale lanes have experienced an unsteady start, struggling with low sales rates and spotty inventory. Sellers are attempting to attract buyers by giving unsold vehicles another go on the auction block. Buyers, fully cognizant of the flagging vehicle values, remain positive in anticipation of a customary spring market. Brand-new models remain scarce but clean and recent model years are still highly desirable as a result. Older models under $20K have been popular among non-franchise dealers; however, franchise buyers haven’t actively participated in downstream lanes nor done much purchasing in the lane from rental companies who have been showing up only occasionally.