Understanding Diminished Value

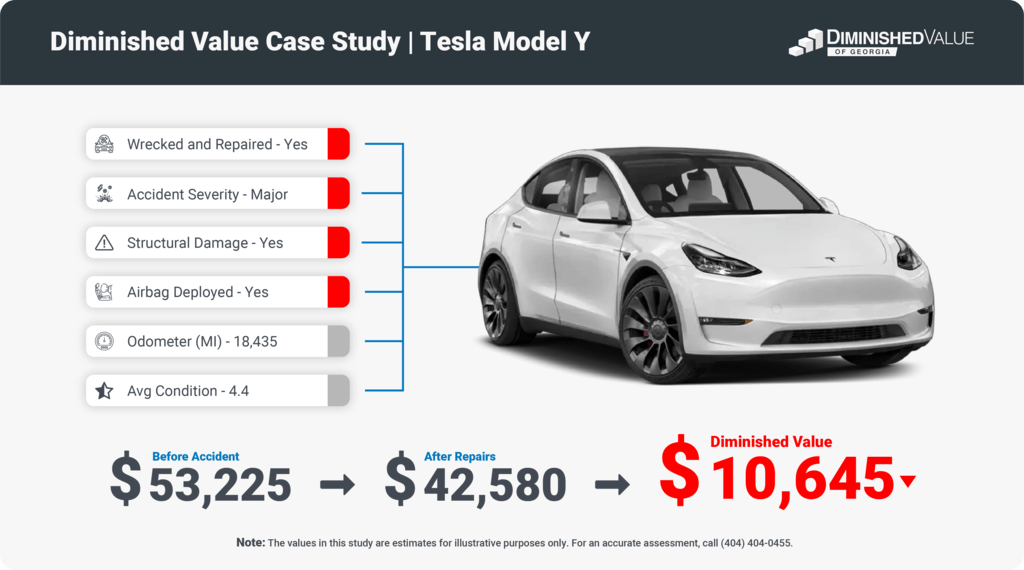

Diminished value is the loss in your vehicle’s market value after an accident. Even with excellent repairs, a car with a history of damage is typically worth less than one that’s never been in an accident.

Buyers tend to view accident history as a potential risk, which can lead to lower offers or longer selling times. This gap in value—between what the car would be worth without damage and its value post-repair—is what a diminished value claim seeks to address.

Types of Diminished Value

There are three primary types of diminished value:

- Inherent Diminished Value: This is the most common type and refers to the depreciation in value simply because the vehicle has a documented accident history.

- Immediate Diminished Value: This type happens right after the accident but before any repairs are made. It reflects the visible damage to the vehicle.

- Repair-Related Diminished Value: This occurs when the repairs made to the vehicle are not up to standard, leaving behind imperfections or unresolved issues.

Can You Claim Diminished Value on a Leased Vehicle?

For lessees, claiming diminished value (DV) is often more complex than for owners. Insurance companies may argue that because lessees don’t technically own the vehicle, they’re ineligible for DV claims.

First, it is important to keep in mind that regardless if the vehicle is yours or leased, it suffers diminished value. So, the question now becomes is it the lessee or the lessor who is harmed by the diminished value of the vehicle?

When the contract ends, you may be charged so the responsible party/insurance company may need to cover the loss in value before the return of the vehicle. If it was a third-party that caused the accident, neither the lessee or lessor are responsible for the DV.

Filing a Diminished Value Claim on a Leased Car

On the other hand, the lessee is still contractually obligated to pay the same monthly lease payment, even though the car is now worth less than the original retail price. There also exists the chance of the lessor or the dealership trying to hold them liable for the lost value when returning the car.

Filing a diminished value claim on a leased car requires clear steps, especially since lessees face unique challenges. Here are a few steps you should take:

- Collect Accident Details: Begin by gathering detailed records—photos, repair estimates, and receipts—to document the damage accurately. This proof will help establish the initial value lost.

- Consult the Lessor: Check your lease agreement or talk to the lessor about DV claim policies. Some agreements may explicitly outline your responsibility for post-accident DV charges.

- Contact the At-Fault Party’s Insurer: If a third party is liable, notify their insurer directly to start your claim. Request an independent appraisal to assess the post-repair DV, as their figures may differ from typical insurance estimates.

- Hire a DV Expert: Consider working with a DV appraiser experienced with lease claims. Their report can provide leverage if you need to negotiate with the insurer or lessor.

The average diminished value amount is $6,200. We can help you get what you deserve.

Check the 5 Common Mistakes When Filing Diminished Value Claims.

Impacts on Lessees and Lessors in DV Claims

When leasing, it’s sometimes difficult to know what to do when the lease term is up and you are thinking about buying your vehicle. Here are a few things to consider.

While some lessors will hold you to the contract price even if they know there’s been an accident, most of them will negotiate a lower purchase price – especially if they’ve already settled a diminished value claim, so it may be best not to purchase the vehicle if they hold you on the pre-accident value.

Therefore, if a third party damages your leased vehicle, it’s important to discuss this with them directly. It’s equally advisable to find out how they handle DV payment after an accident and how it is going to be handled at the end of the contract.

Notifying them of problems during your lease term is essential. If you fail to communicate with them and notify them beforehand, problems may arise in the future.

Conclusion

Navigating diminished value claims on a leased vehicle can be complex, but understanding your rights as a lessee can make all the difference. Whether you’re facing lease-end fees or exploring options with third-party insurers, being proactive and informed is key.

Document everything, consult experts when needed, and keep open communication with your lessor. This approach will help you better protect yourself financially and ensure that, even with a leased car, you’re prepared to address diminished value effectively.