March 2022 Auto Industry Related Headlines:

- With fuel prices rising, the Sub-Compact Car segment moved into positive territory and Compact Cars slowed the rate of decline last week.

- On a volume-weighted basis, the overall Car segment decreased -0.52%. For reference, the previous week, cars decreased by -0.81%.

- The volume-weighted, overall Truck segment decreased -0.51%, compared to the prior week’s decrease of -0.56%.

- Used Retail Listing Volume has dropped again this week and now sits below where we started the year. The Index for CY22 is beginning to mirror CY20 with similar week-over-week declines.

| This Month | Last Month | 2017-2019 Average (Same Month) | |

| Car segments | -0.52% | -0.81% | 0.20% |

| Truck & SUV segments | -0.51% | -0.56% | -0.17% |

| Market | -0.51% | -0.64% | -0.01% |

Used Retail Prices

Used Retail Prices are more accessible than in years past, due to the proliferation of ‘no-haggle pricing’ for used-vehicle retailing. Transparent pricing upfront makes the car buying process more enjoyable for customers and allows Black Book to accurately measure retail market trends.

Used Retail Inventory

Used Retail Listing Volume has dropped again this week and now sits below where we started the year. The Index for CY22 is beginning to mirror CY20 with similar week-over-week declines.

The Estimated Average Weekly Sales Rate has started to pick up over the last few weeks but remains at 65% again this week. March is nearly over, and the Estimated Average Weekly Sales Rate has not had a large increase like CY21.

Wholesale Trends:

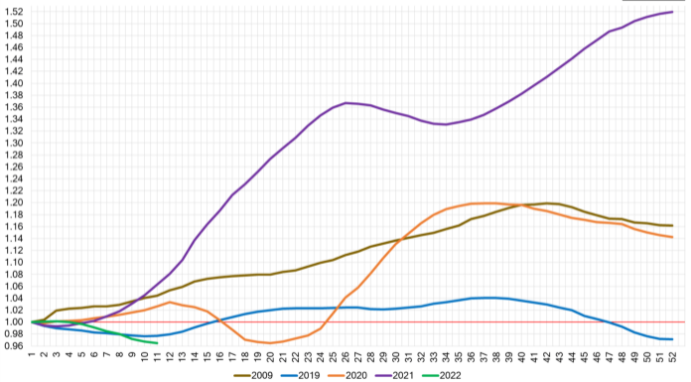

The calendar year 2020 and 2021 ended with used wholesale prices at elevated levels. With economic patterns (including the automotive market) driven by the pandemic, normal seasonal patterns (e.g., 2019 calendar year) in the wholesale market were not observed for most of the last 2 years. We saw a similar picture in 2009, at the end of the Great Recession.

The calendar year 2021 did not have typical seasonality patterns as the market had rapid increases in wholesale values for the majority of the year. The Wholesale Weekly Price Index reached the highest point of the year at the end of December, reporting over 1.51 points. Now, in the calendar year 2022, the index has been reverted back to the 1.00 mark and overall wholesale prices have remained relatively stable in the month of January (green line). As we moved into March, the Wholesale Weekly Price Index continued to decline and is now just below the 2019 trend line, around 0.97.

The graph below looks at trends in wholesale prices of 2-6-year-old vehicles, indexed to the first week of the year. The index is computed keeping the average age of the mix constant to identify market movements