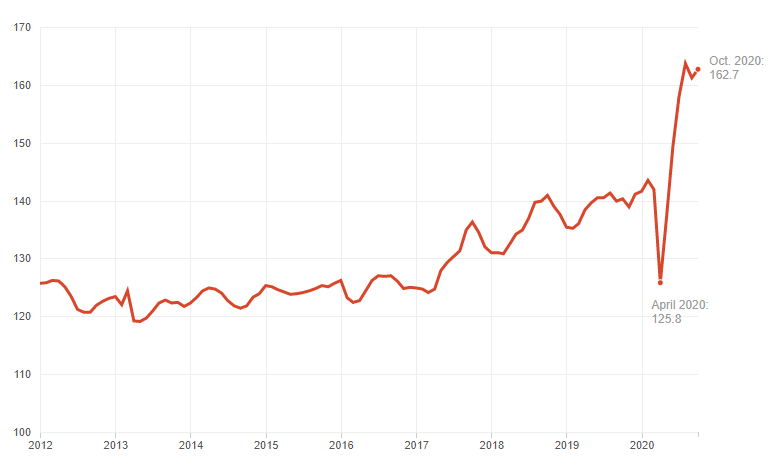

Auction data reflects a brief pandemic-induced fall, then a sharp increase in prices this summer and autumn.

Cars are supposed to depreciate over time, this pandemic has made an exception to this rule.

Supply / Demand Imbalance

Weak Supply and Shortages

- Factories shut down 6 to 8 weeks, no new cars being made

- No Repos, state moratoriums reduced supply

- Weak rental market, less vehicle churn, less inventory at auctions

- Lease Extensions for vehicle leases expiring during the pandemic

Strong Demand

- Stimulus checks gave liquidity to low wage shoppers similar to the tax refund

- Less carpooling due to social distancing forced people who didn’t have cars prior to buy a car

- Low interest rates

- Less reliable and older cars being phased out by shoppers not looking to repair

October 2019 vs. October 2020 Price Fluctuation Per Segment

| Segment | Price Change 2019 to 2020 |

| Compact Cars | +5.5% |

| Midsize Cars | +5.7% |

| Luxury Cars | +18.6% |

| Pickup Trucks | +28.2% |

| Sport Utility Vehicles | +12.9% |

| Minivan | +5.4% |

| Volume adjusted total | +15.4% |

Book Value Comparison

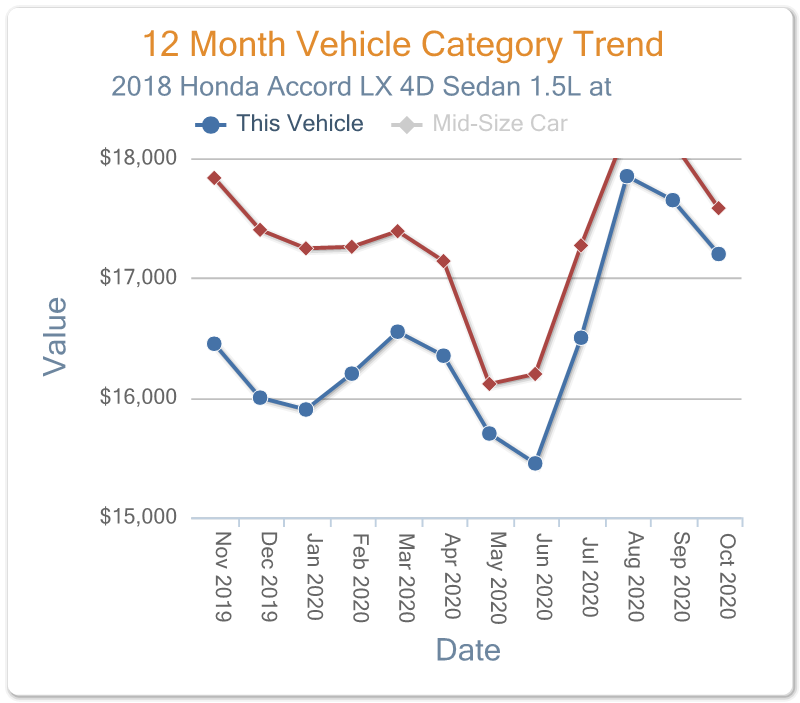

Vehicle #1:

2018 Honda Accord LX 4D Sedan 1.5L at

04/01/2020 Average Trade-In = $16,920

10/30/2020 Average Trade-In = $16,865

Depreciation = $55 or 0.32%

04/01/2019 Average Trade-In = $17,645

10/30/2020 Average Trade-In = $17,220

Depreciation = $425 or 2.4%

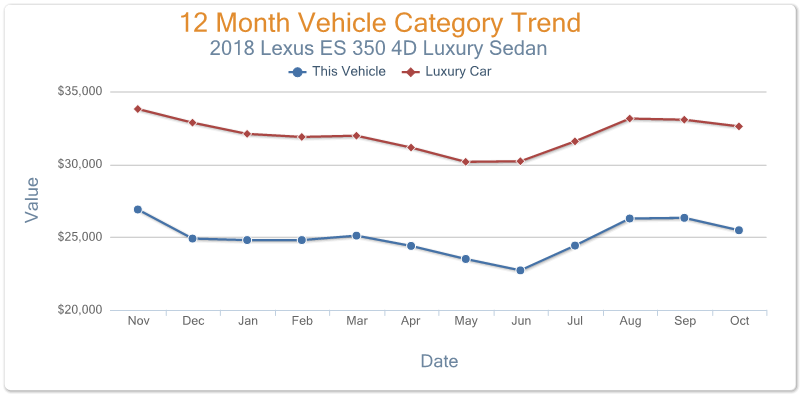

Vehicle #2:

04/01/2020 Average Trade-In = $24,600

10/30/2020 Average Trade-In =$25,425

Depreciation = <$825> or <3.35%> – Car went UP in price

04/01/2019 Average Trade-In = $28,800

10/30/2020 Average Trade-In = $27,500

Depreciation = $1,300 or 4.5%

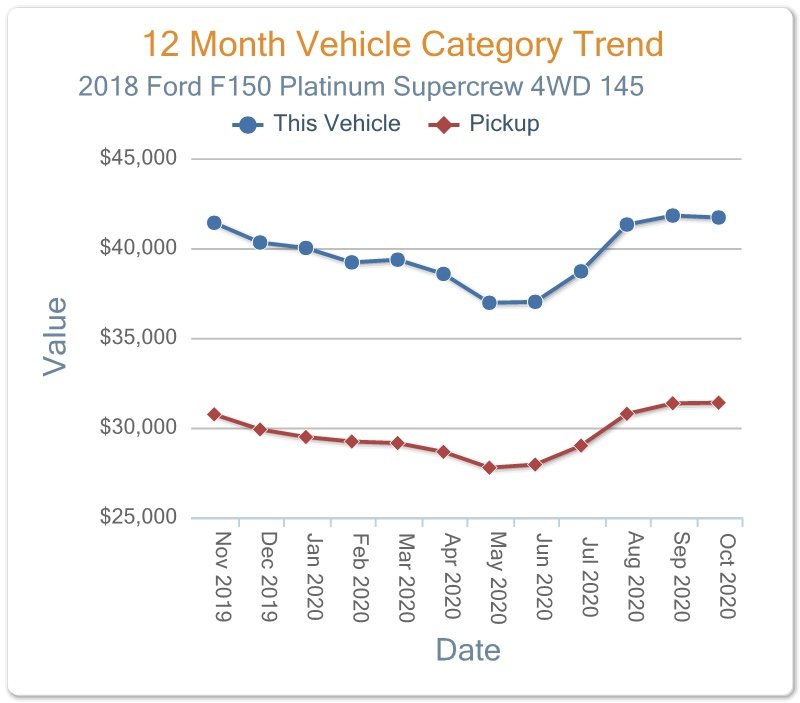

Vehicle #3:

04/01/2020 Average Trade-In = $40,050

10/30/2020 Average Trade-In =$42,400

Depreciation = <$2,350> or <5.86%> – Car went UP in price

04/01/2019 Average Trade-In = $44,060

10/30/2020 Average Trade-In = $42,900

Depreciation = $1,160 or 2.63%