Loss of use after a car accident. You didn’t buy a luxury car so you can drive an economy car when your car is in the shop getting repaired. Get the cash difference today.

Loss of Use CalculatorThis calculator is designed to compute the difference between the rental rate of the damaged vehicle and the replacement vehicle. Please provide us with your information and we will contact you soon. Thank you. |

Don’t want to fill an online form? Print this loss of use questionnaire and mail/fax it to us.

Press Release: Diminished Value of Georgia is Now Offering a Free Loss of Use Claim Calculator

What is Loss of Use After a Car Accident?

Vehicle use is simply the amount of money it costs to own and operate a vehicle for a given length of time. In other words, if you want to temporarily drive a carbon copy of your car (from a few days to a few weeks), how much money would you have to pay? The loss happens when you can no longer enjoy your vehicle because of an accident, hence loss of use.

Since each car is different, the cost associated with vehicle ownership is proportional to the type of vehicle or class. Below are a few components of costs associated with vehicle ownership:

- Vehicle’s actual cash value and/or the corresponding monthly payment

- Vehicle insurance premium

- Maintenance cost

- Amenities and equipment (handicap ramp, DVD screens, tow hitch, etc.)

- Business use (wrapped vehicles or vehicles with vinyl lettering etc…)

Obviously a Kia Rio will cost a lot less to own and operate than a Jaguar.

How and when can I collect Loss of Use?

Usually the loss of use topic is brought up after a car accident or a loss. There are two insurance claim types, 1st party and 3rd party claims.

First Party Claims: These are claims you file against your own policy or carrier, normally if you’re at fault after an accident or if it’s a hit and run or a comprehensive claim like hail or deer. Your insurance policy establishes the parameters of the claim. Most full coverage policies include loss of use recovery in the form of a rental car. The amount allotted for this rental car is normally included in your policy document.

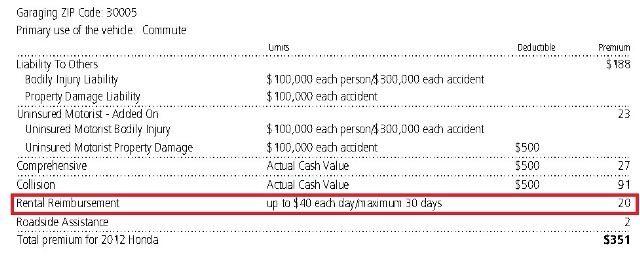

The most common rental reimbursement for insurance policies is $30 for 30 days or a total of $900. Below is a snapshot or a Progressive insurance declarations page showing rental reimbursement of $40/day with a maximum of 30 days or $1,200 total per claim.

Unless otherwise stated in your policy, which is a contract between you and your carrier, you cannot recover additional loss of use beyond the rental terms. So, if your vehicle is in the shop for 60 days, you are normally responsible for the additional rental fees (unless waived by your adjuster for special circumstances). If your car is stolen, your policy normally caps the number of days you can have a rental for. This is what a Progressive policy says about the matter.

Coverage for transportation expenses and loss of use damages begins 48 hours after you report the theft to us and ends the earliest of:

1 when the auto has been recovered and returned to you or its owner;

2 when the auto has been recovered and repaired;

3 when the auto has been replaced; or

4 72 hours after we make an offer to settle the loss of the auto is deemed by us to be a total loss

Third Party Claims: These are claims filed against an at-fault party, for example, a negligent motorist colliding with your vehicle.

Since third party claims follow tort law, the amount of recovery in theory is equal to the loss amount. There are several loss types including:

- Property Damage (collision repair to your vehicle)

- Bodily injury (damage to persons)

- Loss of Value or Diminished Value

- Loss of Use

- Loss of income etc…

To compensate for the loss of use on a third party claim, most carriers offer a rental car. Since bog box rental agencies only carry certain vehicles, odds are you’re not getting the same dollar-for-dollar vehicle as yours.

How Much Can I Recover on third party claims?

Generally speaking, the amount you can recover for loss of use is the reasonable amount it costs for a substitute vehicle for the length of time that you are without your normal car. You can even recover the reasonable value of a substitute vehicle even if one is not rented (if you have a spare vehicle).

What is the Loss of Use Calculator?

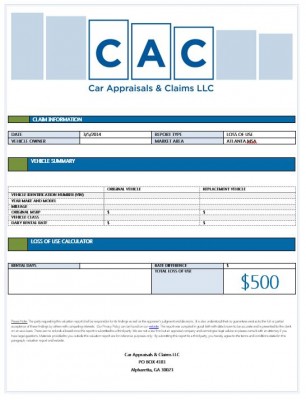

Our loss of use valuation tool helps you recover the full amount of your claim by comparing the rental rate between the vehicle provided to you as a replacement and the actual usage value of your vehicle.

Example:

- Damaged Vehicle: 2013 Volvo XC60 with premium and technology package, Original MSRP $43,000, rental rate $75 per day

- Rental Vehicle: 2013 Ford Escape with cloth seats. Original MSRP $24,000, rental rate $30 per day

- Rental Period: 20 days

- Loss of Use: ($75-$30) X 20 = $900

In this case, after your car is repaired you would send the at fault carrier our Loss of Use valuation report and ask for compensation.

It is very important to demand a vehicle EQUAL to yours from the beginning, if one is not available, make sure you make a point of indicating your dissatisfaction and inform the adjuster of your intent to pursue a loss-in-use claim.

Order a Loss-Of-Use Valuation Report

Loss of use valuation reports are offered for Free to all our existing and prospective Diminished Value and Total Loss clients.