South Carolina Insurance Commissioner Complaint Informati0n

Southe Caroline Office of Customer Service

The Office of Consumer Services provides assistance to consumers on a wide range of insurance claims and policy issues. The Consumer Services staff responds to consumer needs relating to auto, health, homeowners, and life insurance; provides consumers with market assistance by helping to identify hard-to-place insurance coverages within the insurance market; and assists consumers following a catastrophic event. SC DOI Complaint Portal.

Electronic Complaint Form

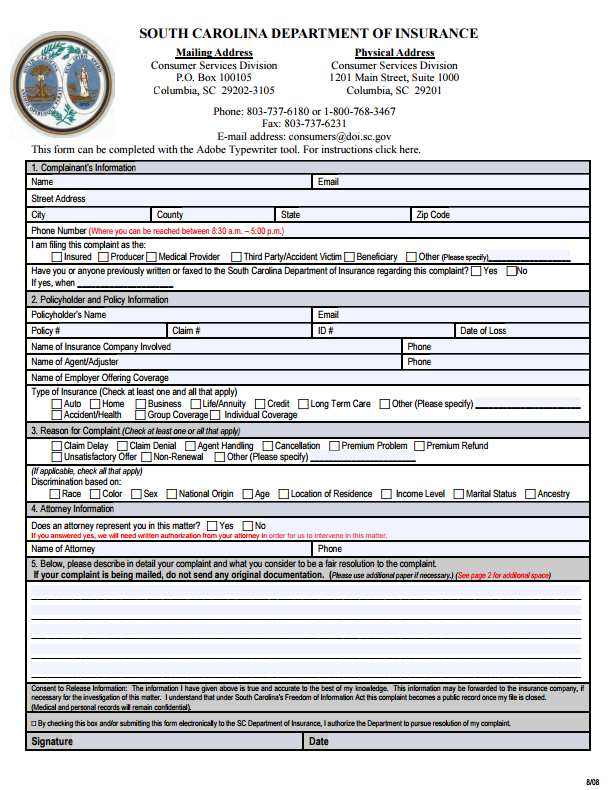

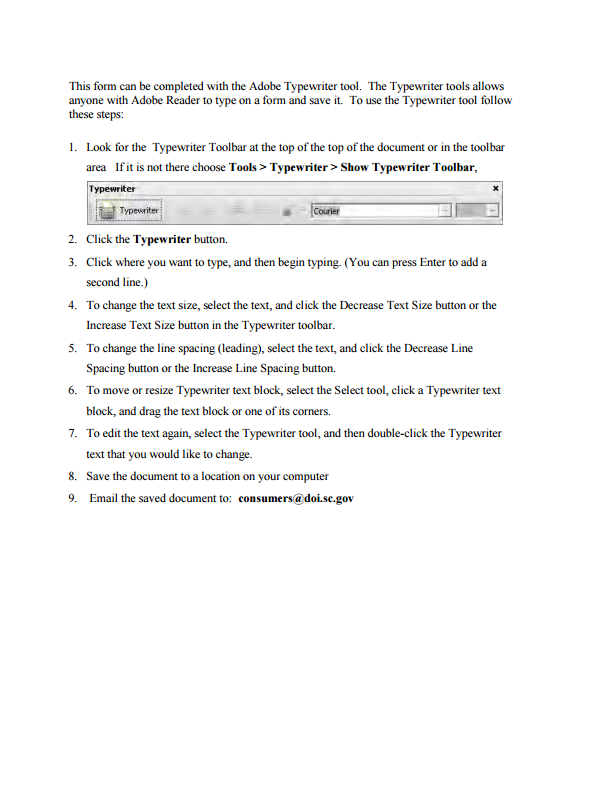

South Carolina Department of Insurance Complaint Form

Paper Form

South-Carolina-insurance-commissioner-complaint – pdf

Important Note for Consumers Represented by Legal Counsel

If you are represented by an attorney in the subject matter of your complaint, you must provide written authorization from your attorney in order for us to intervene in the matter. You may provide this authorization by:

(1) including a letter of authorization with your complaint that is signed by your attorney on their letterhead; or

(2) having your attorney co-sign the complaint form and including their phone number. Alternatively, you may elect to have your attorney file the complaint on your behalf.

Contact Information:

Mailing Address

Consumer Services Division

P.O. Box 100105

Columbia, SC 29202-3105

Physical Address

Consumer Services Division

1201 Main Street, Suite 1000

Columbia, SC 29201