Auction Values – Market Insight.

This week we examine the continued effects the price of gas is having on smaller cars and entry-level cars, which are showing some of the largest declines of the year. Interestingly, even though diesel prices also remain low, they are not having a similar impact on diesel trucks. Dealer sentiment from around the country is also pointing toward lowered prices at auctions to reduce inventory levels.

Source: Auction-Values-Report-Q4-2014

“Gas prices decreased again this week, which will continue to push entry level car values downward. The same can be said for diesel prices at the pump, but diesel trucks still continue to do well on the block.”

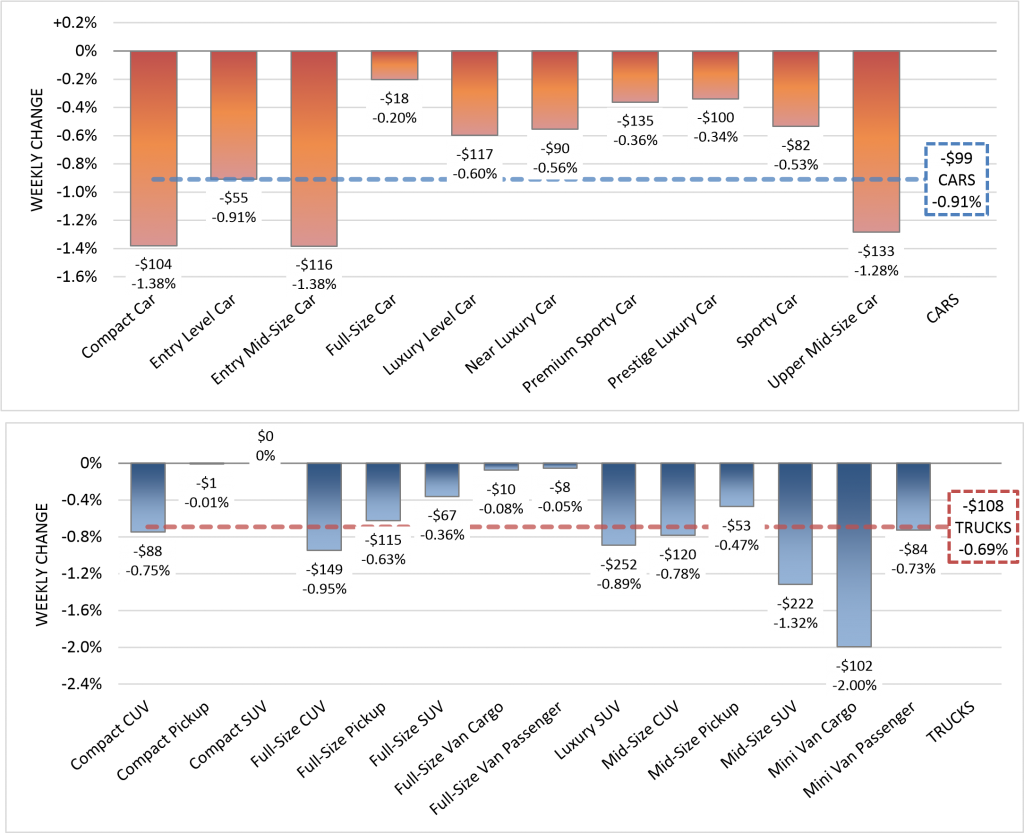

Cars and Trucks Experiencing Largest Declines This Year

- Volume-weighted, overall car values decreased by 0.91% last week. This is the largest depreciation rate seen this calendar year.

- The Compact Car and Entry Mid-Size Car Segments saw the largest depreciation this past week with decreases of 1.38%.

- Volume-weighted, overall truck values decreased by 0.69% last week. This is the largest depreciation rate seen this calendar year.

- Compact Pickup and Compact SUV saw little to no change this past week with 0% and -0.01%, respectively.

Sentiment from the Auction Lanes

Our editors and personnel attend about 60 auctions every week across the country to provide key insights:

“Cars were weak here today but trucks were holding up ok.” Mark from WI

“Trucks topped the list today in the lanes and online.” Richard from FL

“Prices were low here today, dealers selling at almost any price to reduce

inventory.” Gene from PA

“The market rebounded this week in Texas. It was at least a 60% or better sale.” David from TX

“Dealers say they are keeping all the better trade-ins if they can. Good condition older cars are getting hard to find.” Richard from FL

“The market trend in this area is steady to good.” Gene from PA

Vehicle Highlight

2016 Smart ForTwo 2D Coupe has a base MSRP of $15,400 and will be available in 4 trim levels: Pure, Passion, Prime, and Proxy. It will have an 89hp turbo three-cylinder that will come with either a six-speed automatic or a five-speed manual. Close competitors include Scion iA, Honda Fit, Ford Fiesta, Chevrolet Spark, and Hyundai Accent.

This week’s report includes our Monthly Edition Supplement on Specialty Markets.

SPECIALTY MARKETS:

COLLECTIBLE CARS

Lots of Auctions, Lots of Buyers, and Lots of Money

“The collectible market is doing very well right now, with nice examples continuing to bring strong money. It seems like there is an auction every week or two these days, and there are no shortages of either vehicles or bidders. In fact, Barrett-

Jackson just added a major Northeast auction to their schedule, with the inaugural event to be held at

Connecticut’s Mohegan Sun Casino and Resort June 23-25.”

- Barrett-Jackson’s recent Las Vegas sale was a success, achieving a 98% sell through rate (the industry norm is roughly 50-60%). Total sales came in at an impressive $27,000,000.

- Mecum hosted a pair of auctions last month. Their Dallas sale took in $25,000,000 on the sale of 700 cars, and a smaller one in Chicago brought in $13,000,000 from 494 vehicles.

- The last few Ford GTs that have crossed the block have sold for less than what we have been seeing during the past year, so we’ll be keeping a close eye on future sales to see if a correction is due.

Recent Notable Sales Included:

- Chevrolet Corvette L88 Coupe $330,000 (BJ)

2005 Ford GT Coupe $291,000 (BJ)

1966 Ford Fairlane 500 R-Code $275,000 (BJ)

1992 Ferrari 512 TR $295,000 (Mecum)

- Ford Mustang Boss 429 $250,000 (Mecum)

1957 Ford Thunderbird “F” $225,000 (Mecum)

2005 Ford GT Coupe $230,000 (Mecum)

- Pontiac GTO Judge RA IV $160,000 (Mecum)

1969 Pontiac Trans Am $127,500 (Mecum)

1953 Buick Skylark Conv $127,500 (Mecum)

Photo courtesy of Barrett-Jackson

SPECIALTY MARKETS:

RECREATIONAL VEHICLES

RV Values at Auction Continue to Fluctuate

“I’m going to be consistent and stick with last month’s observation that the only constant in the RV market recently has been its inconsistency. Once again, for the seventh month in a row, the values of motorized and towable units have moved in different directions, with Motor Homes inching up 1.1%, while Towables declined a more significant 7.8%. As the weather turns colder, we expect to see both volume and bidding activity at the wholesale auctions drop off. If you have access to capital and some extra room, this might be a great time to pick up some bargains. ”

For Motor Homes (including Class A, B, and C)

- The average selling price was $37,802, up $439 (1.1%) from the previous month

- One year ago, the average selling price was $38,107 Auction volume was down 3% from the previous month

For Towables (including Travel Trailers, Fifth Wheels, and Camping Trailers)

- The average selling price was $10,183, down $863 (7.8%) from the previous month

- One year ago, the average selling price was $10,844

- Auction volume was down 1% from the previous month

SPECIALTY MARKETS:

POWERSPORTS

Powersports Market Shows Typical Fall Patterns

“Nearly all segments in the Powersports market see significant declines this month, and while the price drops are a little larger than usual, they are normal for the time of year as dealers draw down inventory heading towards winter.”

Scott Yarbrough, Motorcycle & Powersports Editor

- The Snowmobile segment continues its slow rise in value as we head towards colder weather and increasing consumer interest, advancing by $23 or .6%.

- The Off-Road bike segment sees the biggest drop in value this month, with an average decline of $136 or 6.1%, which is a little bit higher than normal.

- All of the on-road segments; Cruisers, Scooters, Street Bikes, and Dual Sports are down between

4.4 and 5.0%, reflecting lower inventory levels by dealers.

- The Utility Vehicle and ATV segments are down 3.7% or $285 and 4.4% or $160 respectively.

- The Personal Watercraft and Jet Boat Segments saw minimal drops of 1.2% or $65 and 1.1% or $208 respectively.

SPECIALTY MARKETS:

HEAVY DUTY

Truck Values Drop as Inventory Increases

“When Supply Overtakes Demand, Wholesale Values Tumble.”

Charles Cathey, Editor – Heavy Duty Truck Data With increased incentives, the trucking industry has been able to focus their spending on “Getting and Keeping” drivers, which is arguably the biggest challenge they are currently dealing with. Right now, used late model over the road and regional tractors are being purchased at auction for far less $ than a

month or two ago, and buyers big and small are taking advantage of the situation. This trend is being made possible by heavily increasing depreciation of increased numbers of late model long haul and regional road tractors. This drop in wholesale values has been fueled by certain weak performers and is spreading through much of the other available later model long distance and regional HD road tractors. Older road tractors and construction/vocational trucks, newer and older, have been able to hold their value better than their newer highway relatives.

| Average Wholesale Value Changes (Late Model) | ||||||||||||

| DATE | Constructional/Vocational | Over the Road Trucks & Tractors | Regional Tractors | MODEL YEARS | ||||||||

| Value $ Change % Change | Value | $ Change % Change | Value $ Change % Change | |||||||||

| 11/01/15 | 82,946 | -2182 | -2.6% | 76,215 | -2922 | -3.7% | 66,726 | -3271 | -4.7% | 2013-2014 | ||

| 10/01/15 | 85,128 | -480 | -0.6% | 79,137 | -806 | -1.0% | 69,997 | -766 | -1.1% | 2013-2014 | ||

- 2013-2014 HD Construction/Vocational segment dropped an average of $2,182 (2.6%) in October compared to the average decline of $480 (0.6%) in September.

- 2013-2014 HD Over the Road Tractor segment dropped an average of $2,922 (3.7%) in October compared to the average drop of $806 (1.0%) in September.

- 2013-2014 HD Regional Tractor segment dropped an average of $3,271 (4.7%) in October compared to the average depreciation of $766 (1.1%) in September.

| DATE | Constructional/Vocational | Over the Road Trucks & Tractors | Regional Tractors | MODEL YEARS | ||||||

| Value $ Change % Change | Value $ Change % Change | % Value $ Change Change | ||||||||

| 11/01/15 | 40,221 | -845 | -2.1% | 35,552 | -1313 | -3.6% | 27,634 | -1442 | -5.0% | 2005-2012 |

| 10/01/15 | 41,066 | -301 | -0.7% | 36,865 | -367 | -1.0% | 29,076 | -353 | -1.2% | 2005-2012 |

- 2005-2012 HD Construction/Vocational segment dropped an average of $845 (2.1%) in October compared to the $301 (.7%) in September.

- 2005-2012 HD Over the Road Tractor segment dropped an average of $1,313 (3.6%) in October compared to the $367 (1.0%) average deprciation in September.

- 2005-2012 HD Regional Tractor segment dropped an average of $1,442 (5.0%) in October compared to the average drop of $353 (1.2%) in September.

SPECIALTY MARKETS: MEDIUM DUTY

The Medium Duty Segment decline more than doubles

“Is the lack of used truck demand driving down wholesale prices?”

Bret Swanson, Editor – Medium Duty Truck Data

In October, we saw the Medium Duty segment take a much steeper downturn. We see that in September, the three to ten year old trucks dropped an average of $349 or 1.7%. In October, this same group had an average decline of $613 or 3.0%. The one and two year old models followed a similar pattern. In

September, this group declined on average, $644 or 1.4%. For October, this group had an average decline of $1776 or 3.9%.

| DATE | Medium Duty | MODEL YEARS | DATE | Medium Duty | MODEL YEARS | |||||

| Value | $ Change | % Change | Value | $ Change | % Change | |||||

| 11/01/15 | 19,785 | -613 | -3.0% | 2005-2012 | 11/01/15 | 43,751 | -1776 | -3.9% | 2013-2014 | |

| 10/01/15 | 20,399 | -349 | -1.7% | 2005-2012 | 10/01/15 | 45,527 | -644 | -1.4% | 2013-2014 | |

We keep asking, “How long will fuel prices continue to drop”? That question still cannot be answered, diesel is still on the decline. The national average for diesel now stands at $2.53 per gallon. That is a drop of $1.13 per gallon over the past year.