As the sun dips lower each evening, casting longer shadows over the bustling streets, so too does the automotive market hint at a shift with the arrival of spring’s twilight. This week, as families unpack picnic baskets and adventurers dust off their hiking boots, the auto industry reflects a different sort of change—one that could signal the conclusion of a seasonal high.

Could the robust growth we’ve been witnessing be on its last legs? While it’s too early to draw definitive conclusions, the numbers from this past week paint a narrative of intrigue and emerging patterns, beckoning us to look closer.

Auto Market Update Week Ending May 04, 2024 (PDF)

Market Overview

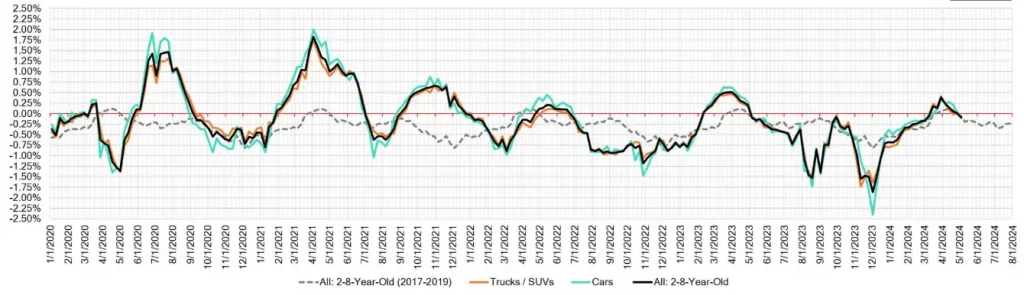

This week’s auto market reported a subtle downturn across various segments, marking the first decline in seven weeks. Notably, this dip aligns with the pre-pandemic seasonal trends, suggesting a return to traditional market rhythms. Here’s a breakdown of the key figures:

| Segment | This Week | Last Week | 2017-2019 Average |

|---|---|---|---|

| Car Segments | -0.06% | +0.04% | – 0.14% |

| Truck & SUV Segments | -0.10% | +0.01% | + 0.06% |

| Overall Market | -0.09% | +0.01% | – 0.09% |

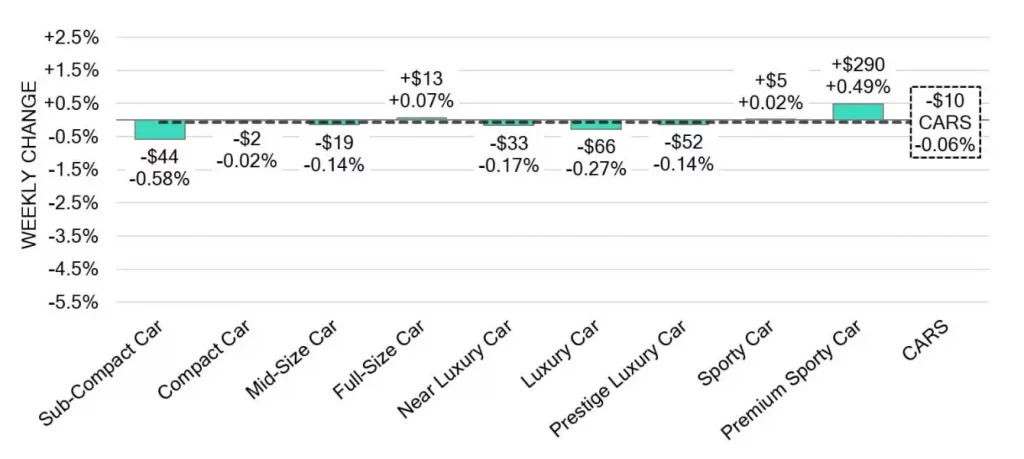

- Car Segments: Experienced a slight decrease of -0.06% on a volume-weighted basis. Interestingly, while the younger (0-to-2-year-old) car segments dipped by -0.05%, the older segments (8-to-16-year-old) saw a minor increase of +0.06%. This mixed performance indicates a nuanced buyer preference.

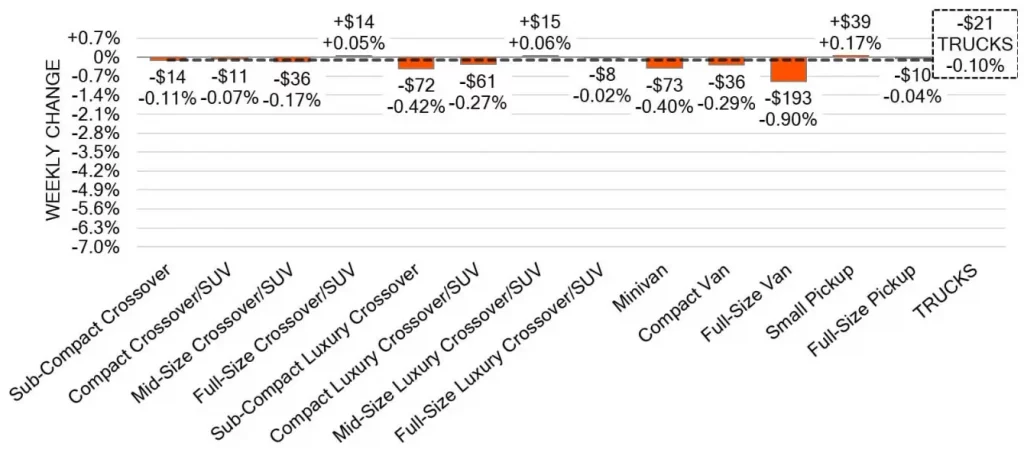

- Truck & SUV Segments: Overall, these segments fell by -0.10%. The older models saw sharper declines, hinting at a potential shift in consumer interest or economic factors influencing purchasing decisions.

- Used Retail and Wholesale Markets: Despite the overall market softening, the Used Retail Days-to-Turn now sits around 40 days, reflecting steady demand. Meanwhile, the wholesale market’s downturn could be hinting at a broader trend or merely a blip in the ongoing cycle.

Segment Spotlight

- Luxury and Sport: The Premium Sporty Car segment outshone others with a notable rise of 0.49%, continuing its ascent albeit at a slower pace compared to previous weeks.

- Challenges in Sub-Compact: The Sub-Compact Car segment faced the harshest decline, dropping by -0.58% and accelerating its depreciation, shedding light on changing consumer preferences or possible oversaturation in the market.

Truck and Utility Vehicles

- Full-Size Adjustments: The Full-Size Van segment continued its decline with a significant drop of -0.90%, marking six consecutive weeks of reductions. This could indicate a market correction or changing fleet demands.

- Pickup Peculiarities: In a reversal of fortunes, the Full-Size Pickup segment recorded a modest decrease of -0.04%, breaking a seven-week streak of growth. This segment remains one to watch, as it often reflects broader economic sentiments.

Market Dynamics

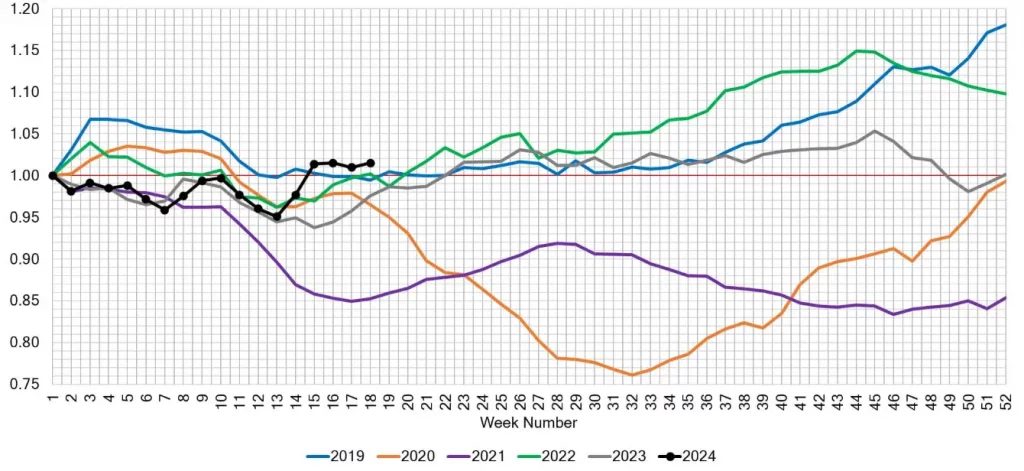

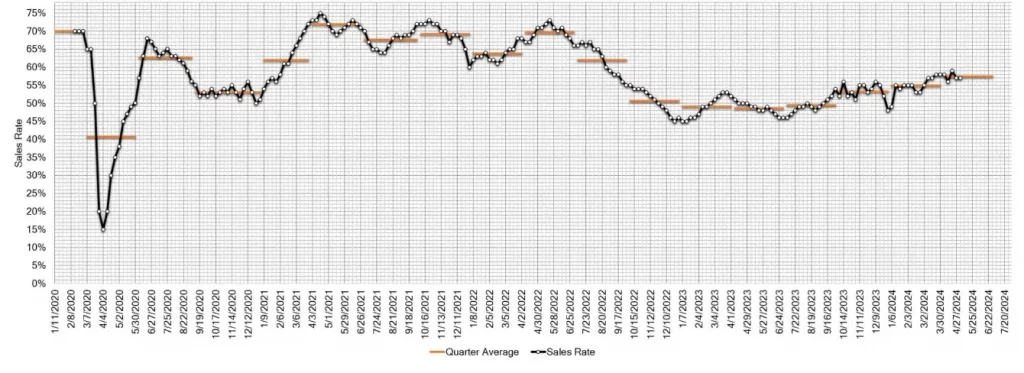

Despite the overall dip, auction conversion rates remain strong at 57%, suggesting that the market still holds substantial demand. This resilience, combined with a slight increase in inventory levels, could be setting the stage for interesting developments in the weeks to come.

As the market continues to evolve, our analysts remain vigilant, parsing through data and trends to provide the most accurate and timely insights. Whether this week’s changes herald a larger shift or are merely temporary adjustments remains to be seen. However, one thing is clear: the auto market never ceases to surprise and challenge our expectations.

Conclusion

As we roll forward, the auto industry’s path is as winding as a mountain road. With each turn comes a new vista or a sudden drop, each demanding attention and adaptation. This week’s market update leaves us pondering the durability of the spring bump. Is it tapering off as part of an expected seasonal adjustment, or are we witnessing the early signs of a more significant shift? Could the spring bump be concluding?