As the frost of winter begins to thaw and the promise of spring looms on the horizon, the automotive market is showing intriguing signs of life. In this week’s Auto Market Update, we delve into the shifting tides of the car and truck segments, where the stirrings of market stabilization whisper tales of change.

Auto Market Update Week Ending Jan 13, 2024 (PDF)

Wholesale Prices: A Glimpse into Market Dynamics

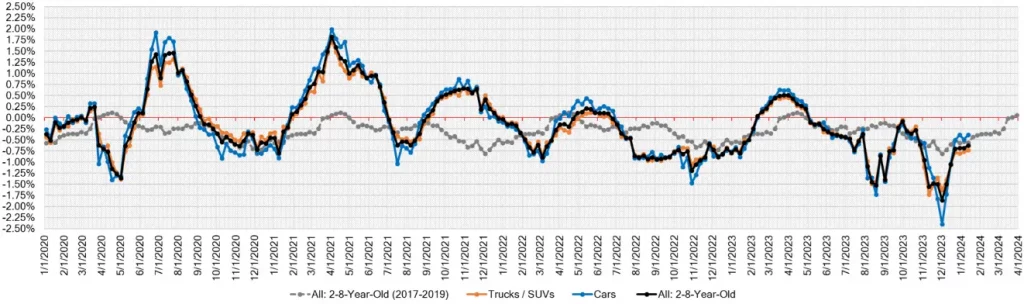

The week ending January 13th, 2024, brought with it a fascinating narrative in the realm of wholesale prices. Two segments, previously dormant, awakened with gains, suggesting a pivotal moment in market trends.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.39% | -0.49% | -0.62% |

| Truck & SUV segments | -0.73% | -0.77% | -0.52% |

| Market | -0.63% | -0.68% | -0.56% |

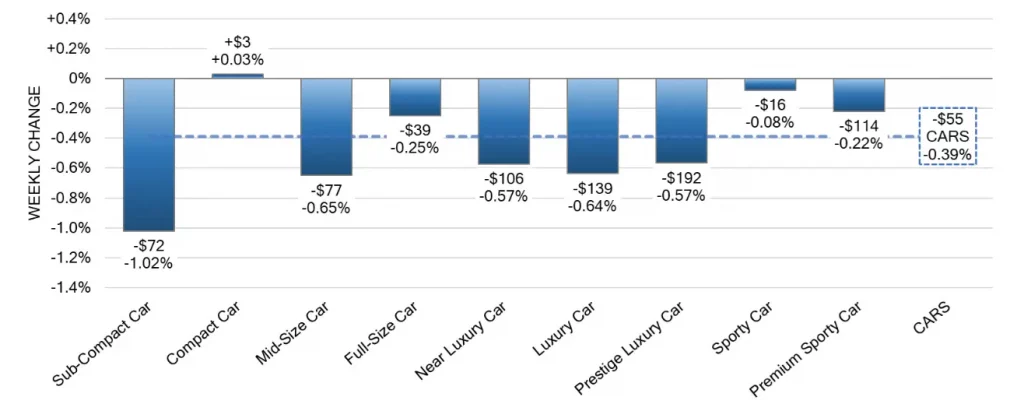

Car Segments: A Detailed Analysis

In a curious turn of events, the overall Car segment noted a decrease of -0.39%, a slight improvement from the previous week’s -0.49%. However, it’s the Compact Car segment that demands our attention.

This segment, often a harbinger of spring’s market strength, has interestingly moved into positive territory, marking a gain of +0.03%. This shift is starkly contrasted against a steep -4.32% drop in the last week of November.

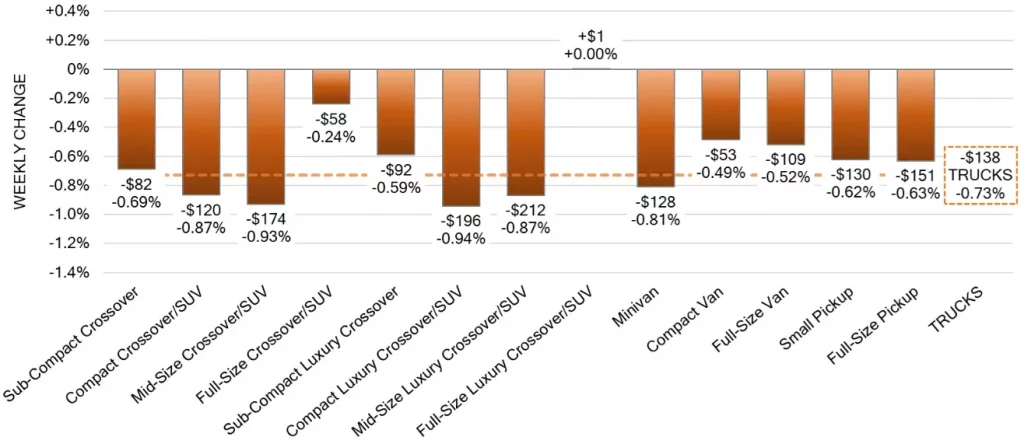

Truck and SUV Segments: A Mixed Bag

The Truck segment, on the other hand, painted a different picture. With a decrease of -0.73%, it showed a slight improvement over the previous week’s -0.77%.

The Compact Luxury and Mid-Size Crossover/SUV segments faced the steepest declines. Yet, the Full-Size Luxury Crossover/SUV segment bucked the trend with a minute increase of +0.002%.

Used Retail and Wholesale Insights

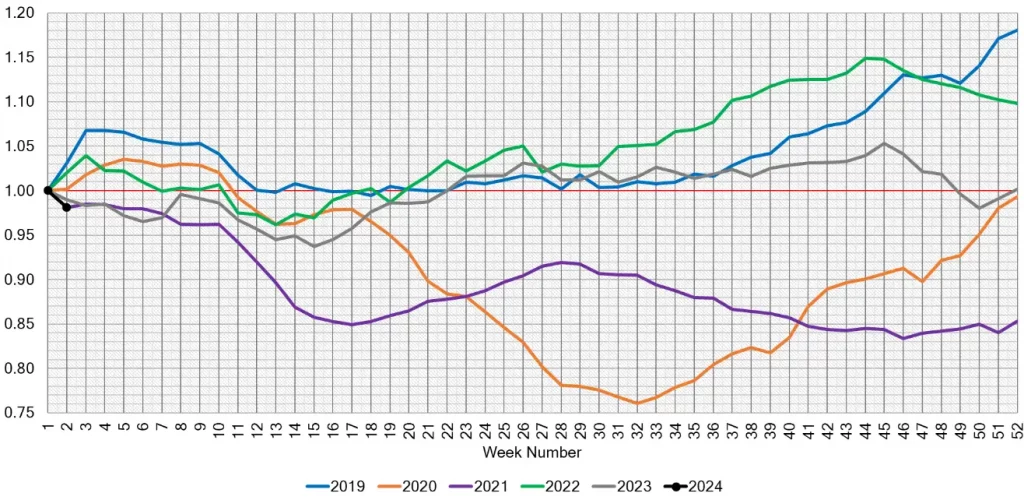

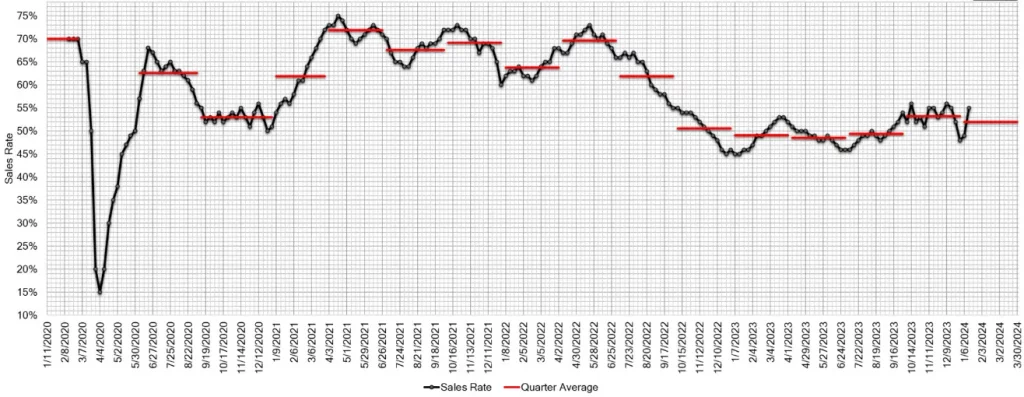

The Used Retail Active Listing Volume Index and the Wholesale landscape offer a broader view of the market. The first week of 2024 stood out with increased inventory and auction conversion rates, signaling a possible normalization in the market. The Weekly Sales Rate leaped to 55%, a hopeful sign of returning stability.

Conclusion:

As we witness these subtle yet significant shifts, the auto market narrative for 2024 begins to unfold. It’s a tale of gradual stabilization and cautious optimism.

With spring approaching, will these trends solidify into a pattern of recovery, or are they merely fleeting glimpses of what could be?

What do you think the coming weeks will reveal about the automotive market’s trajectory?