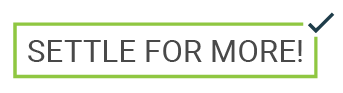

The auto market’s performance in the week ending February 3rd, 2024, brings a sense of stability that has been missing over the past few years. After a period marked by significant volatility, the latest figures suggest a gradual return to more predictable patterns.

This update looks into the specific trends and stats that shaped the market during the last week of January, focusing on details that often go unnoticed.

Auto Market Update Week Ending Feb 03, 2024 (PDF)

Wholesale Prices Overview

In the most recent week, the market continued its trend from the previous week, showing slight decreases across the board but at a rate that suggests things are leveling out.

Car segments saw a decrease of -0.22%, a slight improvement over the previous week’s -0.26%, and better than the 2017-2019 average for the same week of -0.32%. Truck and SUV segments experienced a -0.38% decrease, slightly worse than the previous week’s -0.36% but still an improvement over the historical average of -0.40%.

Overall, the market dipped by -0.33%, matching the previous week’s performance and indicating a stable market environment.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.22% | -0.26% | -0.32% |

| Truck & SUV segments | -0.38% | -0.36% | -0.40% |

| Market | -0.33% | -0.33% | -0.37% |

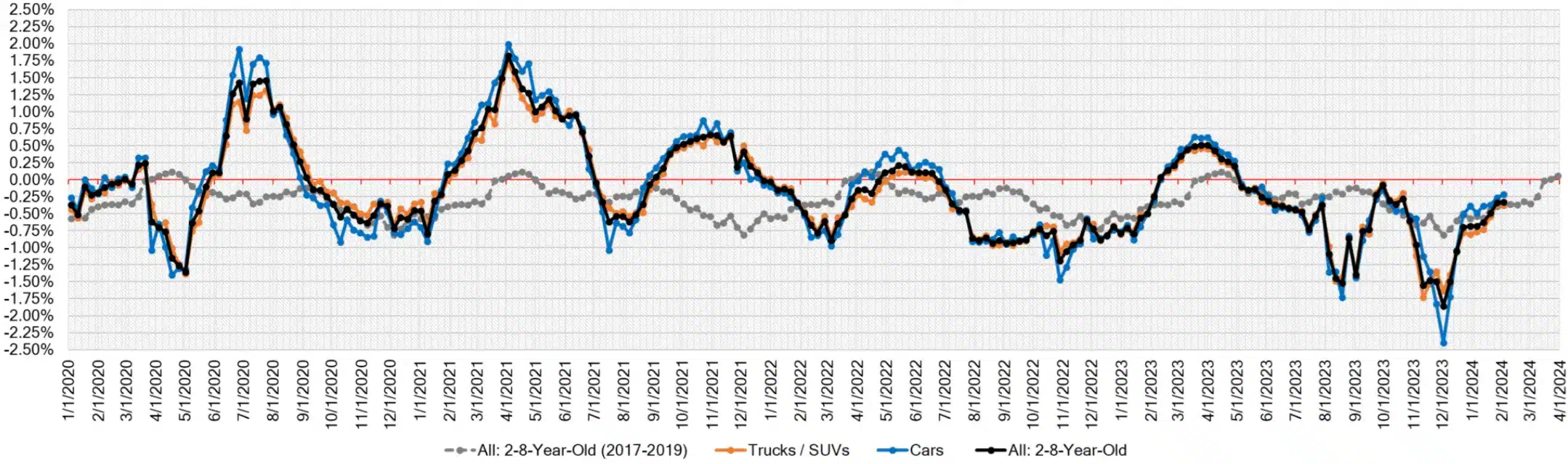

Detailed Look at Car Segments

The car segments had a mixed week with some categories showing signs of growth amidst the general downturn. The Compact Car segment, for example, saw a notable increase of +0.26% last week, with 0-to-2-year-old Compact Cars making significant gains of +0.58%.

This marks a continuation of a positive trend for these cars. On the other hand, the Sub-Compact segment’s depreciation slowed, with a decrease of -0.58%, suggesting a possible stabilization in this category. Sporty Cars also had a slight increase of +0.07%, with older models (8-16 years old) appreciating by +0.18%.

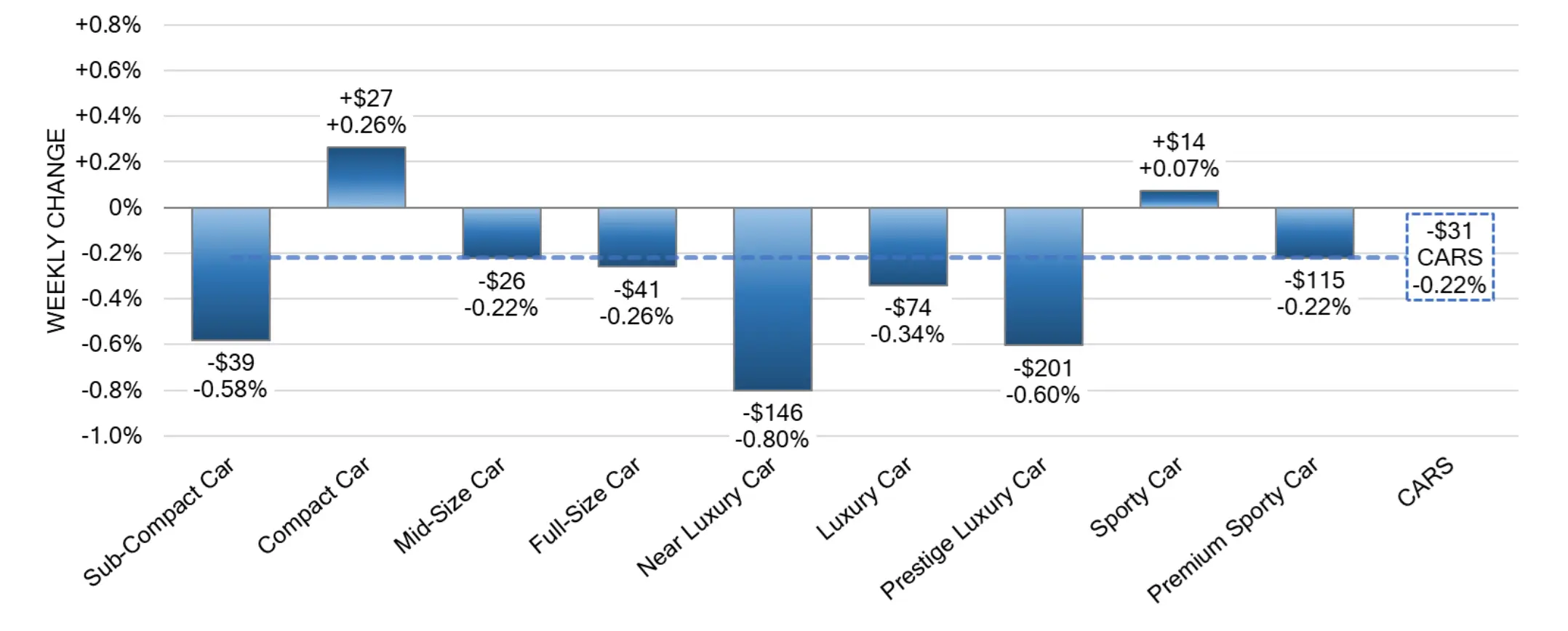

Truck and SUV Segments Experience Dips

The overall Truck segment saw a decrease of -0.38%, with most subcategories showing declines. However, there was a small bright spot in the Full-Size Crossover/SUV segment, which reported a minor increase of +0.03%. This is part of a continuing trend for newer models in this category.

Despite the general downtrend, the slowing rate of decline in Full-Size Trucks and a few positive adjustments in select segments hint at underlying strength in specific areas of the market.

Insights into the Used Retail and Wholesale Market

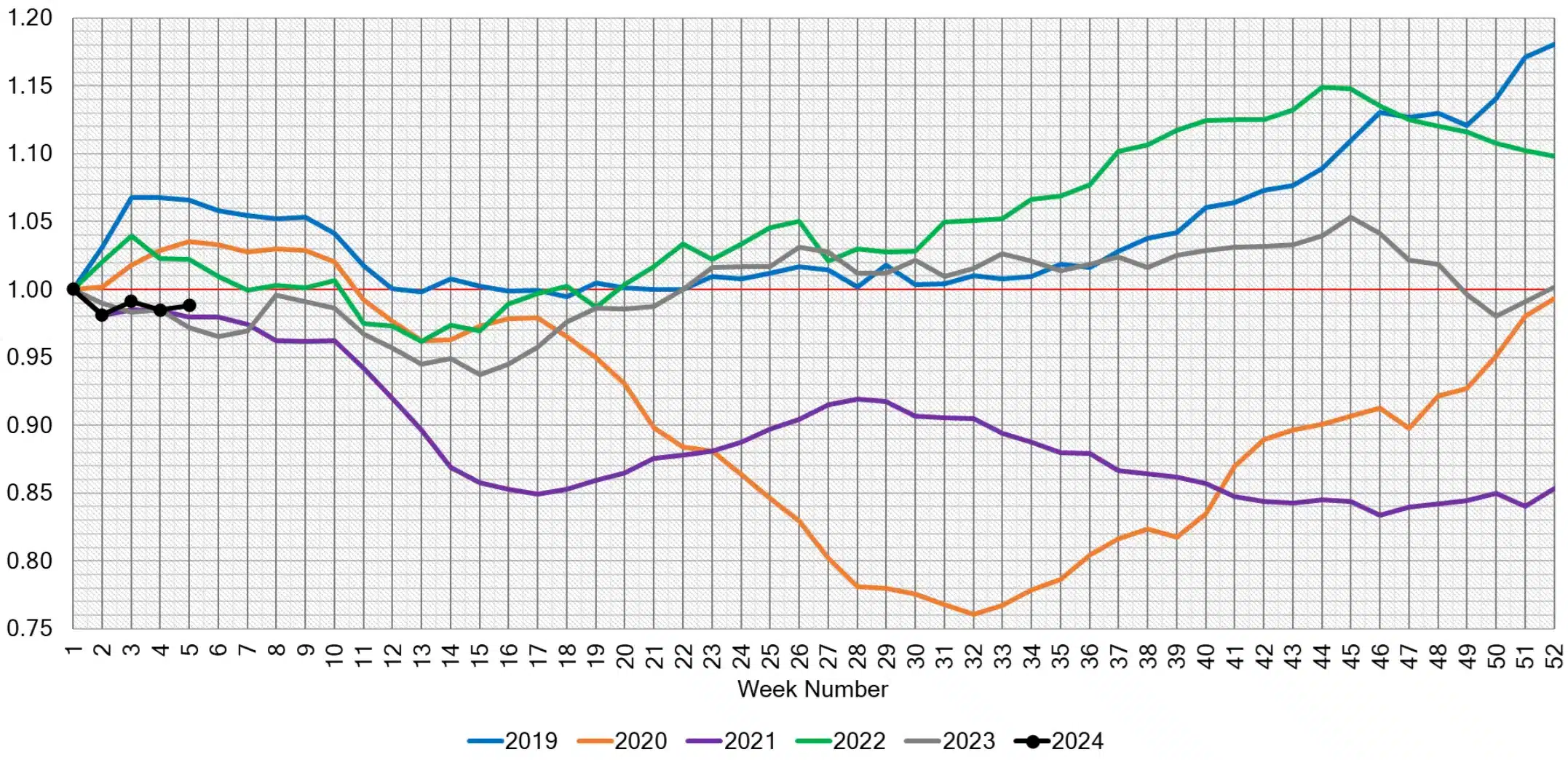

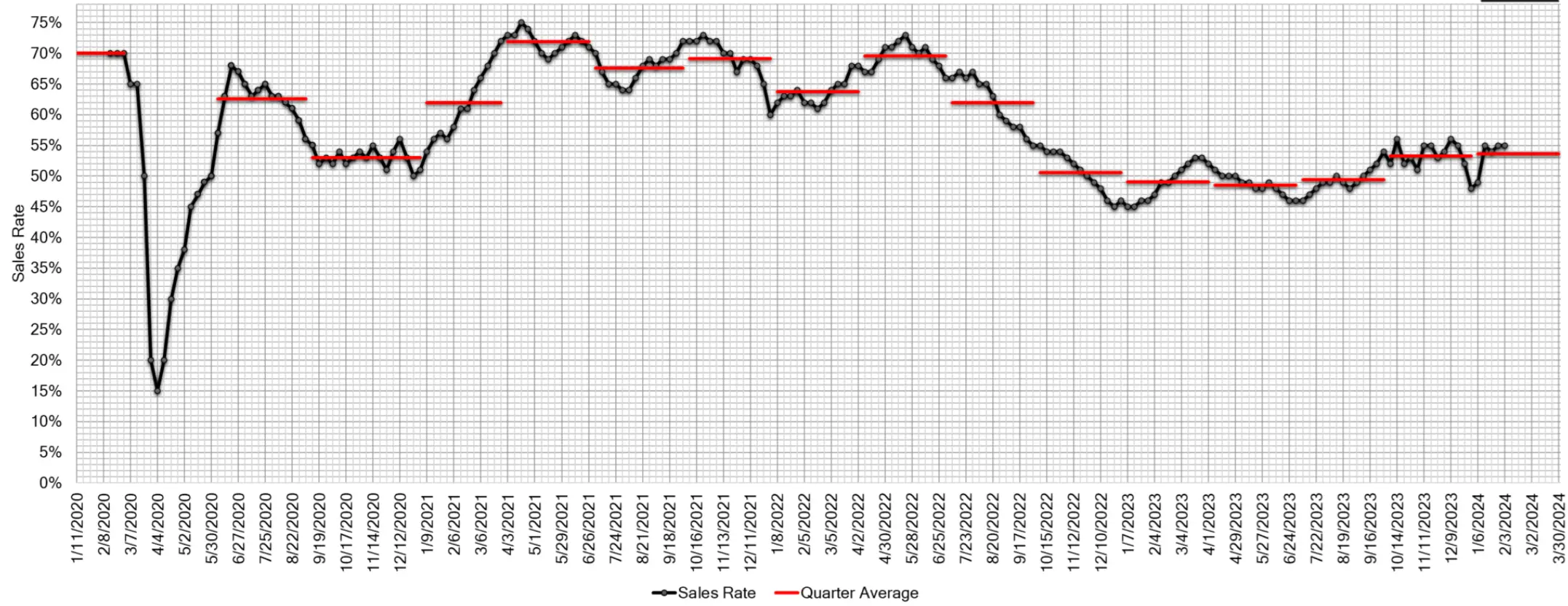

The Used Retail Active Listing Volume Index provides a broader view of the market’s condition, tracking inventory movements across dealerships. As we move into February, the wholesale market is showing signs of increased stability, with less depreciation in car and truck segments compared to December.

Auction conversion rates and inventory levels have remained consistent, indicating a potentially healthier market ahead.

Conclusion

This week’s auto market update highlights a trend towards stability after a long period of fluctuations. With some car segments showing unexpected growth and the overall rate of decline slowing down, there’s a sense of cautious optimism.

As we look forward to the spring market, the question remains: Will these trends continue, leading to a stronger market recovery?