Imagine you’re standing at a crossroads in a bustling city. To your left, luxury cars gleam under the showroom lights, but as you turn right, you notice older models quietly increasing in value. This week, the auto market tells a similar story of diverging paths, where growth continues but with nuanced shifts that only a keen observer might notice.

Auto Market Update Week Ending April 13, 2024 (PDF)

Deceleration in Growth: A Closer Look

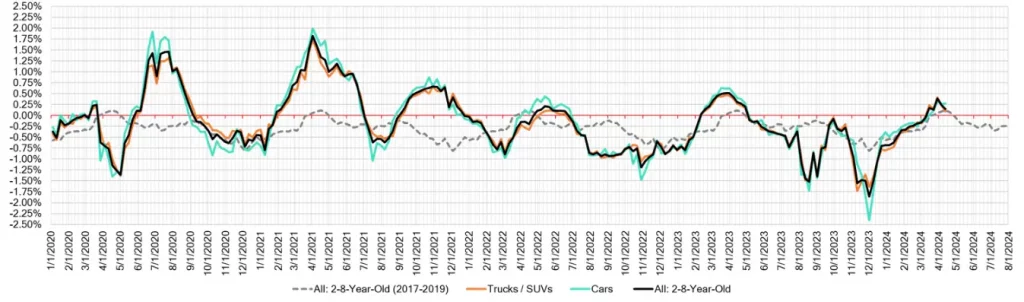

This week, the auto industry continued to grow, but the pace has noticeably slowed down from previous trends. The market overall saw a modest increase of +0.14%, down from +0.24% last week, with cars showing a slightly better performance than trucks and SUVs.

The luxury segments, usually bastions of steadfast growth, experienced a downturn across almost all categories. Interestingly, the Sub-Compact Luxury Crossover segment bucked this trend, holding its ground as the sole beacon of positivity.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

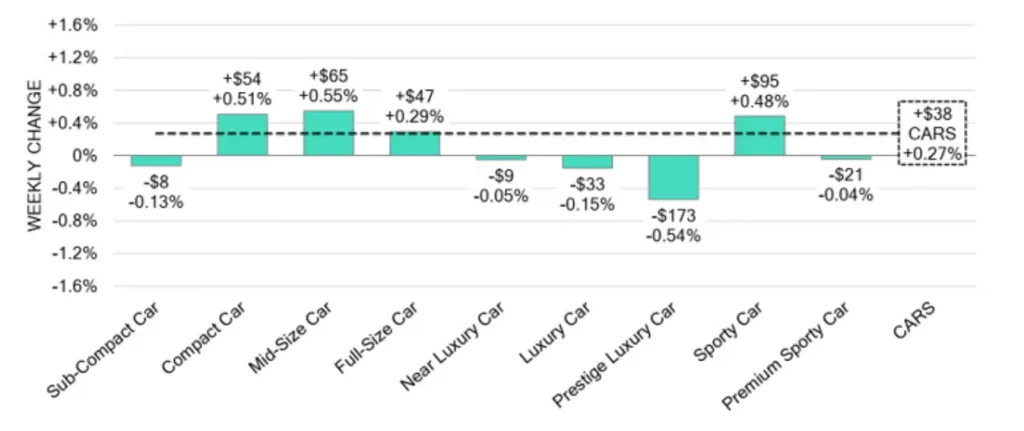

| Car segments | +0.27% | +0.26% | +0.23% |

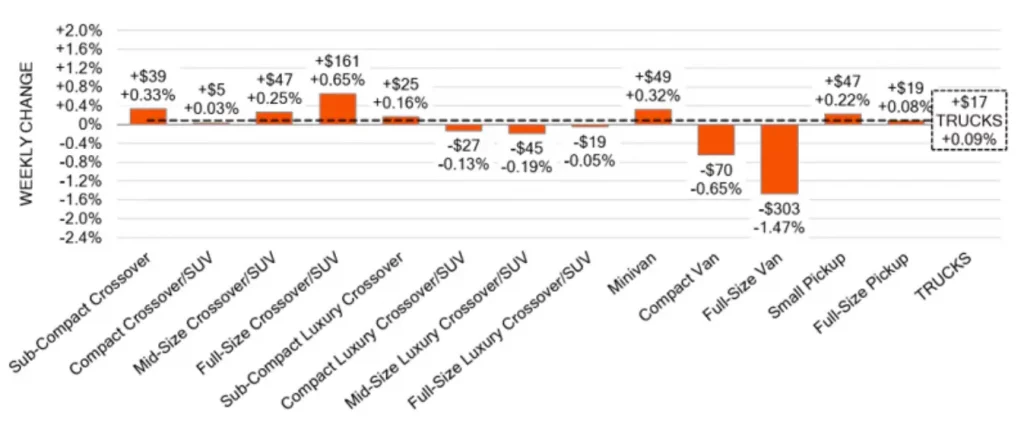

| Truck & SUV segments | +0.09% | +0.23% | +0.04% |

| Market | +0.14% | +0.24% | +0.12% |

Car Segments: Detailed Dynamics

On a volume-weighted basis, the overall car segment witnessed a growth of +0.27% this week. Particularly noteworthy were the Compact and Mid-Size Cars, which not only grew but actually accelerated their gains, increasing by +0.51% and +0.55%, respectively. The Sporty Car category has been enjoying a renaissance, marking its third consecutive week of growth with a rise of +0.48%.

However, while recent-model luxury cars saw declines, the older luxury car categories (8-to-16-year-olds) continued their upward trajectory, a testament to their enduring appeal in a fluctuating market.

Trucks and SUVs: Mixed Fortunes

The truck segments told a story of mixed fortunes. Overall, they grew by a modest +0.09%, but this was a slowdown from the +0.23% seen the previous week. The Full-Size Vans segment faced significant challenges, marking a sharp decline of -1.47% this week. In stark contrast, the Full-Size Crossover/SUV category outshone others with a robust increase of +0.65%, continuing a six-week trend of consistent growth.

Wholesale and Retail Insights

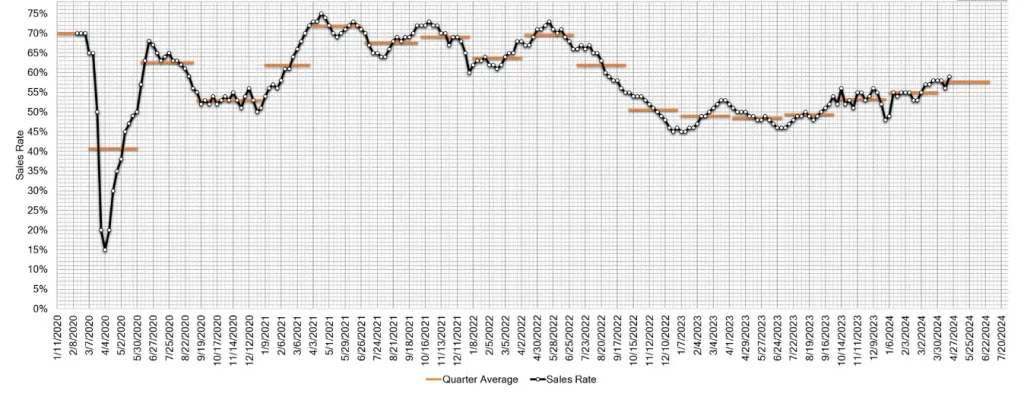

The Wholesale Price Index for 2- to 6-year-old vehicles shows an industry adapting to changing dynamics, with the index helping to spotlight trends that might otherwise go unnoticed in the bustling market.

Meanwhile, the Used Retail Active Listing Volume Index and the Days-to-Turn estimate, which currently stands at 38 days, provide a pulse on the retail side, offering insights into how quickly vehicles are moving off lots.

Conclusion: Observing and Adapting

As we wrap up the second week of April, it’s clear that the auto market, while still growing, is navigating through a period of adjustment. Full-size Vans continues to face depreciation challenges, which might indicate a shift in market preferences or an oversupply issue.

On the flip side, the resilience seen in segments like Full-Size Crossovers/SUVs and older luxury cars highlights areas of potential opportunity for savvy investors and dealers.

As always, our analysts remain vigilant, monitoring the market for emerging trends and gathering insights that help stakeholders make informed decisions. Are you keeping an eye on these subtle shifts in the auto market?