Accidents can leave more than just physical damage to your vehicle; they can also significantly impact its market value. Understanding how car depreciation works post-accident and what steps you can take to claim compensation is crucial. In this comprehensive guide, we’ll delve into the essentials of car depreciation after an accident, how to file a diminished value claim and strategies to minimize your losses.

Car Depreciation After an Accident: What You Need to Know (PDF)

Understanding Depreciation

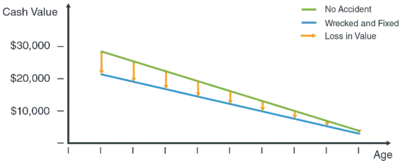

Depreciation is the natural decline in a car’s value over time due to wear and tear, age, and other factors. When your vehicle is involved in an accident, even if fully repaired, it often suffers from diminished value. This term refers to the reduction in a car’s market resale value after it has been damaged and repaired.

Depreciation is a natural part of a car’s lifecycle. Even without accidents, vehicles lose value as they age and accumulate mileage. However, an accident can accelerate this depreciation process. To understand this better, let’s break down the different types of depreciation:

- Straight-Line Depreciation: This is a common method used by car owners to estimate the yearly decrease in their vehicle’s value. Typically, a car loses about 15-20% of its value each year.

- Accelerated Depreciation: After an accident, the car’s value may decrease more rapidly. This method accounts for the immediate and significant loss in value due to damage history.

- Luxury and High-End Depreciation: Luxury cars tend to depreciate faster post-accident due to higher repair costs and a market that is more sensitive to the car’s condition.

How Much Does an Accident Devalue a Car?

Drawing from our extensive experience appraising thousands of vehicles, we can confidently say that accident history typically reduces market value by 10% to 20%. However, the extent to which an accident devalues a car can vary based on several factors:

- Severity of the Damage: Major structural damage can significantly lower a car’s value compared to minor cosmetic repairs. For example, a car that has suffered frame damage might see a higher depreciation rate than one with only superficial damage.

- Age and Mileage: Older cars with high mileage may depreciate less in percentage terms than newer models. However, newer cars tend to lose more value in absolute terms because they start with a higher market value.

- Type of Vehicle: Luxury cars and rare models often suffer greater depreciation due to higher repair costs and the market’s perception of value. For instance, a high-end sports car might see a more significant drop in value compared to a standard sedan.

- Repair Quality: High-quality repairs using original parts can help maintain more of a car’s value. Conversely, subpar repairs can lead to further depreciation.

What Is the Effect of Depreciation on Your Vehicle?

The effect of depreciation on your vehicle means that post-accident, even if it looks and runs like new, potential buyers may offer less due to its accident history. This diminished value reflects the stigma and perceived risks associated with vehicles that have been in accidents.

An important aspect to consider is the impact on insurance. When an insurance company decides the payout for a totaled vehicle, they consider the depreciated value. This can significantly affect the settlement amount you receive, which might be lower than expected if the vehicle has depreciated rapidly.

→ Read: Depreciation Comparison – Top 5 Used Sedans

Can You Receive Compensation for Your Car’s Reduced Value After an Accident?

Yes, you can often receive compensation for the diminished value of your car after an accident. This is known as a diminished value claim. Insurance companies or at-fault drivers may be responsible for compensating you for the loss in market value.

There are three types of diminished value claims:

- Inherent Diminished Value: The most common type, it reflects the loss in market value due to the accident history, regardless of the quality of repairs.

- Repair-Related Diminished Value: This occurs when the repairs themselves cause a loss in value, such as mismatched paint or subpar parts.

- Immediate Diminished Value: The difference in the car’s value immediately before and after the accident, before any repairs are made.

Why an Appraiser is Essential for Your Diminished Value Claim

Getting an appraiser involved after an accident can make a significant difference in your diminished value claim. Here’s how they can help:

- In-Depth Knowledge: Appraisers are well-versed in the latest market trends and valuation methods. They can provide an accurate assessment of how damage and repair quality influence your car’s worth.

- Stronger Negotiations: A professional and certified appraisal report adds credibility to your claim, making it harder for insurance companies to dismiss. This thorough documentation can give you an upper hand in negotiations.

- Thorough Assessments: Appraisers take a detailed look at every aspect of your vehicle’s damage and repairs. Their comprehensive evaluations ensure that no detail is missed, offering a full picture of your car’s current value.

By leveraging an appraiser’s expertise, you can enhance the strength of your claim and improve your chances of obtaining a fair settlement.

Fill out the form below to get a FREE Claim Review or call (678) 404-0455 and receive the compensation you deserve. Discover how much your car lost in value for free.

"*" indicates required fields

State Laws and Diminished Value Claims

State laws can affect the ability to file a diminished value claim. It’s essential to understand the legal framework in your state:

- Claim Eligibility: Not all states allow diminished value claims. Research your state’s laws to determine if you’re eligible.

- Statutes of Limitations: Be aware of time limits for filing claims. Missing the deadline can invalidate your claim.

- At-Fault States: In at-fault states, the at-fault driver’s insurance may be responsible for diminished value. Understanding liability laws can help you navigate the claim process.

The Impact of Market Conditions

Market conditions can influence car depreciation and the success of your claim. Factors such as economic downturns, changes in consumer preferences, and fluctuations in used car prices can all play a role:

- Economic Factors: Economic downturns can reduce car values more rapidly. During recessions, the demand for used cars may decrease, affecting their market value.

- Consumer Preferences: Shifts in consumer preferences can impact specific car models. For example, a growing preference for electric vehicles can affect the value of gasoline-powered cars.

- Supply and Demand: The balance of supply and demand in the used car market influences prices. High demand for certain models can mitigate depreciation.

→ Read: List of Vehicles Over 6000 lbs That Qualify for IRS Tax Benefit in 2024

Conclusion: Navigating Car Depreciation After an Accident

Understanding the nuances of car depreciation after an accident is vital to protect your financial investment. Accidents can significantly diminish a vehicle’s value, but being informed about the process of claiming diminished value can help you recoup some of those losses. Always document every detail of the damage, opt for high-quality repairs, and keep comprehensive maintenance records.

The journey of filing a diminished value claim might seem challenging, but with the right preparation and expert advice, it becomes manageable. Be sure to familiarize yourself with state laws regarding such claims and consider hiring a professional appraiser to provide a credible estimate of your car’s post-accident value.

By taking these steps, you can better navigate the aftermath of an accident, ensuring you minimize depreciation and secure fair compensation. Staying proactive and informed will help you safeguard your vehicle’s worth and handle the financial repercussions more effectively.