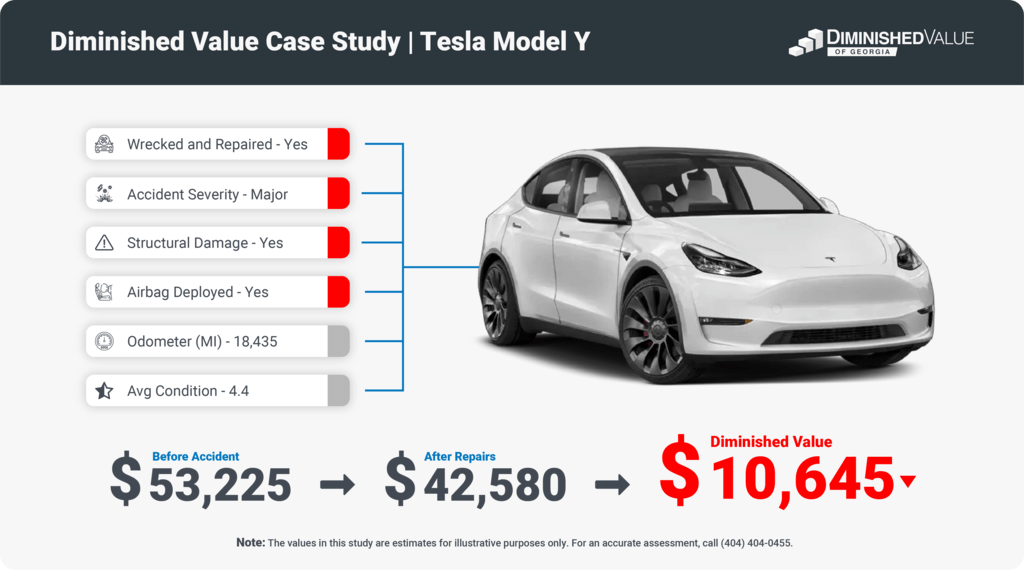

When your car is involved in an accident, even after repairs, its market value often drops. This is what we refer to as diminished value—the difference in your vehicle’s worth before and after the collision.

If you’re insured by USAA, navigating their diminished value claims process can be challenging.

Here, we’ll break down how USAA handles diminished value claims, the key steps to maximize your claim, and why hiring an independent appraiser can assert way better results for you.

What is Diminished Value?

Diminished value refers to the loss in your vehicle’s market value following an accident. Even with top-notch repairs, a car with a history of damage is often worth less than one that’s never been in an accident.

Potential buyers and dealers may be wary of previous damage, no matter how minor it seems. Therefore, you’re not only losing the cost of repairs but also part of your car’s overall value.

In most cases, if the accident wasn’t your fault, you can file a diminished value claim against the at-fault driver’s insurance to recover some of that lost value. But even when it’s your own insurance policy, like USAA, the process can be more complicated than expected. And this is where it gets interesting.

How USAA Handles Diminished Value Claims

USAA, like many other insurers, has a process for handling diminished value claims, but policyholders often encounter roadblocks that make it difficult to get full compensation. Let’s explore some of the key aspects of how USAA processes these claims.

The Appraisal Clause and Its Impact

The appraisal clause is a provision in many insurance policies, including those with USAA, that allows the policyholder and the insurer to resolve disputes over the value of a claim. When you and USAA disagree on how much your car’s value has diminished, you can invoke the appraisal clause.

Each party selects an appraiser, and together, they try to settle on a fair value. If they can’t agree, an umpire is brought in to make the final decision.

However, as you may have read in our article on USAA Admitting Bias in the Appraisal Clause, this process is often biased in favor of the insurer. USAA has a history of using in-house or less-than-independent appraisers, making it harder for policyholders to get a fair valuation.

It’s like playing a game where the rules are stacked against you. That’s why hiring an independent appraiser is crucial (more on that later).

USAA Diminished Value Claim Formula Explained

Another challenge with USAA is its diminished value formula. USAA tends to use a formula that undervalues the true loss in market value. For example, they might rely on standardized methods that don’t take into account specific factors like the type of repairs done, the reputation of the repair shop, or the overall condition of your car before the accident.

Our article on USAA’s Diminished Value Methodology explains this formula in detail. In short, USAA’s formula tends to favor the insurer, resulting in lower payouts for policyholders.

The average diminished value amount is $6,200. We can help you get what you deserve.

How to Maximize Your USAA Diminished Value Claim

Now that you understand how USAA operates, let’s look at what you can do to maximize your diminished value claim. These strategies can help level the playing field and increase your chances of getting a fair settlement.

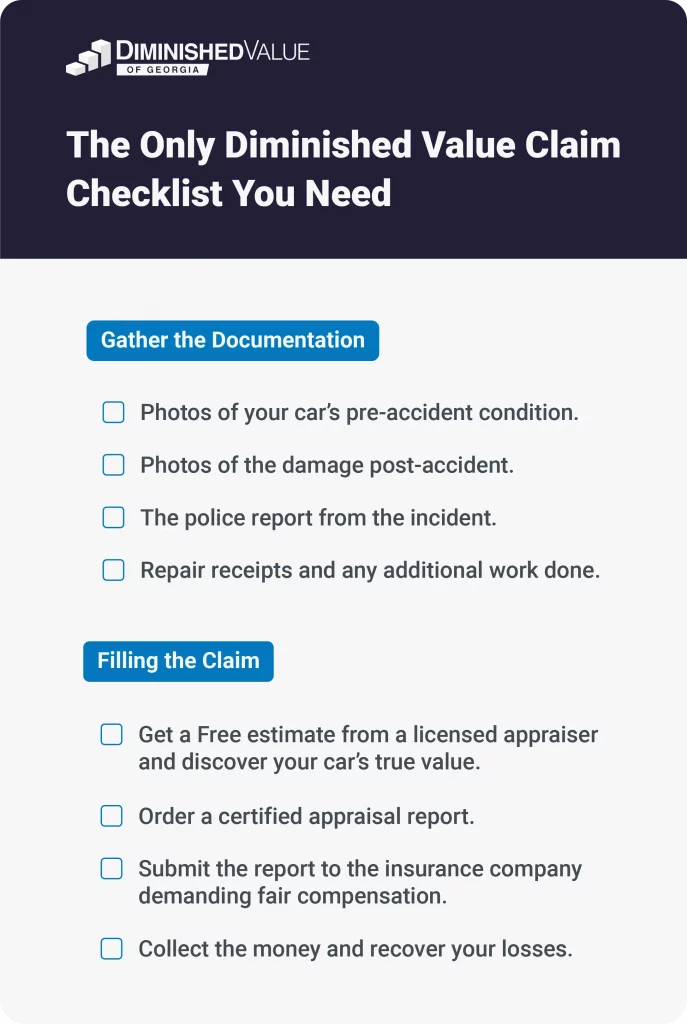

1. Gather Comprehensive Documentation

Documentation is your best weapon. Before filing a claim, gather all the relevant paperwork, including:

- Photos of your car’s pre-accident condition.

- Photos of the damage post-accident.

- The police report from the incident.

- Repair receipts and any additional work done.

Having this information will make it harder for USAA to dispute the value of your claim.

2. Get an Independent Diminished Value Appraisal

This is one of the most important steps you can take. Instead of relying on USAA’s appraisers, who may have a conflict of interest, hire an independent appraiser. A professional appraiser will give you a fair estimate of your car’s true diminished value.

Independent appraisers aren’t tied to the insurance company, so their evaluation is more likely to reflect the actual loss in your vehicle’s worth.

You can read more about this in our guide on the USAA Appraisal Clause Charade.

3. Be Aware of Common Claim Pitfalls

There are a few common mistakes that could weaken your diminished value claim. For instance, if you wait too long to file, USAA may argue that your car has depreciated naturally over time rather than as a result of the accident. Filing promptly is key.

Additionally, be cautious about agreeing to a settlement too quickly. USAA might offer a low initial payout, hoping that you’ll accept before doing your own research. Always seek an independent appraisal first and don’t hesitate to negotiate.

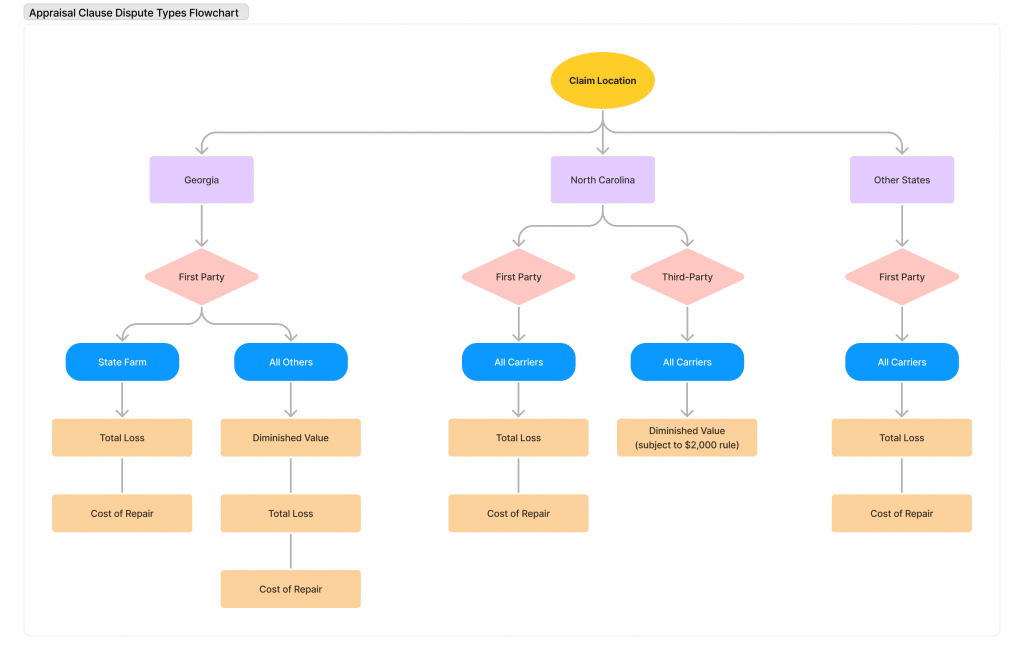

4. Understand Your Policy and State Laws

In Georgia, you’re able to file both first-party and third-party diminished value claims, which makes it easier to recover the full loss in value. However, this varies by state. Some states only allow third-party claims, meaning you can only file against the at-fault driver’s insurance.

Knowing the specifics of your state’s laws and your insurance policy is essential for maximizing your claim. Review your policy and consult state guidelines to ensure you’re on the right track.

5. Understanding the Appraisal Process Bias

As we mentioned earlier, the appraisal clause is supposed to help resolve disputes. But in reality, it’s often stacked in the insurer’s favor. If you invoke the appraisal clause, USAA may select an appraiser who tends to side with them.

This is where an independent appraiser can make a difference. By having your own appraiser, you balance the scales and increase the chances of a fair outcome.

Why Hire an Independent Appraiser?

Hiring an independent appraiser is crucial in diminished value claims, especially with USAA. While some policyholders may be tempted to rely on the insurance company’s process, doing so often results in a lower payout. Independent appraisers provide a fair, unbiased evaluation of your vehicle’s post-accident value, which is critical for ensuring you get what you’re owed.

Plus, working with an appraiser who knows how to navigate USAA’s tactics can give you an edge. They understand the insurer’s diminished value methodology and can counteract the biases in the appraisal process.

Not sure if the insurance offer is fair? Get a Free Claim review from our experts!

FAQs on USAA Diminished Value Claim

Q: Can I file a diminished value claim if I’m at fault in the accident?

A: Generally, diminished value claims are filed against the at-fault driver’s insurance. If you were at fault, USAA may not cover your diminished value loss.

Q: How long do I have to file a diminished value claim with USAA?

A: This varies by state, but it’s best to file as soon as possible. Waiting too long can give USAA grounds to argue that your car’s depreciation is due to normal wear and tear rather than accident-related.

Q: Do I need an appraisal to file a claim?

A: While not mandatory, getting an independent appraisal is highly recommended. It provides evidence of your vehicle’s true diminished value, which can strengthen your claim.

Q: What if USAA denies my diminished value claim?

A: If USAA denies your claim, you can dispute it by invoking the appraisal clause in your policy or seek legal advice. Having an independent appraiser on your side strengthens your case and can help counter a denial.

Q: Can I claim diminished value on a leased vehicle?

A: Yes, in some cases, you can file a diminished value claim for a leased vehicle, depending on your lease terms and state laws. However, be aware that some lease agreements might have specific provisions regarding claims.

Conclusion

Filing a diminished value claim with USAA can be tricky, but by understanding the process, gathering proper documentation, and working with an independent appraiser, you can increase your chances of getting a fair settlement.

Remember, USAA’s diminished value methodology and appraisal process often favor the insurer, so don’t hesitate to take control of your claim.