Auto Market Update Week Ending Aug 26, 2023 (PDF)

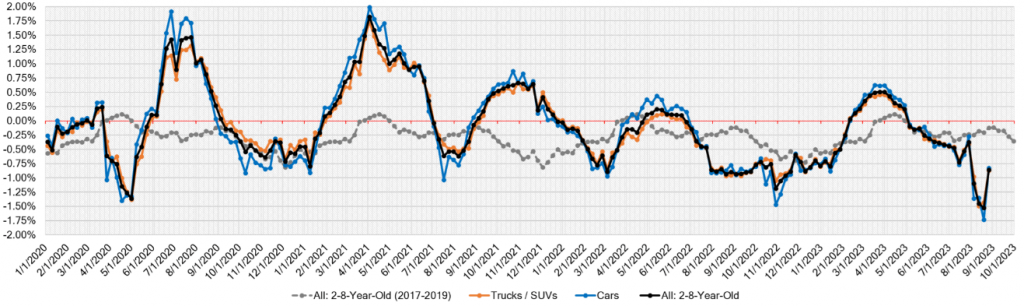

In the ever-evolving landscape of the automotive market, the past week provided some intriguing insights. While wholesale declines persisted, there emerged a glimmer of hope as the pace of depreciation exhibited signs of moderation, receding below the 1% mark for the first time this month. An interesting development taking center stage is the preparation by certain dealers in anticipation of a possible UAW strike, prompting them to proactively seek inventory to mitigate potential supply disruptions.

Market Trends

Let’s delve into the specifics of the week’s trends. Comparing this week to last week and the “2017-2019 Average (Same Week),” the shifts in various segments become evident:

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.83% | -1.73% | -0.10% |

| Truck & SUV segments | -0.87% | -1.43% | -0.14% |

| Market | -0.86% | -1.52% | -0.12% |

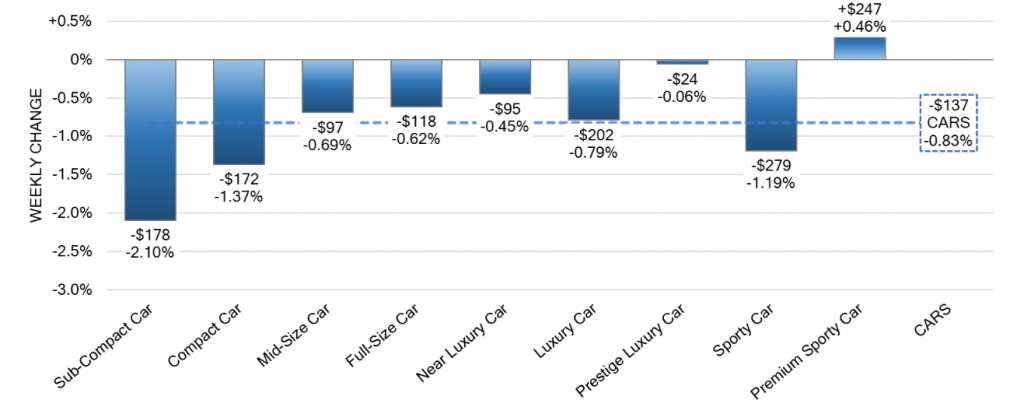

Car Segments

- The Car segment witnessed a decline of -0.83% on a volume-weighted basis, marking a notable improvement from the previous week’s -1.73% dip.

- Diving into the age categories, 0-to-2-year-old Car segments displayed a decrease of -0.37%, while the 8-to-16-year-old Cars experienced a drop of -1.49%. This contrasts with the prior week’s figures of -1.20% and -1.90%, respectively.

- Among the nine Car segments, eight recorded declines, with three surpassing the 1% mark in depreciation.

- A highlight in this segment was the +0.46% increase in Premium Sporty Cars, fueled largely by the robust performance of the Chevrolet Corvette.

- The Compact Car segment had been grappling with over 2% weekly depreciation for the past three weeks, but the latest report shows a slowdown to -1.37%. Meanwhile, the Sub-Compact Car segment claimed the highest depreciation at -2.10%, averaging -1.59% over the last four weeks.

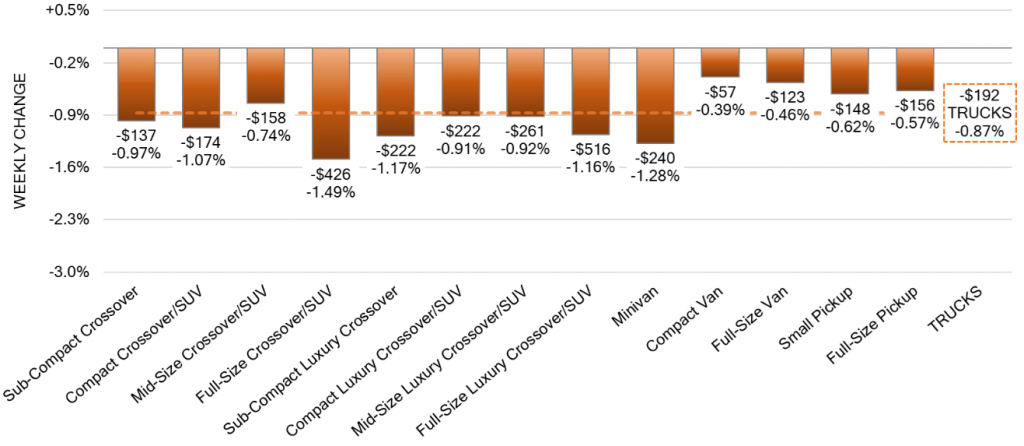

Truck / SUV Segments

- The Truck segment witnessed a decrease of -0.87% on a volume-weighted scale, displaying a noticeable improvement from the previous week’s -1.43% decline.

- Within the age brackets, 0-to-2-year-old models experienced a dip of -0.73%, while the 8-to-16-year-olds saw a decline of -0.95%.

- All thirteen Truck segments encountered declines, with five segments registering depreciation exceeding 1%.

- Notably, the Full-Size Crossover/SUV segment experienced the most substantial decrease, falling by -1.49%, consistent with the segment’s four-week average decline of -1.50%.

- After a series of sharp declines, Full-Size Pickups exhibited a tempered rate of depreciation at -0.57% last week.

- Compact and Full-Size Vans showcased the lowest depreciation, with declines of -0.39% and -0.46% respectively.

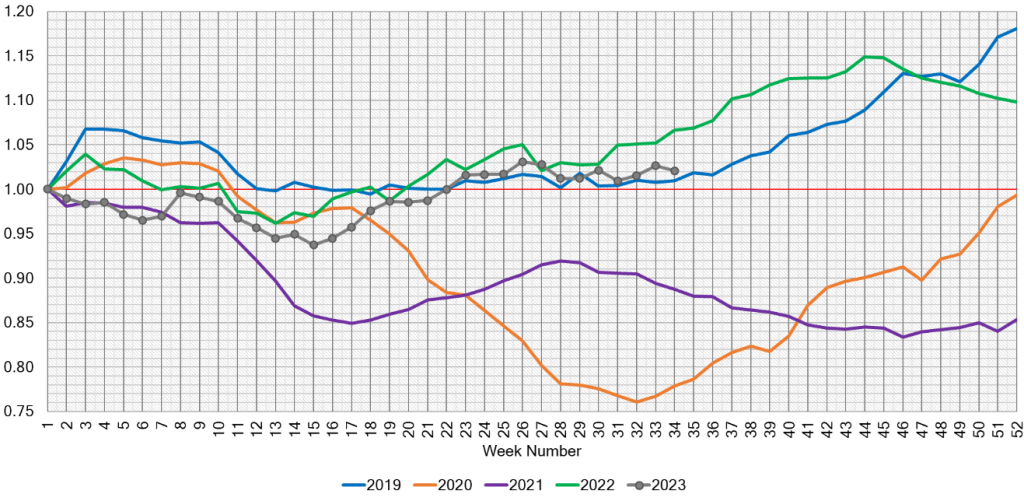

Used Retail

The Used Retail Active Listing Volume Index stands at 1.02 points, offering a snapshot of the current landscape, while the Used Retail Days-to-Turn estimate hovers above 51 days, indicating the time it takes for used vehicles to sell.

Wholesale

- Over the past four weeks, both car and truck segments within the wholesale market have experienced substantial declines. However, the most recent week showed signs of deceleration in these declines.

- Notably, the prevalence of no-sales has risen, reflecting buyers’ cautious approach due to market uncertainties.

- Factors contributing to the pronounced declines include elevated fuel prices and rising interest rates.

- Amidst these dynamics, the looming UAW strike adds an element of uncertainty, with the potential to alter the downward trend.

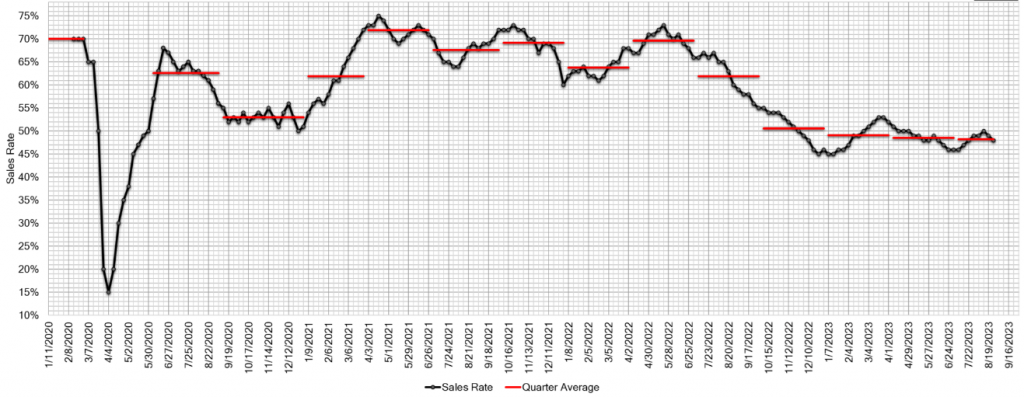

- The estimated Average Weekly Sales Rate saw a decline to 48%.

In this dynamic landscape, the automotive market continues to navigate a complex interplay of factors. The ebb and flow of depreciation rates, coupled with external forces such as labor strikes and economic variables, make for a captivating narrative. As the week ahead unfolds, the industry stands poised to decipher the unfolding chapters of this ever-evolving story.