The Trump administration’s newly proposed tariffs on imports from Canada and Mexico have sparked widespread concerns, particularly within the automotive and energy sectors. These tariffs, set to impose a 25% tax on imported goods, could lead to increased prices for gas, cars, and essential consumer products.

In this article, we’ll explore the specifics of these tariffs, their impact on gas prices and the auto industry, and what consumers should expect in the coming months.

By the end, you’ll have a clear understanding of how these tariffs might influence vehicle costs, fuel expenses, and broader economic trends—and what steps you can take to prepare for potential price increases.

Understanding Trump’s New Tariffs

The recent tariffs imposed by the Trump administration have sparked concerns across industries, especially in the automotive and energy sectors. The policies primarily target imports from Canada and Mexico, two of the U.S.’s largest trading partners.

What Are the Latest Tariff Policies?

The administration has announced a 25% tariff on all imported goods from Canada and Mexico, including auto parts and crude oil. This decision follows previous trade negotiations aimed at securing stricter border enforcement and revising trade agreements.

Canada and Mexico are vital to U.S. trade, supplying essential resources like crude oil and automobile components, while the intent behind these tariffs is to bolster domestic manufacturing and strengthen the U.S. economy, critics argue that they may ultimately lead to unintended economic consequences, including job losses and decreased consumer spending power.

How Tariffs Impact the U.S. Economy

Tariffs of this scale tend to result in higher production costs, which businesses may pass down to consumers. This could lead to increased prices for gasoline, groceries, and vehicles, directly affecting American households.

Additional consequences include:

- Revenue Declines: Companies dependent on cross-border trade could see a drop in earnings.

- Workforce Reductions: To offset costs, businesses may lay off workers or reduce hiring.

- Global Trade Tensions: Retaliatory tariffs from Canada and Mexico could further strain U.S. exports, making American goods less competitive internationally. The recent tariffs imposed by the Trump administration have sparked concerns across industries, especially in the automotive and energy sectors. The policies primarily target imports from Canada and Mexico, two of the U.S.’s largest trading partners. These new trade measures could significantly impact the cost of living for millions of Americans, with ripple effects spreading across the entire economy.

How Tariffs Could Increase Gas Prices

The Role of Canada and Mexico in U.S. Oil Supply

Canada and Mexico account for 70% of U.S. crude oil imports. The U.S. refines this crude into gasoline, making these imports critical to maintaining stable fuel prices. A reduction in imported crude would force refineries to seek alternative suppliers, likely at a higher cost, which would be passed down to consumers at the pump.

Potential Gas Price Increases—What Experts Predict

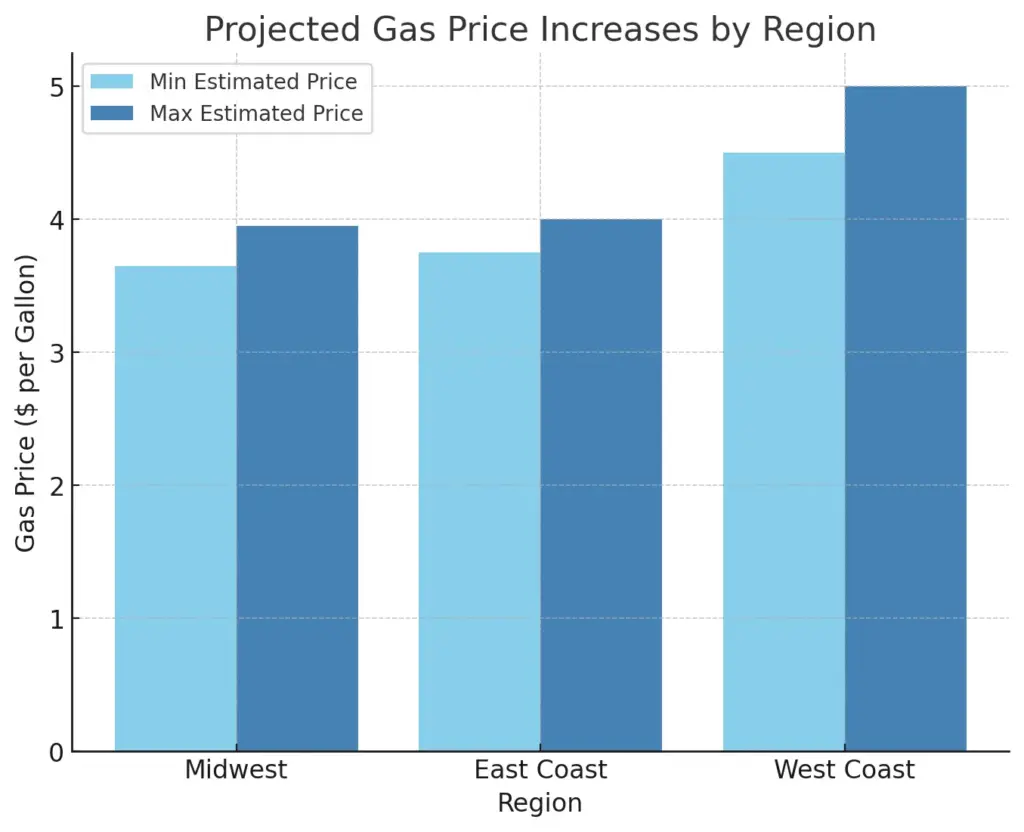

Experts predict that gasoline prices could rise between 40 to 70 cents per gallon in the Midwest, East Coast, and West Coast. In combination with seasonal fuel price increases, the total price hike could reach $1 per gallon. This kind of increase would disproportionately impact lower-income households and those who rely heavily on personal vehicles for work and daily commuting.

Projected Gas Price Increases by Region

| Region | Current Avg. Price | Potential Increase | New Estimated Price |

|---|---|---|---|

| Midwest | $3.25 | $0.40 – $0.70 | $3.65 – $3.95 |

| East Coast | $3.30 | $0.45 – $0.70 | $3.75 – $4.00 |

| West Coast | $4.00 | $0.50 – $1.00 | $4.50 – $5.00 |

Seasonal Fuel Price Spikes: A Double Whammy for Drivers?

Gas prices typically rise in spring and summer due to increased demand. If tariffs remain in place, consumers may face a double impact of seasonal price surges and tariff-induced hikes. This could make travel and transportation significantly more expensive, influencing everything from family vacations to business logistics.

The Auto Industry’s Tariff Dilemma

How Much of the U.S. Auto Market Depends on Imports?

Nearly 47% of vehicles imported into the U.S. come from Canada and Mexico. These imports also account for a significant share of auto parts used in vehicles assembled domestically. Without these imports, production could slow, leading to inventory shortages and increased costs at dealerships.

Rising Costs of Cars and Auto Parts—Who Pays?

Higher import costs mean automakers will have to absorb extra expenses or pass them on to consumers. Estimates suggest an average increase of $5,855 per vehicle, impacting affordability across all car segments. Higher vehicle costs could push some consumers out of the new car market, increasing demand for used vehicles and potentially raising prices in that sector as well.

Automakers’ Strategies to Offset Tariff Costs

Manufacturers are looking at short-term solutions like stockpiling parts, shifting production to the U.S., or negotiating trade exemptions. However, these strategies may not be sustainable if tariffs remain long-term. Some automakers are considering increasing production in other foreign markets with lower tariffs, but this could lead to job losses in North America.

Will Car Prices Go Up? What Consumers Need to Know

How Long Before Car Prices Reflect the Tariffs?

Car dealerships typically have a one to two-month inventory buffer. Prices may begin rising within two months of tariffs taking effect. Consumers looking to buy a new vehicle may need to act fast before price increases take hold.

Which Brands and Models Are Most Affected?

| Brand | % of U.S. Sales from Canada/Mexico |

| Volkswagen | 44% |

| Toyota | 25% |

| GM | 20% |

| Honda | 22% |

| Ford | 18% |

Models heavily dependent on foreign components may see price increases of 10-20%, making some previously affordable options unattainable. Additionally, tariffs could lead to longer wait times for parts and repairs, further frustrating consumers.

Should You Buy a Car Now or Wait?

If you plan to purchase a vehicle in the next 6-12 months, it may be wise to buy now before price hikes take effect. Waiting could mean paying thousands more for the same model. On the other hand, if tariffs are reversed or reduced, waiting could allow for better deals and incentives as the market stabilizes.

The Bigger Picture: Trade Wars and Economic Implications

If tariffs expand beyond North America, other countries may retaliate with their own trade restrictions, further increasing costs for imported goods. This could lead to broader economic uncertainty and fluctuations in financial markets.

Beyond autos and gas, tariffs could affect grocery prices, electronics, and construction materials, leading to widespread inflation across multiple sectors. In particular, industries dependent on raw materials like steel and aluminum could see major cost spikes.

Final Thoughts: How to Prepare for Potential Price Hikes

- Lock in current car prices by purchasing sooner rather than later.

- Consider fuel-efficient vehicles to minimize the impact of rising gas prices.

- Monitor trade developments to anticipate further economic shifts.

- Compare dealership promotions before tariffs fully affect pricing.

- Explore alternative transportation options such as carpooling or public transit to reduce fuel expenses.

While the one-month pause on tariffs has given the industry temporary relief, uncertainty remains high. Consumers and businesses alike must prepare for the potential economic ripple effects these tariffs could bring. Staying informed and making strategic financial decisions will be crucial as the situation evolves.