A seismic shift has occurred in China’s automotive market, a transformation so rapid and significant that it’s leaving the rest of the world in its wake. In July 2024, China reached a landmark achievement: more than half of all new cars sold were either electric vehicles (EVs) or hybrids.

This isn’t just a fleeting moment; it’s the result of years of strategic planning, relentless innovation, and strong governmental support. The rise of new energy vehicles (NEVs) in China signals a major turning point, not just for the country, but for the global automotive industry. Let’s explore the driving forces behind this extraordinary growth and what it means for the future of transportation worldwide.

Why 50% of New Cars Sold in China Are Now EVs or Hybrids (PDF)

From 7% to 50%: A Fast-Tracked Revolution

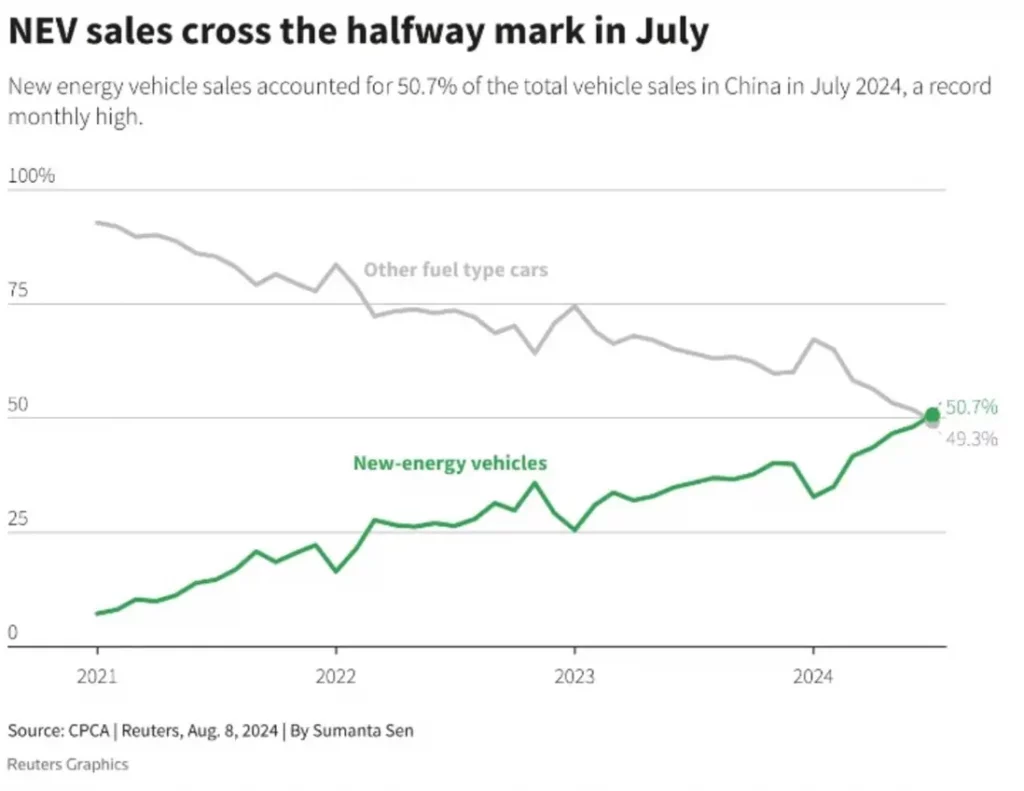

Only a few years ago, the notion that 50% of new cars sold in China could be electric or hybrids would have been met with skepticism. Back in 2021, NEVs made up a modest 7% of the market, a figure that seemed unlikely to make a significant dent in the dominance of traditional internal combustion engine vehicles. Fast forward to July 2024, and NEVs now account for a staggering 50.7% of all new car sales. This incredible rise didn’t happen by chance—it’s the result of deliberate and sustained efforts on multiple fronts, from government policy to consumer behavior and technological advancements.

Table: Growth of NEV Sales in China (2021-2024)

| Year | Percentage of Total Car Sales | Key Milestones & Events |

|---|---|---|

| 2021 | 7% | Early-stage growth driven by subsidies and environmental policies. |

| 2022 | 15% | Expansion of EV infrastructure and increased consumer interest. |

| 2023 | 28% | Domestic brands ramp up production and innovation. |

| 2024 | 50.7% | Record-setting sales in July, marking a pivotal moment in the market. |

The Forces Behind China’s NEV Surge

China’s rapid climb to 50% NEV sales in just three years is nothing short of remarkable, but it’s not an isolated phenomenon. This surge is the result of a combination of factors that have aligned perfectly to propel China’s automotive market into the electric age.

1. Strategic Government Policies and Incentives

One of the most significant drivers of China’s NEV boom has been the strong support from the government. Unlike many other countries, where electric vehicle adoption has been more organic and market-driven, China’s rise has been carefully orchestrated by government initiatives. The Chinese government has implemented a range of policies designed to make NEVs not only more accessible but also more attractive to consumers.

For example, in July 2024, the government doubled down on its efforts to boost NEV sales by increasing cash subsidies for vehicle purchases to 20,000 yuan ($2,785) per purchase, a move that was retroactive to April. These subsidies have made NEVs a more appealing choice for budget-conscious consumers, helping to drive the surge in sales.

Moreover, China has imposed restrictions on the purchase of traditional fuel-powered vehicles in major cities, while simultaneously relaxing restrictions on NEVs. In Beijing, a city notorious for its strict vehicle quota system, the government expanded its NEV license quota by 20,000 in July 2024, making it easier for consumers to purchase electric and hybrid vehicles. This strategy has effectively created a favorable environment for NEVs to thrive, while discouraging the continued use of traditional vehicles.

2. The Rise of Domestic EV Giants

While global brands like Tesla often grab headlines, it’s China’s homegrown automakers that have been the true driving force behind the country’s NEV revolution. Companies such as BYD, Li Auto, and NIO have been at the forefront of the industry, pushing boundaries in terms of technology, affordability, and consumer appeal.

BYD, in particular, has emerged as a powerhouse in the NEV market. The company has consistently set new sales records, and July 2024 was no exception. BYD’s success can be attributed to its aggressive pricing strategies and its ability to offer a wide range of models that cater to different segments of the market. Although the company continued to offer discounts in July, the intensity of these price cuts has decreased compared to earlier in the year, signaling that the market is beginning to stabilize.

The popularity of BYD’s hybrid models, such as the BAO 5 SUV, which saw a price reduction of up to 17.3% at the end of July 2024, highlights the growing consumer interest in vehicles that offer the benefits of both electric and traditional powertrains. This dual approach allows consumers to transition to electric driving without fully committing to a pure EV, which can be particularly appealing in regions where charging infrastructure is still developing.

3. Cutting-Edge Technology and Expanding Infrastructure

China’s swift embrace of new energy vehicles (NEVs) has been underpinned by a dual strategy of cutting-edge technology and expansive infrastructure development. In recent years, the country has poured vast resources into establishing a widespread network of charging stations, transforming the convenience of owning an electric vehicle. By the close of 2023, China had rolled out more than 3.2 million public charging stations, a scale that leaves other nations trailing behind.

This vast network of chargers has significantly reduced the “range anxiety” that once held back potential EV buyers. With charging points readily available across cities and highways, electric vehicles have become a practical choice for daily transportation needs. Moreover, technological breakthroughs in battery design have played a critical role in boosting NEV adoption. Companies like CATL have been at the forefront, engineering batteries that not only extend driving range but also cut down charging time and enhance safety, making EVs more appealing to a broader audience.

Beyond just financial perks, the Chinese government has cleverly navigated urban challenges by adjusting policies to favor NEV ownership in crowded cities. For example, in Beijing—a city known for its stringent vehicle quotas aimed at controlling congestion—the government expanded the NEV license quota by 20,000 in July 2024. This strategic move made it easier for residents to own NEVs while keeping a tight rein on the growth of conventional vehicles, thereby encouraging a gradual yet significant shift toward cleaner transportation options.

4. Shifting Consumer Preferences

An increasing environmental awareness among Chinese consumers is fueling the surge in NEV adoption. As the public becomes more attuned to the impacts of climate change and pollution, there’s a growing desire to make eco-friendly choices. This shift in mindset has led many to see NEVs as a practical and impactful way to minimize their carbon footprint, driving demand for electric and hybrid vehicles across the country.

Moreover, NEVs are no longer seen as just a green alternative—they’re also becoming status symbols. The combination of cutting-edge technology, sleek designs, and the prestige associated with being an early adopter of new technology has made NEVs highly desirable among China’s growing middle class. This shift in consumer preferences is helping to drive demand, particularly among younger, tech-savvy buyers who are keen to embrace the future of transportation.

Challenges Facing China’s NEV Market

While the growth of NEVs in China is undoubtedly impressive, the market is not without its challenges. The broader economic environment poses some risks, particularly as the Chinese economy faces headwinds from the ongoing property market crisis and weakening consumer confidence.

A 3.1% drop in domestic car sales in July 2024 highlights that China’s auto market isn’t entirely sheltered from the broader economic challenges. This downturn marks the fourth month in a row of declining sales, indicating that the NEV boom could face headwinds if the economic landscape continues to falter.

Table: China’s Domestic Car Sales and NEV Market Performance (July 2024)

| Category | July 2024 Performance | Notes |

|---|---|---|

| Total Car Sales | -3.1% (decline) | Reflects broader economic challenges affecting consumer spending. |

| NEV Sales | +50.7% (record high) | Driven by government incentives and strong brand performance. |

| Pure Electric Vehicle (EV) Sales | +14.3% | Continued strong growth, outpacing the broader market. |

| Hybrid Vehicle Sales | Steady growth | Represents a significant portion of the NEV market. |

The Global Ripple Effect

China’s dominance in the NEV market is not just a national achievement—it’s reshaping the global automotive landscape. As the world’s largest auto market, China’s decisions and trends have a profound impact on the global industry.

1. Impact on International Markets

The rapid adoption of NEVs in China is putting pressure on automakers and governments in other countries to accelerate their own transition to electric vehicles. In the United States, for example, electric and hybrid vehicles accounted for just 18% of car sales in the first quarter of 2024, a far cry from China’s 50.7% in July.

This gap is forcing Western nations to reevaluate their approach to electric vehicles. Europe, in particular, is taking cues from China’s achievements, with the European Union now pushing for stricter emissions targets and aiming to eliminate internal combustion engine cars by 2035. China’s NEV success story is both motivating and pressuring other regions to accelerate their own transitions to electric mobility.

2. China’s Global Ambitions

China’s NEV strategy isn’t confined to its domestic market; it’s also making significant strides in international markets. In July 2024, China’s vehicle exports increased by 20% year-on-year, although this was a slight decrease from the 28% growth seen in June. As Chinese automakers prepare for potential EU tariffs on their EV exports, they are nonetheless poised to compete on the global stage.

Chinese automakers are capitalizing on their proficiency in mass production and cost efficiency to penetrate markets long controlled by Western giants. As they extend their reach globally, the competition is expected to heat up, which could lead to lower prices and spark further advancements in the electric vehicle industry across the world.

Looking Forward: The Future of China’s NEV Market

The rapid growth of NEVs in China is a clear indication that the country is on the path to becoming the global leader in electric vehicles. With robust government support, strong domestic brands, and a rapidly expanding infrastructure, China’s NEV market is well-positioned for continued success.

However, the future is not without challenges. The broader economic landscape will need to stabilize to ensure sustainable growth, and automakers will need to continue pushing the envelope in terms of innovation and efficiency. The easing of the price war among domestic brands is a positive sign, suggesting that the market is maturing and companies are focusing on long-term profitability rather than short-term gains.

As the rest of the world watches China’s NEV market with keen interest, one question looms large: Will other countries be able to catch up to China’s head start, or is China destined to lead the charge into an electric future?

What are your thoughts—can China maintain its momentum in the NEV market, or will global competitors close the gap?