Electric vehicles (EVs) are having a moment in the U.S., and factory incentives are playing a huge role. Despite Tesla’s notable decline in market share, other automakers are stepping up, thanks to some hefty incentives that are making EVs more affordable than ever. Let’s dive into the details and see how these incentives are reshaping the EV landscape.

How U.S. Factory Incentives Are Driving the EV Market Surge (PDF)

The Incentive Effect

In April 2024, new EV registrations saw a significant boost, rising by 14% after a slow first quarter. A key driver of this surge? Automaker incentives that sometimes exceeded $10,000 per vehicle. These incentives aren’t just random discounts; they’re strategic moves to make EV payments more comparable to traditional internal combustion engine (ICE) vehicles. This strategy seems to be paying off.

According to S&P Global Mobility, these incentives have led to 102,317 new EV registrations in April alone. This figure represents a 7.4% share of total light-vehicle registrations, which reached nearly 1.4 million. Notably, this double-digit growth for EVs outpaced the 7.3% gain in the overall light-vehicle market.

Tesla’s Unusual Position

While the EV market is growing, Tesla is experiencing a bit of a slump. New Tesla registrations fell by 17% in April, marking three consecutive months of decline. Tesla’s share of the U.S. EV segment dropped to 46.3% from 63.8% a year earlier. This drop is significant, considering Tesla’s previous dominance in the EV market.

Tom Libby, an industry analyst at S&P Global Mobility, notes, “A couple of years ago, we were all talking about how Tesla was the only EV brand doing well and everybody else was struggling. And now it’s the reverse.”

Winners in the EV Race

Excluding Tesla, U.S. EV registrations soared by 69%. Legacy automakers and new players like Rivian are making substantial gains. For instance, Ford’s EV registrations shot up by 169%, Kia’s increased by 172%, and Toyota’s skyrocketed by an astounding 647% for its bZ4X crossover.

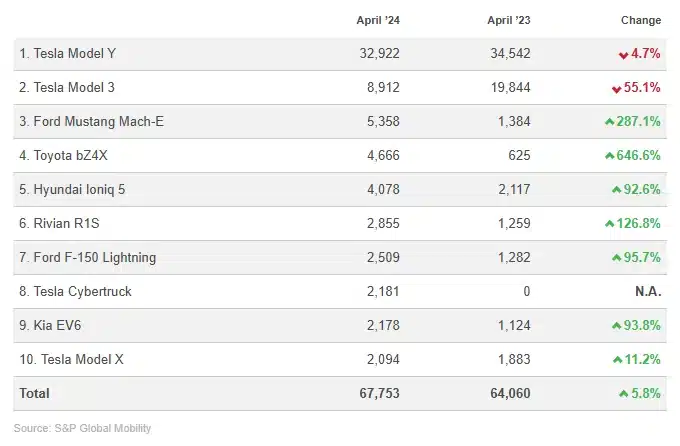

Here are the top 10 EV models in April 2024 compared to April 2023:

- Tesla Model Y: 32,922 registrations (-4.7%)

- Tesla Model 3: 8,912 registrations (-55.1%)

- Ford Mustang Mach-E: 5,358 registrations (+287.1%)

- Toyota bZ4X: 4,666 registrations (+646.6%)

- Hyundai Ioniq 5: 4,078 registrations (+92.6%)

- Rivian R1S: 2,855 registrations (+126.8%)

- Ford F-150 Lightning: 2,509 registrations (+95.7%)

- Tesla Cybertruck: 2,181 registrations (N.A.)

- Kia EV6: 2,178 registrations (+93.8%)

- Tesla Model X: 2,094 registrations (+11.2%)

The Role of Incentives

Incentives are clearly driving these numbers. Toyota’s bZ4X, for example, saw its April incentives total $10,963 per vehicle, a massive increase from $718 in April 2023. This kind of pricing brings EVs closer to their ICE counterparts, making them more appealing to a broader audience.

Other automakers are following suit. The Ford Mustang Mach-E had incentives around $9,000, leading to a nearly quadrupled registration number year-over-year. Nissan’s Ariya and Lucid’s Air sedan also saw significant increases in registrations due to generous incentives.

Challenges Ahead

While incentives are helping to clear out inventory, some analysts warn this may not be sustainable. Karl Brauer from iSeeCars.com suggests that the current surge is partly due to automakers dealing with an overproduction hangover from the previous year. He notes, “It will be more telling to see how companies like Hyundai, Kia, Toyota and the domestics adjust their EV production going forward.”

General Motors has already responded by tightening its manufacturing plans, reducing its EV production target from 300,000 to between 200,000 and 250,000 for the year.

The Future of Tesla

Tesla’s strategy of relying less on incentives might need rethinking. Although the Model Y and Model 3 saw some incentives, they were significantly lower compared to competitors. This could explain the sharp decline in their registrations. With new federal EV tax credit rules and increased competition, Tesla’s path forward seems challenging.

Conclusion

The U.S. EV market is dynamic and rapidly evolving. Factory incentives are driving a surge in registrations, benefiting legacy automakers and new entrants alike. While Tesla faces new challenges, the overall market is growing. The coming months will be crucial in determining how sustainable this growth is and whether Tesla can regain its footing. What do you think lies ahead for the EV market?