As 2024 approaches, the American auto industry is showing signs of an exciting transformation. This period marks a critical juncture, with the industry emerging from the challenges of the global pandemic and navigating the complexities of supply chain disruptions.

In this article, we take a deep dive into the projections and trends shaping the U.S. car market for the coming year. Our focus will be on unraveling the statistics, predictions, and expert opinions that are setting the stage for what could be a pivotal year in automotive sales.

From consumer impacts to shifting market dynamics, we explore what these changes mean for the broader economic landscape and the future of the U.S. automotive sector.

U.S. Car Sales Trends and Predictions for 2024 (PDF)

Industry Trends and Sales Projections

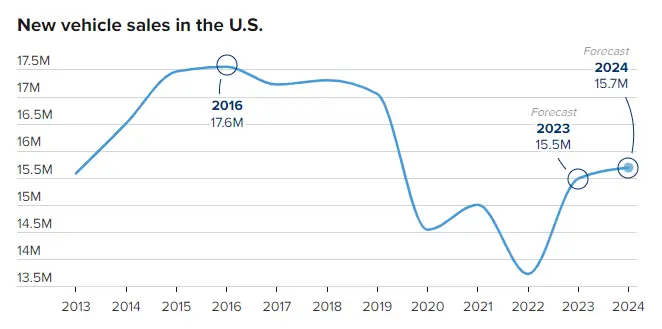

According to recent forecasts, the U.S. is set to witness a year-over-year increase in new vehicle sales, estimated to be between 1% and 4%. This translates to approximately 15.6 million to 16.1 million vehicles, marking the highest sales since 2019’s 17 million units. Such an uptick symbolizes a pivotal recovery from the 2022 slump, where sales plummeted to under 14 million vehicles – the lowest in over a decade.

The anticipated boost in U.S. sales is more than just numbers. It signals a resurgence in production, potentially alleviating the recent affordability challenges fueled by inflation, high interest rates, and soaring vehicle prices. Jessica Caldwell, Edmunds’ head of insights, points out that 2023 will be a year of balancing increased inventory with high interest rates, creating a complex market dynamic.

Shifting Market Dynamics: Pricing Power and Incentives

Edmunds’ analysis suggests that the era of new vehicle pricing power for automakers has reached its zenith. With inventory levels improving, incentives are making a comeback, impacting the market equilibrium. This shift, while beneficial for consumers, poses challenges for automakers and dealers who have enjoyed record profits in recent years.

Investor Insights and Automaker Strategies

For investors, the landscape is mixed. Increased sales are positive, but the resurgence of incentives and potential price reductions could dampen profits. Automakers are now facing a critical decision: maintain the current supply-demand balance or strive to push sales volumes back to pre-pandemic levels, as noted by Caldwell.

Global Perspective and Comparative Analysis

Globally, the auto sales scenario is slightly different. S&P Global Mobility forecasts a 2.8% year-over-year increase in worldwide auto sales. The U.S. growth, albeit modest, is significant in this context, marking the first sequential sales growth in the automotive industry since 2015-16.

Specific Forecasts by Leading Firms

- S&P Global Mobility anticipates U.S. sales to hit 15.9 million units in 2024, a 2% increase from the projected 15.5 million units in 2023.

- GlobalData predicts a near 4% rise in U.S. new vehicle sales to 16.1 million units.

- Edmunds estimates a sale of 15.7 million new cars and trucks, approximately a 1% increase from 2023.

- Cox Automotive, at the conservative end, forecasts 15.6 million vehicle sales, driven primarily by fleet or commercial sales.

Industry Outlook and Economic Impact

The overall expectation for 2024 is cautious optimism. The industry is transitioning from clear supply-side challenges to a more complex, demand-driven environment. As Cox Automotive’s chief economist, Jonathan Smoke, remarks, the anticipated growth, though constrained, represents a return to normalcy after years of market turbulence.

The U.S. automotive industry is on a path of recovery and growth for 2024. With increased vehicle production, easing affordability concerns, and a return to more stable market conditions, the industry looks forward to a year of cautious optimism and strategic adjustments.

As we step into 2024, the automotive sector remains a vital indicator of economic health and consumer confidence in the United States.