Q: When does the type of Uninsured Motorsit coverage matter?

A: The types of Uninsured Motorist ONLY matters IF the other driver has some insurance or is under-insured.

IF THE OTHER DRIVER HAS NO INSURANCE. THIS BECOMES IRRELEVANT.

Uninsured Motorist Property Damage Types

With Uninsured Motorist Property Damage coverage, the insurance company pays for repair costs if your covered vehicle sustained property damage in an accident where the at-fault driver has no liability coverage. They will also pay for physical damage to any property owned by you that was in the covered vehicle at the time of the accident.

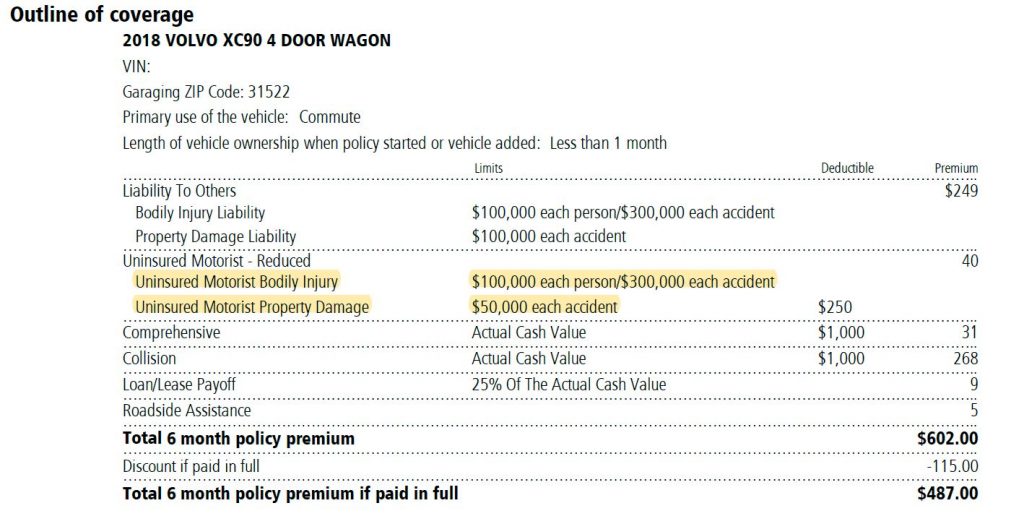

The type of coverage is normally listed in the Auto Insurance Declarations Page.

Insureds normally select one of the following types of Uninsured Motorist coverage unless they reject it in writing; the limits you select cannot exceed your liability limits and it must be the same on each vehicle.

- Uninsured Motorist Coverage – Added On to At-Fault Liability Limits (Uninsured Motorist – Added On)

Under this option, the insurance company will pay you for your damages in addition to the at-fault driver’s liability coverage limit up to your Uninsured Motorist – Added On Coverage limit.

- Uninsured Motorist Coverage – Reduced by At-Fault Liability Limits (Uninsured Motorist – Reduced)

Under this option, the insurance company will only pay you up to the difference between the at-fault driver’s liability coverage and your Uninsured Motorist – Reduced Coverage limit.

Example of Uninsured Motorist – Added On Coverage and Uninsured Motorist – Reduced Coverage Claim Payment Calculation

An underinsured driver fails to stop at a red light, hits your car and causes you to have $175,000 in damages. The at-fault underinsured driver (At-Fault’s) has $50,000 of Liability Coverage. Your policy contains $100,000 of Uninsured Motorist Coverage.

Uninsured Motorist – Added On Coverage

(This coverage is also referred to as Uninsured Motorist Coverage – Added on to At-Fault Liability Limits.)

At-Fault’s Liability Coverage Limit $50,000

Your Uninsured Motorist – Added On Coverage Limit $100,000

Total Amount of Your Damages $175,000

Payment Break Out:

At-Fault’s Liability Coverage = $50,000

Your available Uninsured Motorist – Added On Coverage = $100,000

Total Payment = $150,000(a)

Amount Not Covered = $25,000(b)

(a) The maximum available coverage in this example was $150,000 (At-Fault’s Liability Coverage Limit + Your Uninsured Motorist – Added On Coverage Limit).

(b) Please notice that $25,000 of the loss was not covered.

Uninsured Motorist – Reduced Coverage

(This coverage is also referred to as Uninsured Motorist Coverage – Reduced by At-Fault Liability Limits.)

At-Fault’s Liability Coverage Limit $50,000

Your Uninsured Motorist – Reduced Coverage Limit $100,000

Total Amount of Your Damages $175,000

Payment Break Out:

At-Fault’s Liability Coverage = $50,000

Your available Uninsured Motorist – Reduced Coverage = $50,000(a)

Total Payment = $100,000

Amount Not Covered = $75,000(b)

(a) The total available Uninsured Motorist – Reduced Coverage you have in this example is $50,000, which is determined by subtracting the At-Fault’s Liability Coverage Limit from Your Uninsured Motorist – Reduced Coverage Limit.

(b) Please notice that $75,000 of the loss is not covered.

Note: These definitions are intended only as a guideline. All terms and coverages are defined solely by the policy. Coverage limits, deductibles and certain exclusions may apply.