U.S. Car Sales Exceeded Expectations in February (PDF)

The demand from both consumers and fleet customers remained strong in February, but automakers are facing a balancing act to maintain profitability with severely underutilized factories.

The new vehicle market has reacted well this month, recording sales growth compared to 2022. This is due to demand for fleet owners and customers supplying the industry – with transaction prices high and incentives low holding steady even as the downturn from inventory shortages. However, conditions are gradually returning to normality, indicating continued profitability for the industry going forward.

According to automakers reporting their sales in February, Ford and Hyundai-Kia both posted double-digit increases, led by Ford’s 22 percent increase. Sales at Mazda North America, Subaru of America, and Volvo Car USA also increased last month, but Toyota Motor North America’s sales fell 2.4%, despite the first year-over-year increase since January 2022 at Lexus.

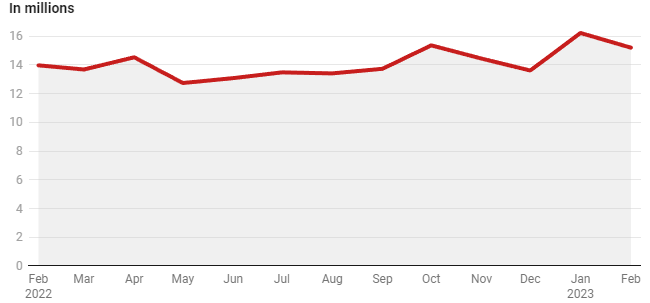

Motor Intelligence’s seasonally adjusted, annualized sales rate for February was 15.19 million, compared to 13.96 million in the same month last year and 16.21 million in January this year. LMC Automotive found that industry-wide sales were up 9.5 percent annually at 1.14 million vehicles – including those from automakers not yet reporting – prompting them to increase their forecast of US sales in 2023 to 15 million; a rise from 14.9 million previously predicted.

While the industry suffered from supplier disruptions last year that are still here, fleet demand is more than offsetting the reduction in retail consumer demand. Fortunately, inventory levels started to recover and availability increased in January.

It is still possible for resellers to control their pricing power, albeit to a moderately diminished extent. Figures showed that 31% of retail sales in February were above sticker price, indicating strong consumer demand outstripping supply. Despite being half of what it was over the summer, automakers won’t encourage sales until that number gets as close to zero as possible and drops into the single digits. Although they are moving in the right direction, there is still some way to go to achieve this goal.

As manufacturers attempt to balance factory utilization rates while avoiding overstocking dealers, we expect incentives to rise slowly this year. The trend of incentives will likely begin to creep back in, but it might take some time. The automakers will have a little more discipline to avoid overbuilding, but that balancing means that they will likely start enticing consumers back into the market.

North American factory utilization is at 65 percent, as sales are not quite meeting potential. This has caused manufacturers to consider “opening the valves on production” in order to increase profits. Even with the introduction of EVs impacting capacity, it is estimated that around 15 million cars can still be sold profitably – lower than the 23.4 million total factory capacity.